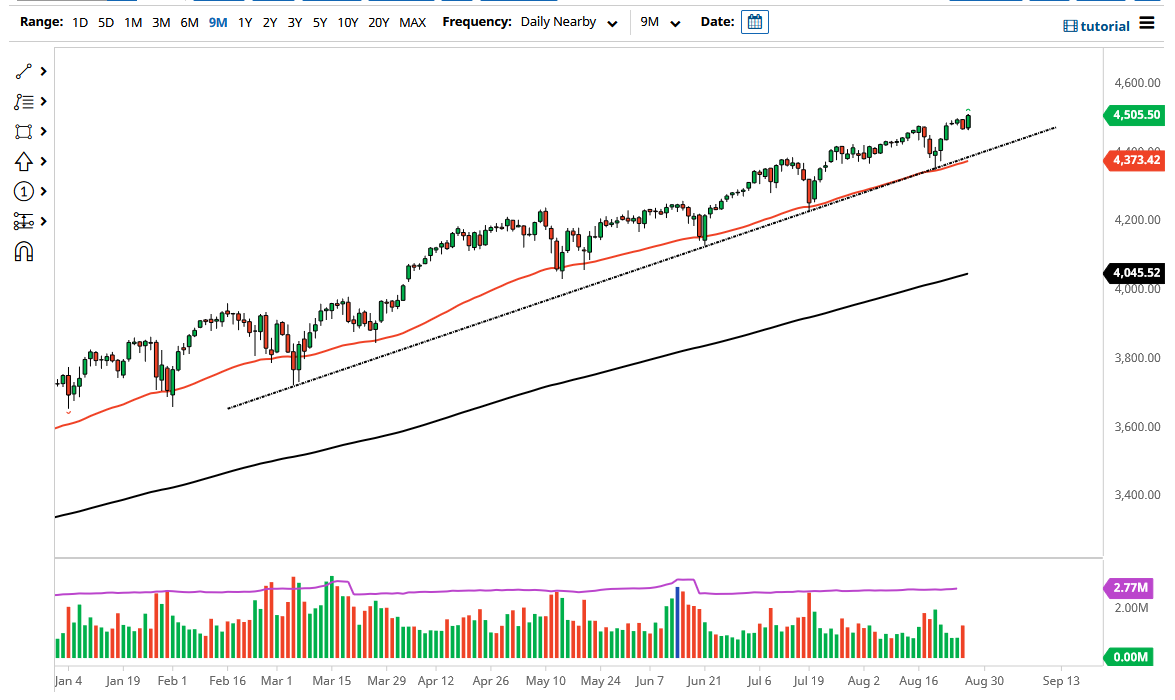

The S&P 500 saw a lot of bullish pressure on Friday as we continue to see the market rally based on the Federal Reserve. As Jerome Powell was very cautious about becoming too hawkish during the trading session on Friday, it does make a lot of sense that we would continue to see this market go higher. The fact that we have pierced the 4500 level and it looks like we are going to close above there at the end of the day suggests that the market is ready to go to its next target, the 4600 level.

The S&P 500 does tend to move in 200-point increments, so that would make sense. The 4500 level would offer a certain amount of psychological importance, but really at this point I do not think that the market is too concerned about this. After all, it is all about keeping that money loose for Wall Street to continue making money. With that being the case, I think buying the dips will continue to be the way forward, especially as the uptrend line and the 50-day EMA are so reliable as of late.

If we did break down below that area, then you could be a buyer of puts, because at least in that scenario you do not risk anything more than your original premium. The downside would probably be very quick and rapid because it would represent some type of major shift in attitude. Nonetheless, they Federal Reserve will do whatever it can to keep the market alive; that is what it does for a living. Ultimately, I think that we are not only going to go to the 4600 level, but we could be looking at a significant move higher than that. The markets have found every excuse they can to continue going higher and have ignored reality for so long that anybody who has been paying attention recognizes that the stock market moves on liquidity, not reality. Or better yet, you should possibly suggest that as long as there is the Fed to back up the market, it is only a matter of time before we go even higher. Wall Street does not care about Main Street, it is all about corporate profits and they have been good over the last quarter.