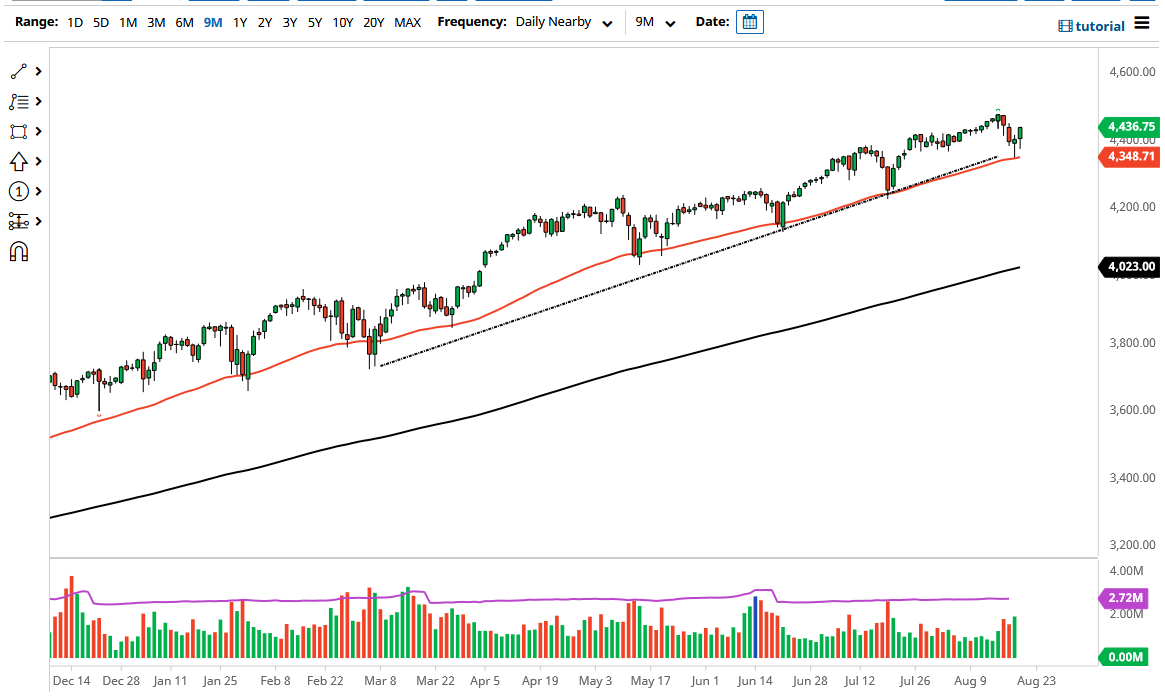

The S&P 500 initially fell during the Friday session but turned around to show signs of life again. The uptrend line underneath has offered support, right along with the 50-day EMA during the previous session on Thursday. Now that we have bounced this way, it suggests that we are going to continue to see more of the same “buy on the dips” type of attitude that has been a mainstay of this market.

Earnings season has come and go for the most part, and it has been relatively strong. Beyond that, the index is not an index of 500 stocks, rather it is an index of roughly 7 stocks with 493 incidental ones thrown in for good measure. As long as the biggest companies in the United States continue to do well, the S&P 500 will have to go higher. I think at this point we are much more likely to see 4500 than 4200, although both of those are potential targets. If we continue to see buying pressure, the 4500 level could offer a little bit of resistance, but just from a pure psychological standpoint, not necessarily anything that matters. After that, then I anticipate that the S&P 500 would go looking towards the 4600 level, as this market does tend to move in 200-point increments.

If we were to somehow break down below the 50-day EMA, then it is possible that we could see a little bit of a dip, and that would not necessarily be the worst thing imaginable as the market has been in an uptrend for what seems like a lifetime. I would be a buyer of puts under the 50-day EMA, but I would not go “all in”, because it is only a matter of time before somebody comes up with a narrative to turn things around or the Federal Reserve steps in and does something liquidity-related. The market could pull back all the way to the 4000 level and still be relatively bullish, because that would be a simple 10% correction or so, which is run-of-the-mill in bullish markets. As long as the United States continues to outperform the rest of the world, the S&P 500 will continue to grind away to the upside.