The S&P 500 rallied significantly again on Monday, as it looks like traders are trying to price in the idea of the Federal Reserve pausing tapering. The Jackson Hole Symposium is going on this week, and traders are starting to bet on Jerome Powell refusing to push up the timeline for tapering, although several Federal Reserve governors have recently suggested that we could see a bit of tapering between now and the end of the year.

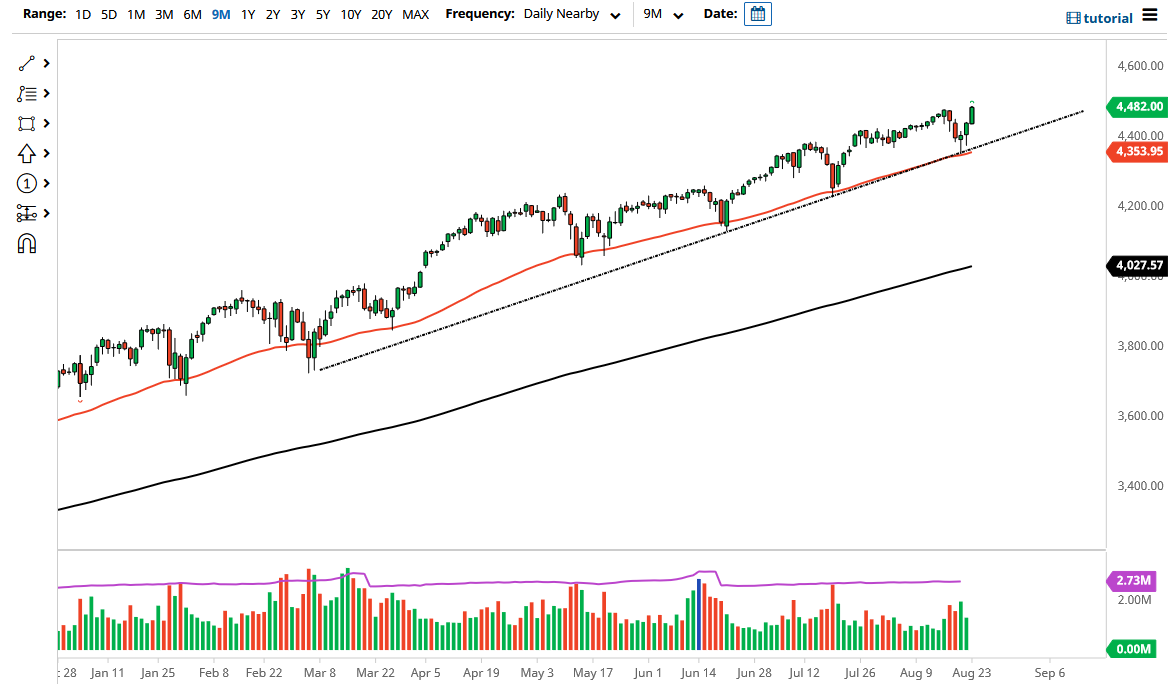

The uptrend line underneath has offered quite a bit of support, as the uptrend line has been followed for multiple months and is backed up by the 50-day EMA. The 4400 level underneath has offered quite a bit of support as well, so all in all I believe this is a market that will break above the 4500 level rather quickly. If the S&P 500 turns around, I think there will be plenty of value hunters getting involved in order to pick up “cheap stocks.”

The outlier of course would be the fact that it is possible that Jerome Powell will suggest that the tapering will begin sooner, and that will throw Wall Street into a bit of a tizzy. At that point, I anticipate that we would probably pull back and possibly even break down below the uptrend line. If that happens, it is more likely than not that Jerome will turn his attitude around once we get towards the 200-day EMA down at the 4000 level. With that in mind, I think that shorting is all but impossible, but if we do get some type of tapering situation that works against stock markets, I would be a buyer of puts.

Having said all of that, I believe that we are probably more likely than not going to go looking towards the 4600 level, as the market tends to move in 200-point increments. That has been the case for ages now, and I do not think that will change anytime soon. If Jerome decides to continue “playing ball” for Wall Street, then it is likely that we will simply continue to go from the lower left to the upper right, just as we have for a majority of the last 13 years.