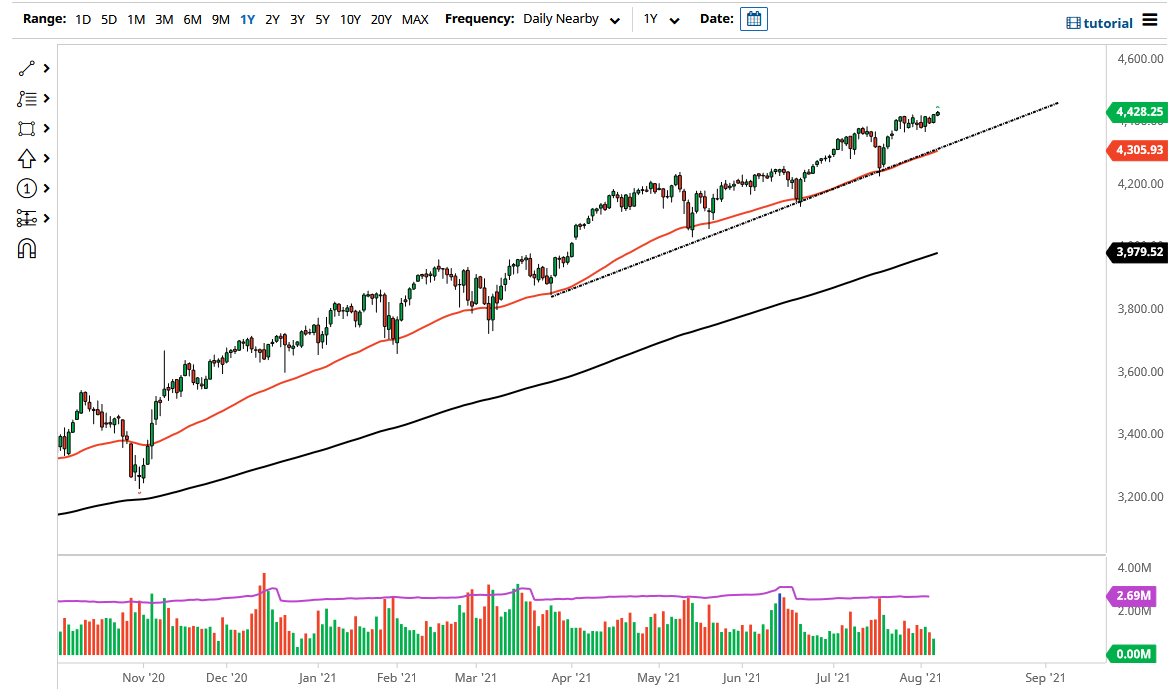

The S&P 500 rallied just a bit during the trading session on Friday, as we continue to see a lot of upward mobility in this market. At this point, the market is likely to continue seeing buyers on dips, so value hunting is still the most likely of propositions that you will see here. The uptrend line underneath and the 50-day EMA both cause a lot of support, and I think what we are seeing here is the likelihood of more of the same action that we have seen multiple times.

If we were to break down below the uptrend line and the 50-day EMA, then it is possible that we would see a drift down to the 4200 level, possibly even the 4000 level. I think the 4000 level is essentially the “floor in the market”, as the 200-day EMA sits in that same general vicinity. I believe at this point that any time we get sellers in this market, we have to look at it as a potential buying opportunity, because the liquidity measures that the Federal Reserve continues to do will continue to push this market higher over the longer term.

I believe we are likely to see this market go looking towards the 4500 level, which could cause a little bit of psychological resistance, but at the end of the day the market does tend to ignore these given enough time, and it is just another big figure. Because of this, I think we are looking at a scenario where there will be plenty of interest in this market, so I just do not see an argument for shorting.

I believe the uptrend line will hold, and that is assuming that we get anywhere near there. I think it would probably be difficult to make that happen, especially as the 4350 level underneath should be supportive based upon the action that we have seen over the last couple of weeks. In general, this is a market that I think eventually will find reasons to go higher, and Friday was an indication that we are already starting to see buyers jump back in and take advantage of the slightest hint of momentum.