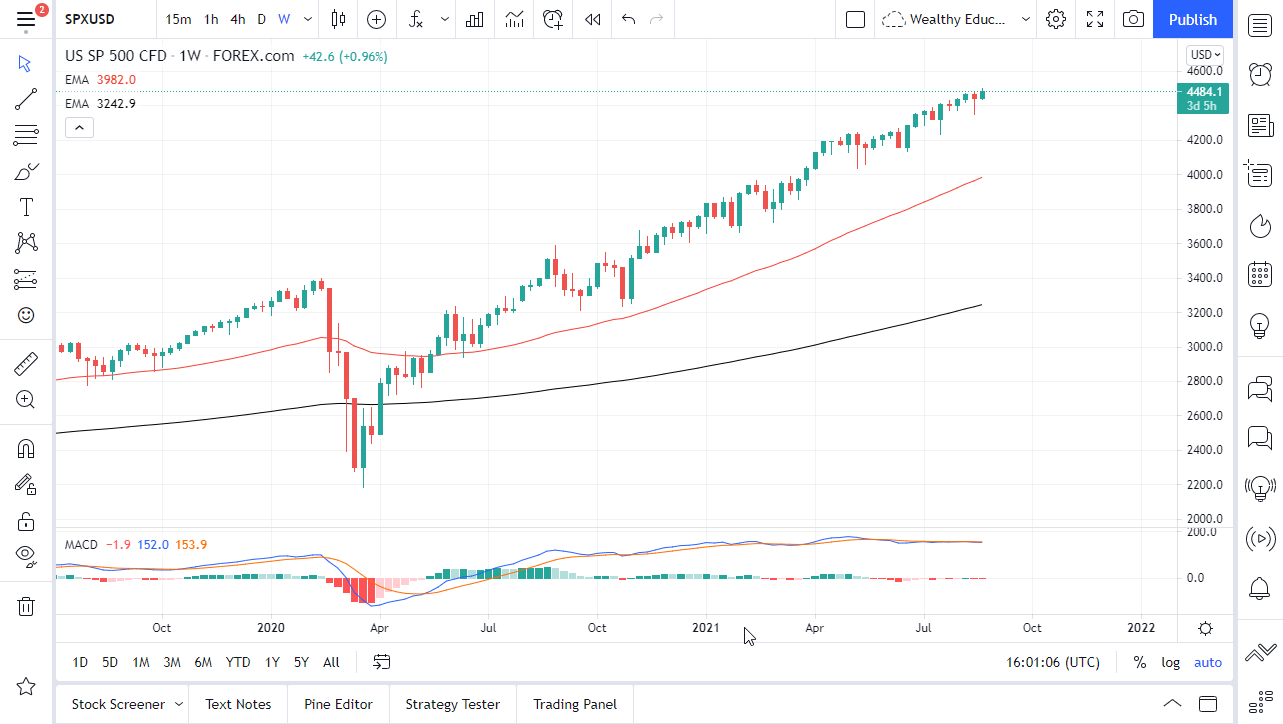

The S&P 500 has continued to see a lot of bullish pressure over the longer term, as we have been moving forward in a perfect 45° angle. This means that the market is likely to see plenty of momentum, because it is an angle that does not show signs of wearing down. Ultimately, if we pull back from here it is likely that we would see plenty of buyers underneath. The 4200 level is a large, round, psychologically significant figure and obviously an area that people would be paying attention to. After that, we have the 4000 level, an area that currently sees the 50-week EMA hovering just below it, and the 200-day EMA on the daily chart.

Ultimately, this is a market that I do think continues to go much higher, although the 4500 level is offering a bit of trouble. Breaking above the 4500 level then opens up the possibility of a move towards the 4600 level. The market does tend to move in 200-point increments, so that is when I look at placing trades. The market pulling back continues to offer value from what I can see, as we have seen over the last 13 years. The market will show plenty of stability, but that is about all we have. After all, there are so many different sectors in the S&P 500 that could move this market higher, as most recently it was the banks, but it also ends up being technology at times. In other words, the market is built to continue going higher and that will be the way forward.

The last couple of weeks have been very choppy but we will continue to drift to the upside given enough time. With this, I think we are just seeing more of the same and, unless we see some type of massive change in Federal Reserve policy, something that is very sudden and shocking, I believe that this is a market which you should simply wait for to give you plenty of opportunities to pick up value that we can take advantage of just as everybody else does. If the market drops more than 10%, I am pretty sure that the Federal Reserve will come out and say or do something to lift the market yet again, as that has been the pattern for so long.