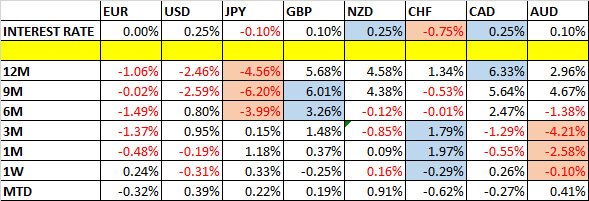

This week we will begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 18 years of Forex prices, which show that the following methodologies have all produced profitable results:

Trading the two currencies that are trending the most strongly over the past 3 months.

Assuming that trends are usually ready to reverse after 12 months.

Trading against very strong counter-trend movements by currency pairs made during the previous week.

Buying currencies with high interest rates and selling currencies with low interest rates.

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast August 2021

For the month of August, we make no forecast as there are no clear trends in the Forex market showing very strong momentum.

Weekly Forecast 8th August 2021

Last week, we made no weekly forecast, as there were no large counter-trend price movements in any important currency pairs or crosses.

We again make no forecast this week.

The Forex market saw low volatility last week. The seven Forex majors moved an average of 0.27% against the USD, with the largest percentage move coming from USD/JPY, moving only 0.55%. GBP/USD, a reasonable size of the Dollar Index, was virtually unchanged at 0.01%. The low volatility was probably reflective of a relatively light week for economic data releases, the key release being CPI and PPI data.

Volatility is likely to be low to moderate next week. Volatility will be helped by a few high-impact economic data releases, including core retail sales and FOMC meeting minutes.

Last week, EUR and JPY showed strength against the US dollar (EUR/USD and USD/JPY, respectively). CHF showed lots of strength for four consecutive days, particularly Monday and Tuesday, and wiped out much of that strength on Friday – although it moved only 0.08% from open to close during the week, it had a large range within the week.

You can trade our forecasts in a real or demo Forex brokerage account.

Previous Monthly Forecasts

You can view the results of our previous monthly forecasts here.

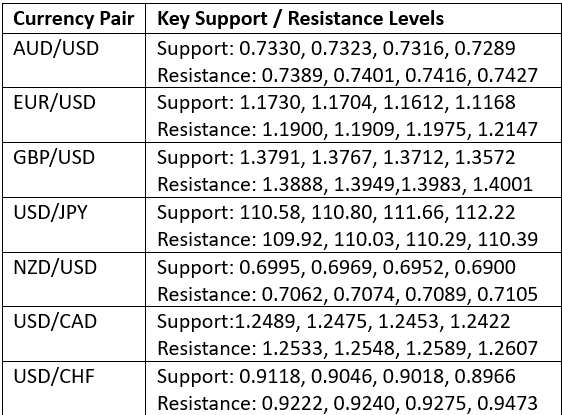

Key Support/Resistance Levels for Popular Pairs

We teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

GBP/CHF

Normally, I focus on Forex majors, but a nice sideways channel on GBP/CHF is visible on both the haily and 4-Hour charts:

AUD/USD

AUD/USD is such an interesting pair from a support & resistance point of view. A large head & shoulders reversal pattern has formed over the first six months of 2021. The neckline of that pattern stood at 0.75812 – it was broken and then retested as resistance, thus providing a short entry opportunity. Note that “flipping” levels, i.e. support turning into resistance, and vice versa, can work out well. Now the price is retesting a previous resistance, 0.74135. The confluence of these factors gives us a nice bearish outlook for this pair.

That is all for this week. You can trade our forecasts in a real or demo Forex brokerage account to test the strategies and strengthen your self-confidence before investing real funds.