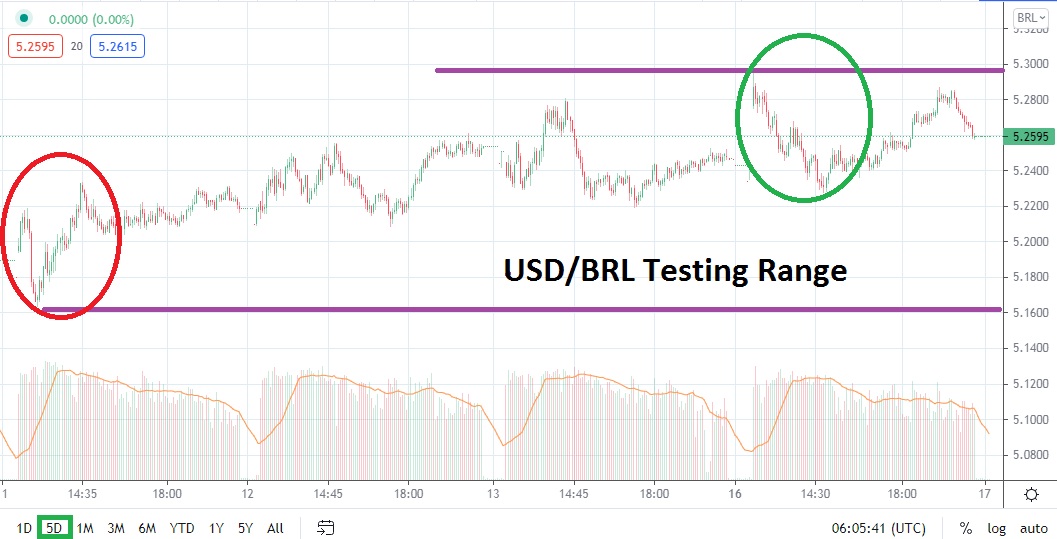

The USD/BRL remains placed within the higher confines of its short and mid-term price ranges. The past week of trading within the USD/BRL has created an incremental bullish trend and important resistance levels have been tested, but they have held their ground. The 5.2900 juncture remains tantalizing close, but has been hard to sustain any real value above for the past month.

Taking a look at a one month chart, the USD/BRL has demonstrated three tests of the 5.2900 value and a failure to sincerely bust through the number higher. Upon opening for trading yesterday, the USD/BRL did gap higher and briefly traded above the 5.2900 juncture, but this duration proved short lived as selling came into the forex pair and a low below the 5.2300 actually developed which then caused another reversal higher. However, after hitting yesterday’s low water mark, intriguingly the USD/BRL was only able to make a high around the 5.2875 mark and then it also started to see price erosion emerge.

The USD/BRL finished yesterday’s trading near the 5.2600 juncture and this number should make speculators rather suspicious. The forex pair continues to show an ability to incrementally track higher and support levels have certainly risen in the past week incrementally.

Yesterday’s move lower which went below the 5.2300 level couldn’t find any real staying power and the overall short term trend of the USD/BRL continues to look slightly bullish. Last week there were certainly signs the USD/BRL might be about to demonstrate a renewed bearish trend, but trading within the forex pair the past handful of days has produced a rather uncorrelated result compared to the general weakness the USD has exhibited in the broad forex markets.

Speculators may be tempted to think the USD/BRL looks overbought at its current values, but it is traversing dangerous support levels which have increased in the short term. Going against the trend may prove to be worthwhile, but selling the USD/BRL should be done carefully and with a limited amount of leverage. And until the USD/BRL is able to penetrate important support near the 5.2200 juncture, traders actually may find the best results could be found by simply buying the forex pair on slight reversals lower near the 5.2400 mark and then looking for moves upwards towards the 5.2700 to 5.2800 levels in the short term.

Brazilian Real Short Term Outlook:

Current Resistance: 5.2740

Current Support: 5.2390

High Target: 5.2980

Low Target: 5.2180