The USD/INR is trading near the 74.2500 level as of this morning and what should intrigue speculators of the forex pair is that technical and fundamental clues are being demonstrated. Yes, the USD/INR could turn a page very quickly and produce sudden volatility upwards which would destroy the points about to be made, but until evidence is produced that shows the trend is about to be broken traders may want to pay attention.

Technically the USD/INR remains within a rather polite bearish trend and has shown little inclination of violent reversals higher. Certainly there are natural cycles which have been expressed and seen resistance levels come into view, but technically resistance levels have been incrementally decreasing the past week. It can be argued too per one month charts, that the USD/INR has consistently established a downward trajectory.

Of fundamental interest is the notion that the USD/INR was able to remain quite steady yesterday as news about the Taliban takeover in Afghanistan took hold. While this can be argued regarding importance within the affairs of political and economic effects on India, there is no denying India constantly remains within a rather precarious relationship in the region via geo-politics.

The result is that a Taliban government in Afghanistan will have an effect within the region which India is a major geo-political force. The fact that no ill effect to the USD/INR was displayed yesterday as the onslaught of political news from the region was broadcast is a reason for optimism perhaps for the forex pair.

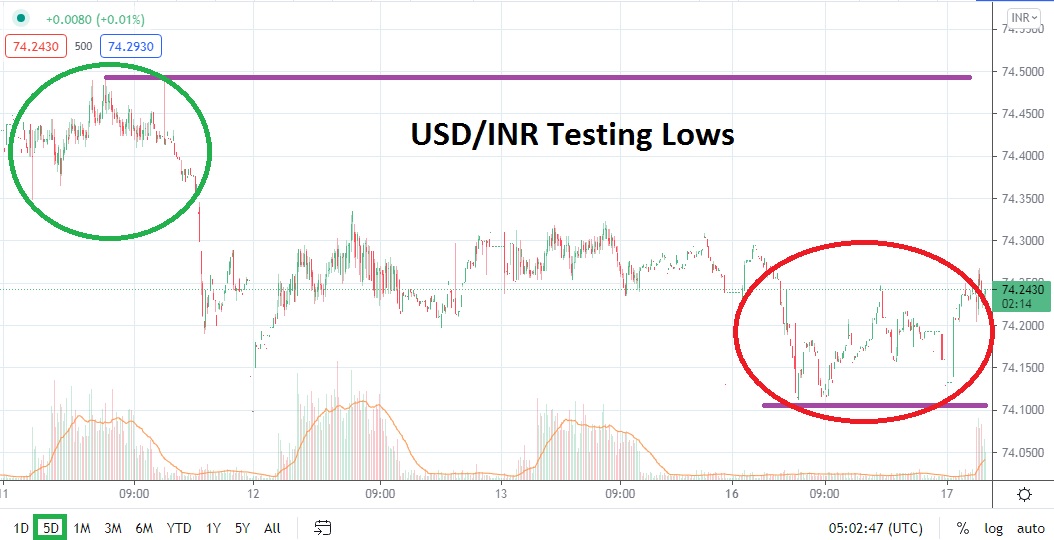

Support for the USD/INR now looks important around the 74.1900 juncture. As of yet, the USD/INR has not been able to sustain values below the 74.2000 mark for a quality amount of time, but traders should pay attention because if these marks are broken lower and transactional volumes increase it could spur on further bearish movement.

Short term resistance near the 74.2900 juncture may prove to be important too. If this level continues to hold and is not punctured higher, this could also be a signal that bearish sentiment remains the dominant factor technically for financial institutions. Speculators who want to sell the USD/INR should remain patient. Conservative wagers may prove wise to wait for slight reversals higher, while looking for downside action.

Indian Rupee Short Term Outlook:

Current Resistance: 74.2900

Current Support: 74.1900

High Target: 74.3500

Low Target: 74.1050