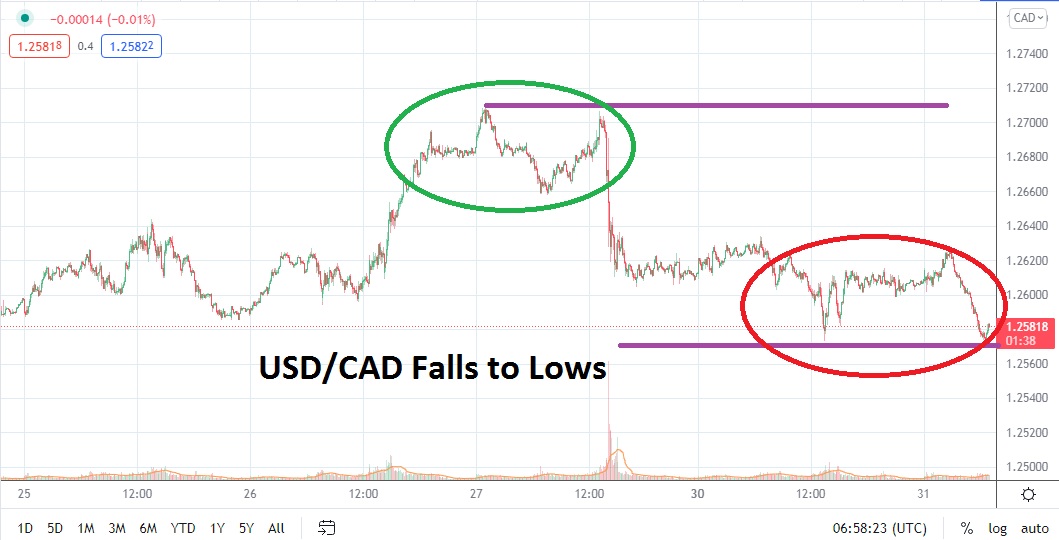

The USD/CAD has produced a rather demonstrative and volatile month during August. Speculators of the Forex pair may be glad to put past four weeks of trading behind them if they have suffered from the volatile moves of the Canadian dollar. On the 20th of August, the USD/CAD was trading near a high of 1.29500, a summit it had not touched since the 21st of December 2020. As of this writing, the USD/CAD is near the 1.25800 vicinity, and is once again trading near levels it has challenged frequently in August.

As the USD/CAD trades within it current waters, the pair is next to important technical support which has been created due to the rather volatile fluctuations experienced the past two weeks. The 1.25650 ratio looks to be important and if it begins to be challenged, this could create additional selling sentiment that believes targeting values of 1.25600 to 1.25200 is a legitimate plan.

Since the beginning of June, the USD/CAD has endured a rather steady bullish trend, but the highs made on the 20th of August may have acted as a siren call announcing the pair had been overbought. The global Forex market has seen the USD take on a weaker tone the past week and this has seen stronger momentum the past few days. The manner in which the USD/CAD has correlated to the broad marketplace is a sign that further downside action technically may be demonstrated.

If the 1.260000 resistance level proves to be durable and does not see a sustained amount of trading above this juncture, it may be a significant indicator that additional selling may develop. Cautious traders may want to wait for slight moves higher which come within sight of perceived resistance levels in order to ignite their short positions.

After seeing a variety of bullish movements which have likely perplexed traders who held onto their selling sentiment, the USD/CAD may be ready to challenge important support ratios which are close by. If the 1.25700 to 1.25600 levels begin to see a test of their values and support proves vulnerable within these ratios, bearish momentum may continue to build in the short term.

Canadian Dollar Short-Term Outlook

Current Resistance: 1.26000

Current Support: 1.25620

High Target: 1.26350

Low Target: 1.25100