The USD/JPY will remain unstable until the much-anticipated Jackson Hole Symposium later this week. The currency pair is moving in a range between the support level 109.62 and the resistance level 110.14, and is settling around the level of 109.85 as of this writing. Ahead of the week's event, the July minutes indicated that the majority of US Federal Reserve rate-setters would be happy to begin the process of ending QE this year if the economy develops in line with expectations set in June.

As a result, market prices shifted from an implied indication of a 62% chance of a Fed rate hike before the end of 2022 to a 68% chance, despite last week's minutes clearly describing FOMC members as eager to emphasize that there is no “mechanical link between the tapering timing of the eventual increase in the target range of the federal funds rate.”

It is therefore possible that the uncertainty about Jerome Powell's message will encourage caution among the bulls, and there is also room for market disappointment to affect the dollar after the fact if the Fed chairman says anything that indicates that market expectations for the timing of tapering or is very ambitious. Commenting on this, Brian Daingerfield, G10 FX analyst at Natwest Markets said, “Although the FOMC minutes are not new, they continue to push the Fed's tapering talks forward, challenging risky assets on the back of adjustment of global growth forecasts. Jackson Hole may give a similar boost, but we don't expect September to be the tapering announcement - we see November as the most likely."

On the other hand, it affected the sentiment of investors and markets. The United States gave full approval for Pfizer's COVID-19 vaccine yesterday, which could boost public confidence in the doses and immediately open the way for more universities, businesses and local governments to make vaccinations mandatory. The Pentagon immediately announced that it would press ahead with plans to force vaccinations in the military amid the battle against the highly contagious delta variant. Similarly, the University of Minnesota said it will require its students to get the dose, as the major Louisiana public universities have done.

More than 200 million doses of Pfizer have been served in the United States under emergency provisions - and hundreds of millions worldwide - since last December. Going a step further and granting full approval, the Food and Drug Administration has cited months of factual evidence that serious side effects are extremely rare. Commenting on the full approval, US President Joe Biden said that for those who hesitated to get the vaccine until it received what he called the "gold standard" of Food and Drug Administration approval, "the moment you've been waiting for is here." "Please vaccinate today," he added.

For its part, Pfizer said the United States is the first country to grant full approval for its vaccine, in a process that required a 360,000-page application and rigorous inspections. The Food and Drug Administration did not previously have much evidence to judge the safety of a dose.

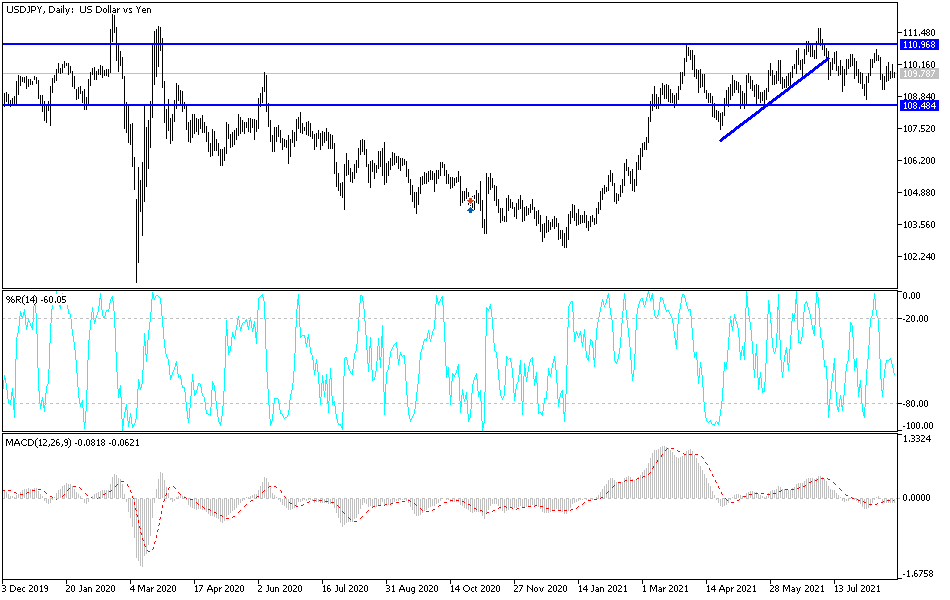

Technical analysis of the pair

There is no change in my technical view of the performance of the USD/JPY currency pair, as stability will remain above the psychological resistance 110.00, motivating the bulls to move within technical buys to the next psychological resistance level at 111.20. On the other hand, the support level 108.80 will remain crucial for a strong bearish trend. The situation on the daily chart is neutral with a bulish bias.

The currency pair will be affected by risk appetite and the announcement of US new home sales.