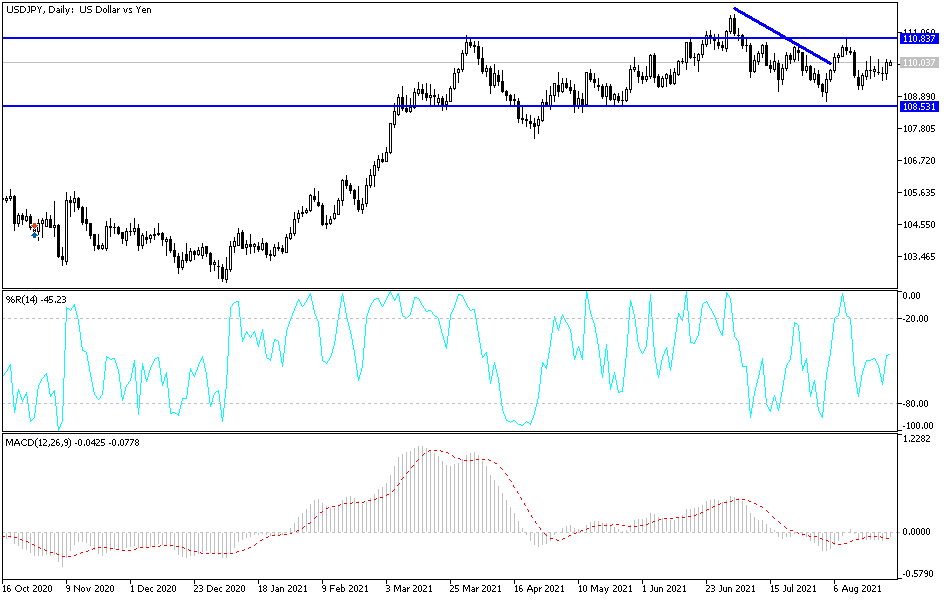

The US dollar is preparing to move against the rest of the other major currencies ahead of the Jackson Hole Symposium after allowing them in recent days to achieve some gains. After settling around the 110.15 resistance yesterday, the USD/JPY pair collapsed to the 109.47 support level. The markets are looking for indications from the statement of US Federal Reserve Chairman Jerome Powell tomorrow regarding if and when there will be a tightening of the bank’s policy amid a strong recovery of the US economy.

While the dollar has slipped this week after earlier strong gains against many currencies, Powell's speech on Friday at the Global Central Bankers Conference in Jackson Hole, Wyoming could put a floor on the dollar. A group of analysts has suggested that the renewed encroachment of the coronavirus in some parts of the world, and recent momentum in others, will lead the bank to be more cautious about ending its quantitative easing program in a widely expected cutback.

However, the minutes of the Federal Reserve's July meeting indicated that the process could begin before the end of the year, and if Powell sticks to that provision in any policy remarks made on Friday, the dollar may find itself better supported. So far, we have seen that the Fed's slow but steady approach to normalizing its monetary policies supports the dollar.

The dollar's rally may be on the cusp of a reversal, says Commerzbank Analyst Karen Jones in a technical discovery that comes just as the underlying reasons for the US currency's softening begin to emerge. “Technically speaking, the US dollar is in the embryonic stages of a reversal,” says Jones, who heads the bank's technical analysis team. The call comes at a time when the strong dollar was the best performer among the world's top 10 freely traded currencies just last week.

But, could the recent rally in the dollar signal a last chance for this trend?

Jones took a look at the longer-term charts (weekly and monthly) in an effort to stay away from the recent short-term noise in order to give an idea of where the bigger trends might lie. “Yes, there is more work to be done, but the failure is moving higher through USD/CAD, USD/SEK and bounces from the 55-week moving average on GBP/USD, not to mention a potential reversal pattern on EUR/USD, which It means a weakening of the US dollar going forward.”

Looking at the US Dollar Index - which depicts the performance of the dollar against a basket of major currencies - reveals the failed challenge of the March rally at 93.44. As Jones says: "This adds weight to the idea that this was just a correction and that the dollar is back under pressure."

Technical analysis of the pair

Stability of the USD/JPY above the psychological resistance of 110.00 will continue to support the upward correction, and if the dollar gains momentum from the announcement of the US economic growth figures and the weekly jobless claims today the next targets for the bulls will be 110.65 and 111.20.