The USD/JPY has been recovering strongly, most recently reaching the 110.35 resistance level. The bullish performance is supported by investors abandoning the Japanese yen amid concerns about the epidemiological situation in Japan, in addition to the positive US economic releases led by the jobs report, which signals a possible raising of US interest rates. All in all, the US dollar found new bidding interest in the wake of the strong US jobs report for July, although this strength was more pronounced against the EUR.

The US non-farm payrolls came in at 943K for the month of July, better than the 870K that the market had expected and an improvement from the previous month's 938K. Also, the US unemployment rate was reported to have fallen to 5.4% in July, beating analysts' expectations for a decline to 5.7% from 5.9% in June. Therefore, the US dollar was bought in the wake of the data as investors interpreted it as providing additional confirmation that the US economy is developing in a manner consistent with the withdrawal of monetary stimulus from the Federal Reserve.

Commenting on this, Simon Harvey, Senior FX Market Analyst at Monex Europe, said: “The previous market view in US dollars was confirmed by net employment gains and upward revision for June.” For its part, the Fed has long said that it will only start withdrawing monetary support once it feels that the US economy has sufficiently recovered. Market developments - including the dollar's rally - suggest that the Fed will be justified in announcing a plan to reduce QE asset purchases at upcoming meetings.

Average wages in the US rose 0.4% month-on-month to July, faster than the 0.3% the market had expected. Annual wage growth came in at 4.0% in July, stronger than the 3.8% the market had been expecting.

But before the US Federal Reserve offers more realistic guidance on higher interest rates, it should scale back its quantitative easing program, and a series of strong jobs reports "make the possibility of tapering seem closer at hand", according to Emma Samani, FX analyst at Monex Europe. “The data provides all the reasons why dollar traders are bullish after the data. The dollar's strength was also supported by the Treasury market, where 10-year bond yields rose around 1.3%.”

Looking at the details of the jobs report, the employment rebound in July was again mainly driven by the leisure and hospitality sector. Employment in this sector increased by 380K in July. The number of jobs in the trade and transport sector (47K), business services (60K) and education and health (87K) also increased.

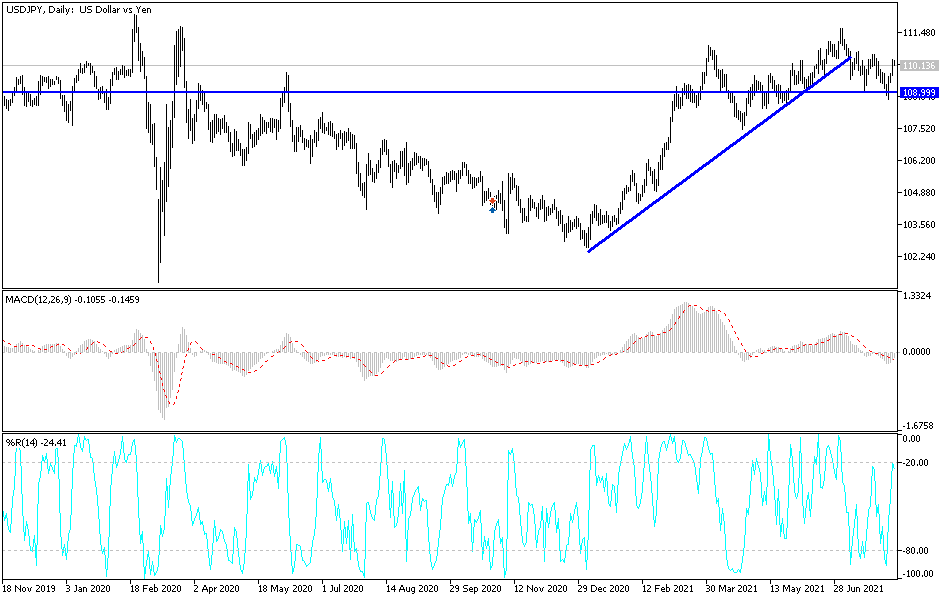

Technical analysis of the pair

The USD/JPY is stable above the psychological resistance of 110.00, which will continue to support the upward correction and put the bulls on path to breach the next psychological resistance of 111.20.

On the downside, the currency pair will return to the bearish channel that was formed since the beginning of trading last month, if it returns to test the support levels of 109.55 and 108.80 again.

The currency pair will continue to be affected by the reaction of investors to the US jobs numbers and the risk appetite of investors.