This is the lowest for the currency pair in three months, before settling around the 109.10 level. The choppy trading returns while investors weigh optimism about the economic outlook against the rise. The latest in cases of coronavirus infection around the world. Recent data has shown some signs of slowing economic growth, but investors may see this as further evidence that the Fed won't start tapering off stimulus anytime soon.

The US central bank has repeatedly pledged to maintain its asset purchases at current levels until "more significant progress" is made toward meeting its maximum employment targets and price stability. Last week, Federal Reserve Chairman Jerome Powell noted that the central bank was "a long way" from changing policy, noting that there was still "some ground to cover on the labor market side."

However, concerns about the rapid spread of the delta variant of the coronavirus continue to weigh on investors' minds, as the new wave led to renewed lockdowns in some parts of the world. Data from the Centers for Disease Control and Prevention has shown a jump in new coronavirus cases in the United States in recent weeks, with the seven-day moving average of new cases reaching 72,790 last Friday, surpassing the peak seen last summer.

At the same time, the increase also appears to have led to more Americans getting vaccinated, with the CDC saying that 70 percent of adults in the United States have now received at least one dose of the coronavirus vaccine.

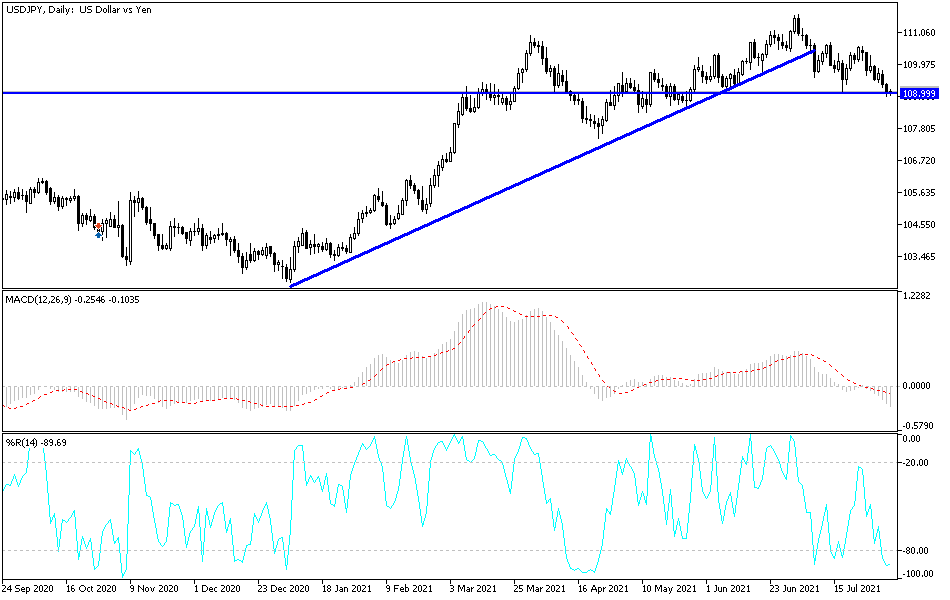

According to the technical analysis of the pair: On the daily chart, the USD/JPY currency pair moved towards important support levels, which were noted in the recent technical analyzes that it confirms the bears’ dominance. At the same time, the technical indicators may move to oversold levels, and therefore it is possible to buy from them, waiting for the moment of rebound. The most important for the bears and for buying are currently 108.75, 108.00 and 107.55, respectively. On the other hand, there will be no opportunity to correct higher without breaching the psychological resistance 110.00, otherwise the stronger decline in performance will remain.

The currency pair will be affected today by the extent to which investors take risks or not, in addition to the announcement of the ADP survey reading to measure the change in the number of US jobs in the non-farm sector and the ISM purchasing managers index reading for the services sector.