The USD/JPY kept its bullish momentum last week to some extend, hovering around the 110.00 psychological resistance level, crucial for a bullish trend. The rebound gains reached the resistance level at 110.22 and closed the week’s trading around the 109.80 level, starting this week stable around the 109.78 level. The gains of the US dollar may increase or collapse on a signal from the US Federal Reserve at the upcoming Jackson Hole symposium this week. I expect trading in limited ranges until this event.

Commenting on the performance of the US dollar, Richard Vranulovic, a foreign exchange analyst at Westpac, says, “The US dollar is in a leadership position. Risk appetite is likely to remain constrained by the continued spread of the delta variable, which leads to safe haven flows into the US dollar. However, at the same time, the Fed continues its slow tapering path, providing critical importance and continued support to the US dollar.”

The US dollar is at its highest level since November 2020.

Investor sentiment turned to caution last week after some disappointing economic reports on US retail sales, housing and consumer confidence. The surge in coronavirus infections across the US and around the world due to a highly contagious delta variant have given traders reason to pause with the US market near all-time highs.

During the first year of the COVID-19 coronavirus pandemic, Japan, Australia and New Zealand have been in relatively good shape, but they are taking divergent paths in dealing with new outbreaks of the rapidly spreading delta variant. In New Zealand and Australia, the governments put the entire countries on strict lockdown over the past week. Elsewhere around the Pacific, though, Japan is resisting such measures in the face of a record boom, instead emphasizing an accelerated vaccine program. Australia fell somewhere in the middle. In general, different approaches can have far-reaching consequences for their economies and the health of their citizens.

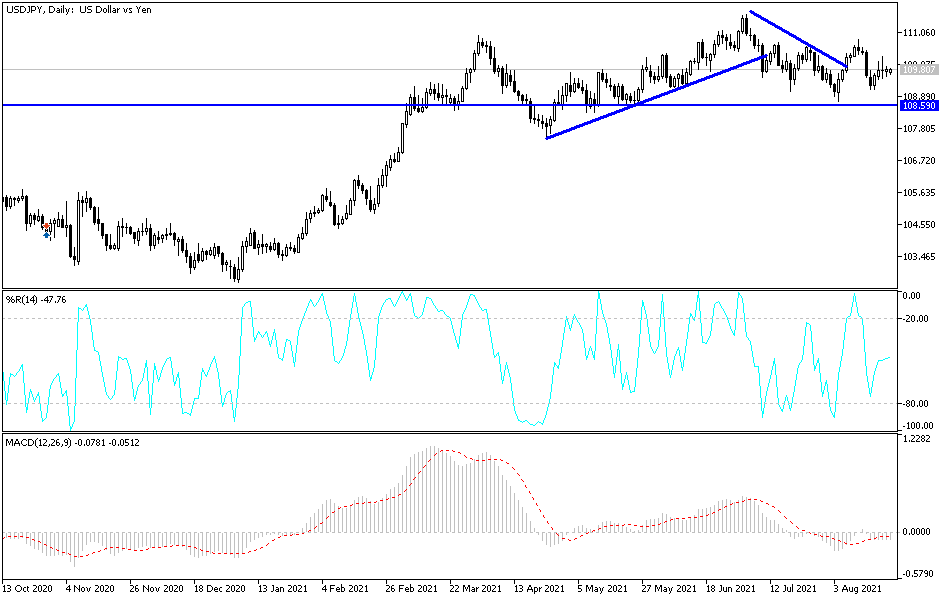

Technical analysis of the pair

On the daily chart, it seems clear that the performance of the USD/JPY currency pair is neutral, and will exude a bullish bias if it returns to stability above the 110.00 psychological resistance. The price of the USD/JPY may remain moving in narrow ranges until investors and markets react to the Jackson Hole symposium on the future of tightening the Fed's policy, the strongest supportive factor for the recent US dollar gains.

The currency pair may abandon expectations of a rebound higher if it moves towards the support level at 108.80.