Even with a US dollar weakened by the Fed's comments at the Jackson Hole Symposium, the USD/JPY did not experience strong losses as did the other US dollar pairs. The pair only retreated to the level of 109.70 and then started back to the threshold of the psychological resistance at 110.00 in this morning's trading.

Fed Chairman Powell was frank last Friday when he emphasized that the decision to end the Fed's giant bond-buying program does not mean that the initial increase in the key rate is closer, and it appears he is sending confusing signals to market segments that have become more confident since he said at a meeting last month that he might raise interest rates by the end of next year.

Commenting on this, Zach Bundle, currency analyst at Goldman Sachs, says, “With pricing now largely declining, and the currency stronger as a result, pursuing the process shouldn't push the dollar higher from this point on. So we expect the US dollar to stabilize over the coming weeks, and possibly fall against certain pairs with attractive domestic fundamentals.”

Powell also noted on Friday that there are still six million Americans out of work as a result of the pandemic and reminded the market that more of these jobs will need to recover in order to actually end the bond-buying program, before emphasizing that restoring all jobs lost is a prerequisite for any rate hike, which is why Friday's non-farm payrolls report will get a lot of attention.

We expect the general tone for the August data to remain positive, albeit less optimistic than the July data. After back-to-back gains of 938,000 and 943,000, we look to US non-farm payroll growth to ease somewhat in August to 525,000 and for the unemployment rate to drop "only" 0.1 point to 5.3%. The consensus is that the US economy created or recovered from the coronavirus about 750,000 new jobs in August, down from 943,000 in the previous month but still greater than the pandemic averages seen before the third quarter.

US COVID-19 deaths have reached more than 1,200 per day nationwide, the highest level since mid-March. The average daily new cases are more than 155,000, returning to what they were in January.

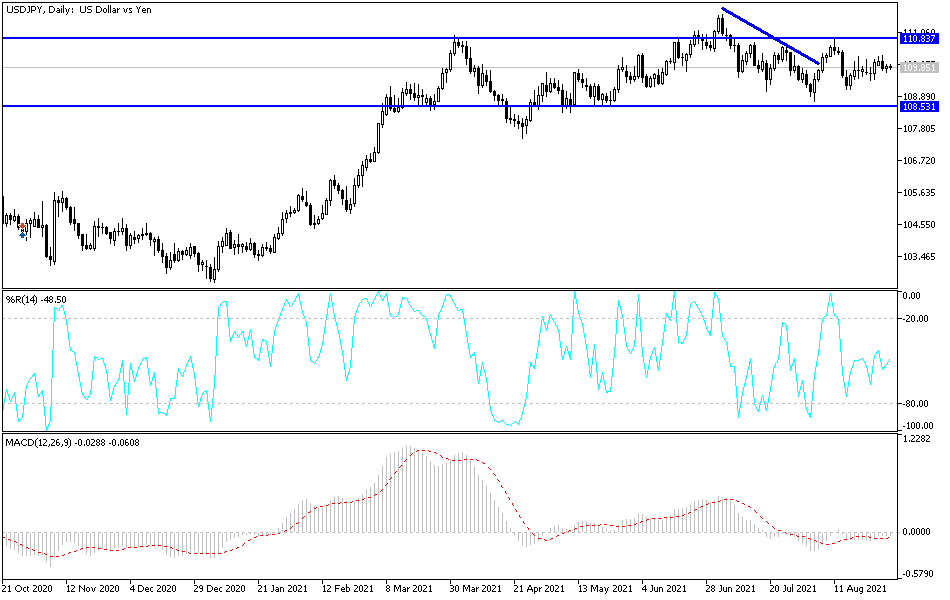

Technical analysis of the pair

The psychological resistance at 110.00 will remain the starting point for the bulls to dominate the pair's performance. With enough momentum, the next targets will be 110.65 and 111.20. A strong bearish turn will occur if the pair moves below the support level at 109.00. I still prefer buying the currency pair from every downward level.

The currency pair will be affected today by risk appetite, as well as the reaction to the announcement of US consumer confidence figures.