It traded around the 109.47 support level, near the lowest level recorded last week around 109.36, the lowest level in two weeks. As I expected, the dollar will remain under these pressures until the US jobs numbers are announced by the end of the week, the strongest driver of the US dollar pairs during this week. The dollar's trajectory, however, has generally weakened since last Wednesday's Federal Reserve monetary policy decision. It saw the bank signal it was heading toward scaling back its $120 billion per month quantitative easing (QE) program, slower than the market had expected.

Commenting on this, Bob Schwartz, chief economist at Oxford Economics says: “For the most part, the Fed's message on financial markets has landed loudly, as a sense of wait-and-see seems to be the dominant view among investors. This makes sense given all the uncertainties about inflation and the path the economy will take over the next several months amid the spread of the fast-spreading delta virus.”

The Fed's patience is rooted in FOMC officials' desire to better see the US labor market before emergency monetary support is withdrawn from the economy. This means there is a lot more to be determined by the results of next Friday's non-farm payroll report. The July non-farm payrolls report is due at 13:30 on Friday. A strong number in line with the 895K consensus is likely to lead, analysts at MUFG note a buoyant trend that sees economists overestimating the likely pace of job growth at the same time. This leaves the dollar vulnerable to declines after the announcement.

The reaction of the to the previous non-farm payroll reports is clear - the tendency for dollar weakness is very strong. In the last eight issues of the NFP, the dollar weakened after one hour in seven of those times - an implied probability of 88%. So Lee Hardman, currency analyst at MUFG, says this reflects the fact that markets are in a position to have very strong job growth that does not meet expectations.

Japan expanded a state of emergency related to the coronavirus to four other regions in addition to Tokyo on Friday after a record rise in infections as the capital hosts the Olympic Games. In this regard, Japanese Prime Minister Yoshihide Suga declared a state of emergency in Saitama, Kanagawa and Chiba, near Tokyo, as well as in the western city of Osaka, from Monday until August 31. The emergency measures already in place in Tokyo and the southern island of Okinawa will be extended until the end of August, after the Olympics and until the Paralympic Games starting on August 24th.

The increase in the number of cases in Tokyo despite emergency measures taken for more than two weeks raises doubts that it can effectively slow down the infection. Five other regions, including Hokkaido, Kyoto, Hyogo and Fukuoka, will be subject to less stringent emergency restrictions.

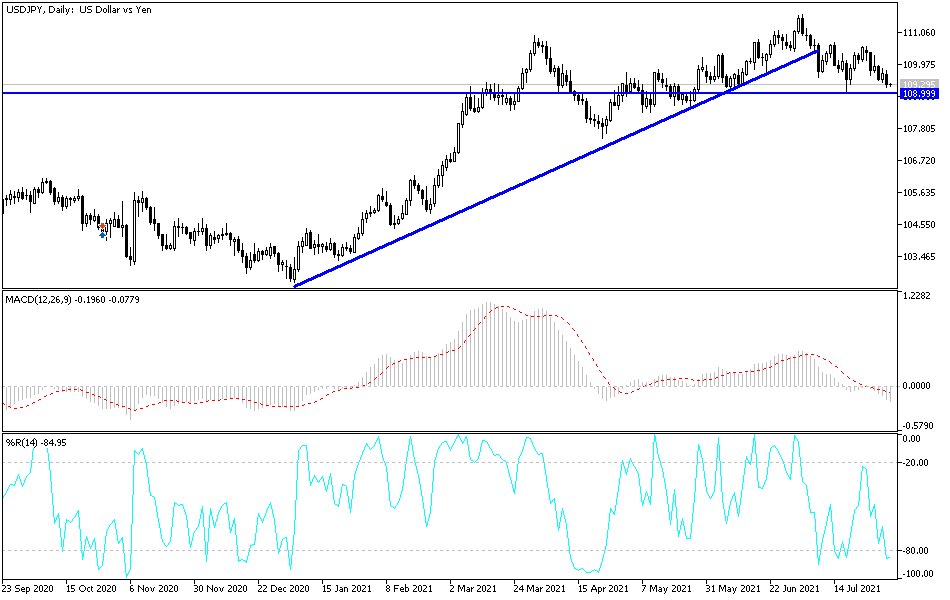

According to the technical analysis of the pair: The continued decline of the USD/JPY currency pair below the psychological resistance level of 110.00 will continue to support the continuation of the downward trend for the pair. At the present time, the closest support levels for the pair are 109.10, 108.75 and 108.00, respectively, which are important areas for stronger bears control over performance. I think that the second and third level is the most appropriate for thinking about buying the pair to take advantage of the rebound up at any time. On the upside, the resistance level 111.20 is still the most important for the bulls' return to dominate the performance and get out of the current bearish performance. The currency pair will be affected today by the extent to which investors take risks or not, with the absence of important and influential economic releases.