The USD/JPY has been moving in a narrow range, with markets and investors awaiting the Jackson Hole Symposium. The symposium is where the US Federal Reserve may decided to continue its monetary policy or end it. The USD/JPY is moving between the 110.15 resistance level and the 109.41 support level, settling around 109.75 as of this writing.

Nordea Markets says that the US dollar tends to increase when growth expectations in the US rise compared to the rest of the world and vice versa. The IMF's latest forecast shows that they expect the global economy to grow 6.0% in 2021 and 4.9% in 2022, with advanced economies growing 5.6% and 4.4%. But they expected the US to lead growth of 7.0% and 4.9% in 2021 and 2022, respectively.

The downgrade of global economic growth forecasts have led to a 100-250 basis point decline in the G10 currencies against the dollar since the end of July. "It is likely that both drivers will need to move towards a strong dollar to fall on a sustainable basis," says Zach Bundle, analyst at Goldman Sachs. "Given the significant role that global growth forecasts have played in the recent G10 FX performance, we will need more confidence that delta-spreading outbreaks are waning before we recommend a pro-cyclical dollar short."

The general dollar-supportive background therefore remains in place, so any pause in the currency's appreciation may be transient in nature.

The US Commerce Department released a report showing a rebound in new home sales in the US in July. The report showed new home sales increased by 1.0 percent to an annual rate of 708K in July after declining by 2.6 percent to an upwardly revised rate of 701K in June.

Economists had expected new home sales to jump 3.6 percent to a rate of 700,000 from 676,000 originally reported in the previous month. And while new home sales in June were revised up, the annual rate remains the lowest since April of last year. The increase in new home sales came as new home sales in the West rose 14.4 percent to an annual rate of 215,000.

New home sales in the South also rose 1.3%, while sales of new homes in the Northeast and Midwest fell 24.1% and 20.2%, respectively. The Commerce Department also said the median sales price for new homes sold in July was $390,500, up 5.5 percent from $370,200 in June and up 18.4 percent from $329,800 last year. Estimates of new homes for sale at the end of July were 367,000, representing a supply of 6.2 months at the current sales rate.

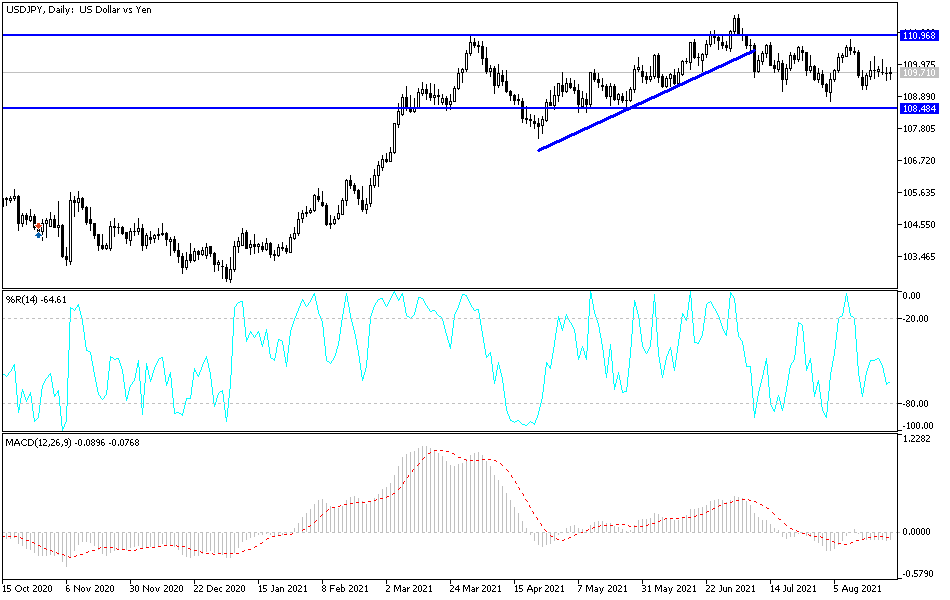

Technical analysis of the pair

The USD/JPY will continue to move in narrow ranges until markets and investors react to the statements of Federal Reserve Chairman Jerome Powell at the Jackson Hole seminar. Stability above the 110.00 psychological resistance will allow for a move towards the next resistance levels at 110.60 and 111.20. On the other hand, the 108.80 psychological support will remain crucial to ending the current bullish trend. I still prefer buying the currency pair from every bearish level.

The currency pair will be affected by risk appetite as well as the reaction from the announcement of US durable goods orders.