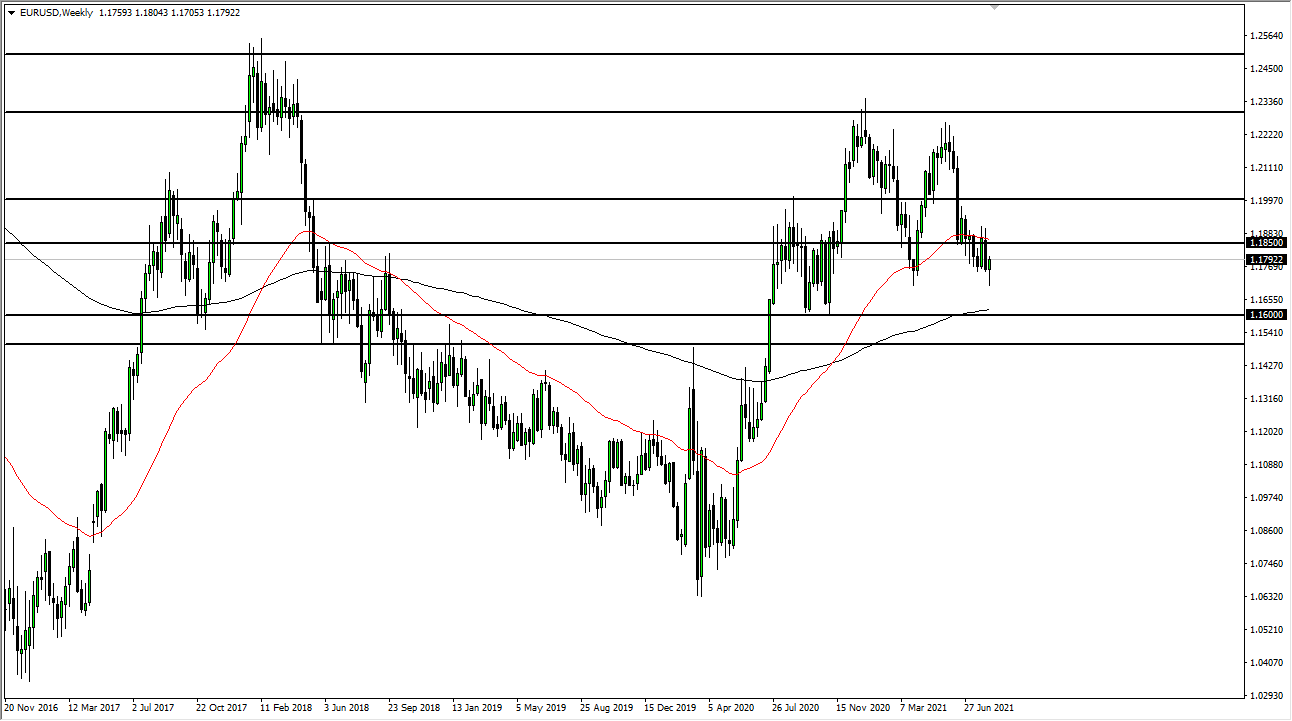

EUR/USD

The euro fell initially during the week but then turned around to form a bit of a hammer. Because of this, I think we are going to see a little bit of upward pressure, but you can also make a strong argument for the fact that the 1.1850 level continues to offer resistance. In other words, I think we will see an initial attempt to rally a bit, only to turn around and break down. Whether or not we break down to reach towards 1.16 level is a completely different question, I think we are simply “slumping” going forward, so it is likely that we will continue to see more of the same.

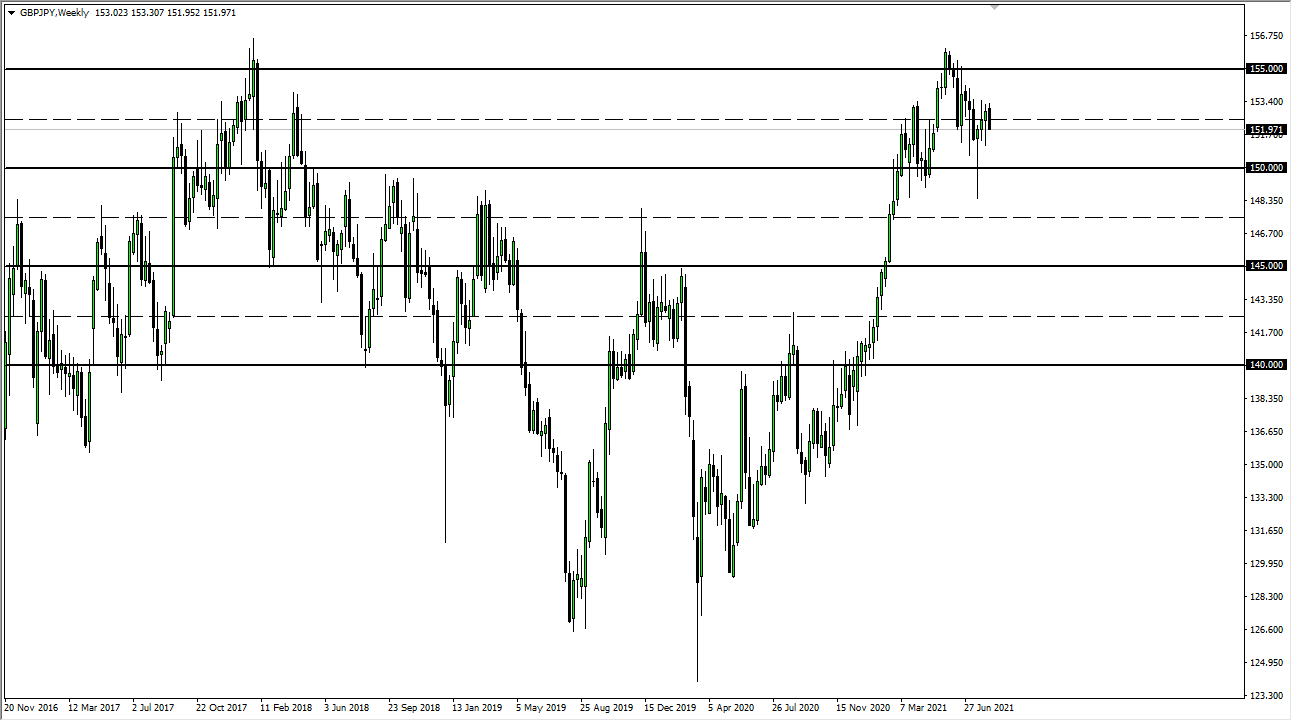

GBP/JPY

The British pound initially rallied during the week, but then broke down quite a bit to slice through the ¥152 level by the time we got towards the end of the session on Friday. By doing so, the market is likely to continue to see a lot of noisy behavior, and it certainly looks as if we are trying to break down towards support again. I think the ¥150 level underneath will continue to be significant support, so as long as we stay above there the market will probably continue to consolidate more than anything else. On the other hand, if we were to break above the ¥153.50 level, then we may go looking towards the ¥155 level.

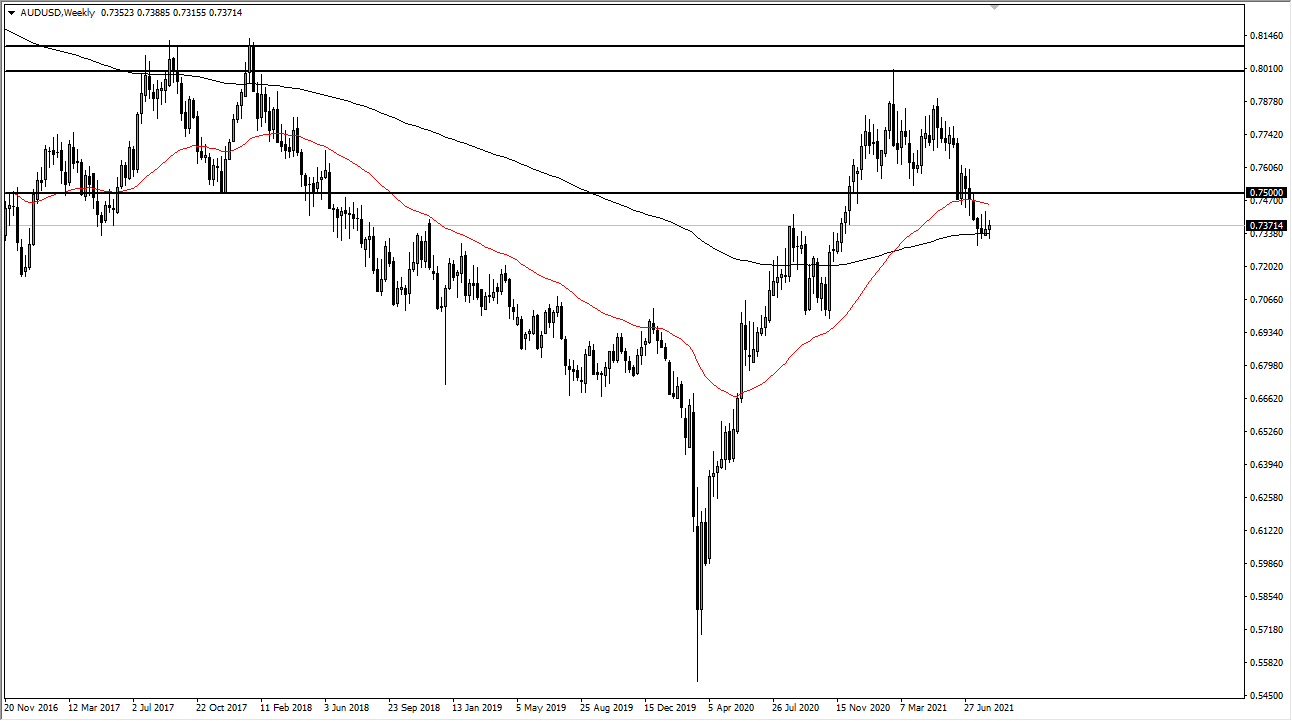

AUD/USD

The Australian dollar went back and forth during the week, as we continue to see a lot of confusion in this market. After all, the Australian government has closed down Canberra as well, now having three of the largest cities in Australia shut down. With that being the case, it certainly puts a bit of an anchor around the neck of the Aussie. From a technical standpoint, we are sitting just above the 200 week EMA with the market going back and forth between the 0.73 level and the 0.74 level. I suspect that we are going to see more of the same going forward.

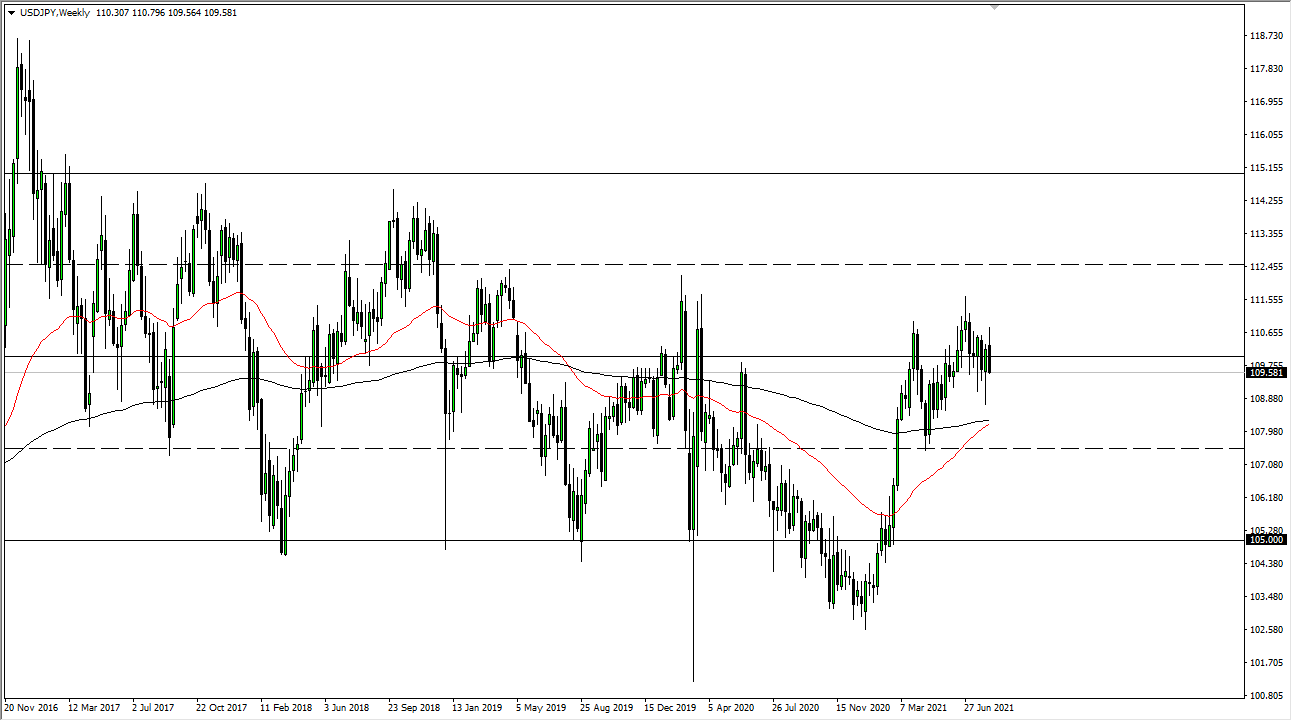

USD/JPY

The US dollar initially tried to rally during the week but then broke down significantly to slice through the ¥110 level again. However, the ¥110 level has been very attractive for the market, as it seems to be acting as a bit of a magnet for price. However, if we break down below the ¥108.50 level, then we could break down below there to test the ¥107.50 area. To the upside, I see a massive amount of resistance at the ¥111.50 offering a bit of a “ceiling in the market.”