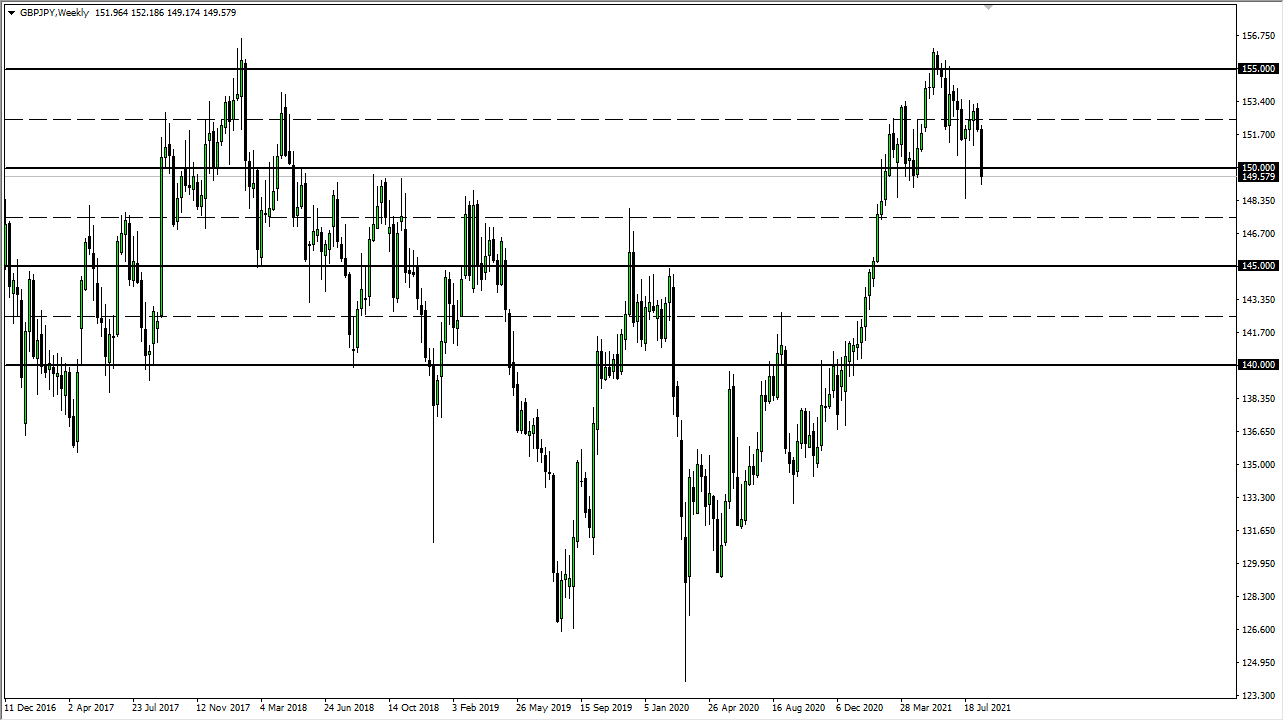

GBP/JPY

The British pound got hammered during the week, not only against the Japanese yen but against almost everything else. We have definitely seen a huge shift into “risk off” sentiment, and I think that continues to play out around the Forex world. With that being the case, I think the market will continue to look at rallies as potential selling opportunities until something changes quite drastically. If we break down below the hammer from five weeks ago, the bottom is going to fall out of this market, and we go much lower.

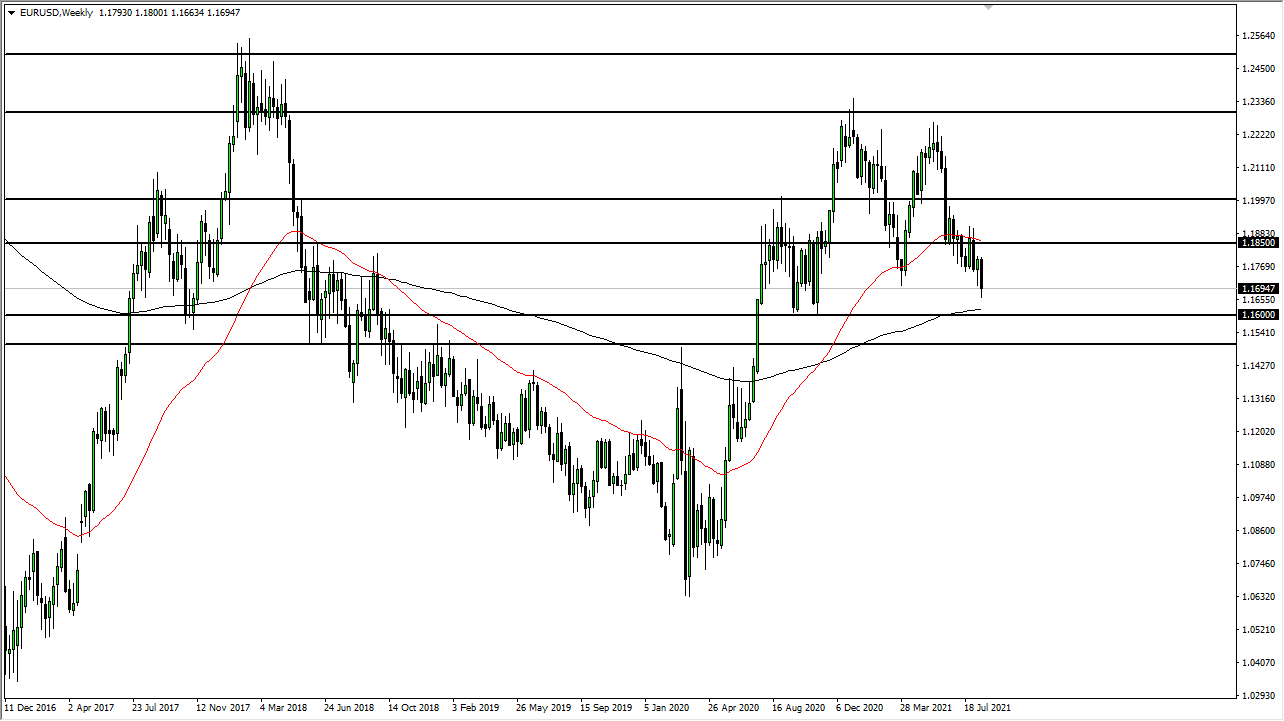

EUR/USD

The euro fell significantly during the week, breaking below the 1.17 level. At this point, the 1.16 level is more than likely going to be targeted, and at this point we might get a short-term rally that we can sell into. Signs of exhaustion will certainly get faded, unless we can somehow take out the 1.1850 level. Breaking above that level would open up the possibility for an uptrend. Until then, I am se all short-term rallies.

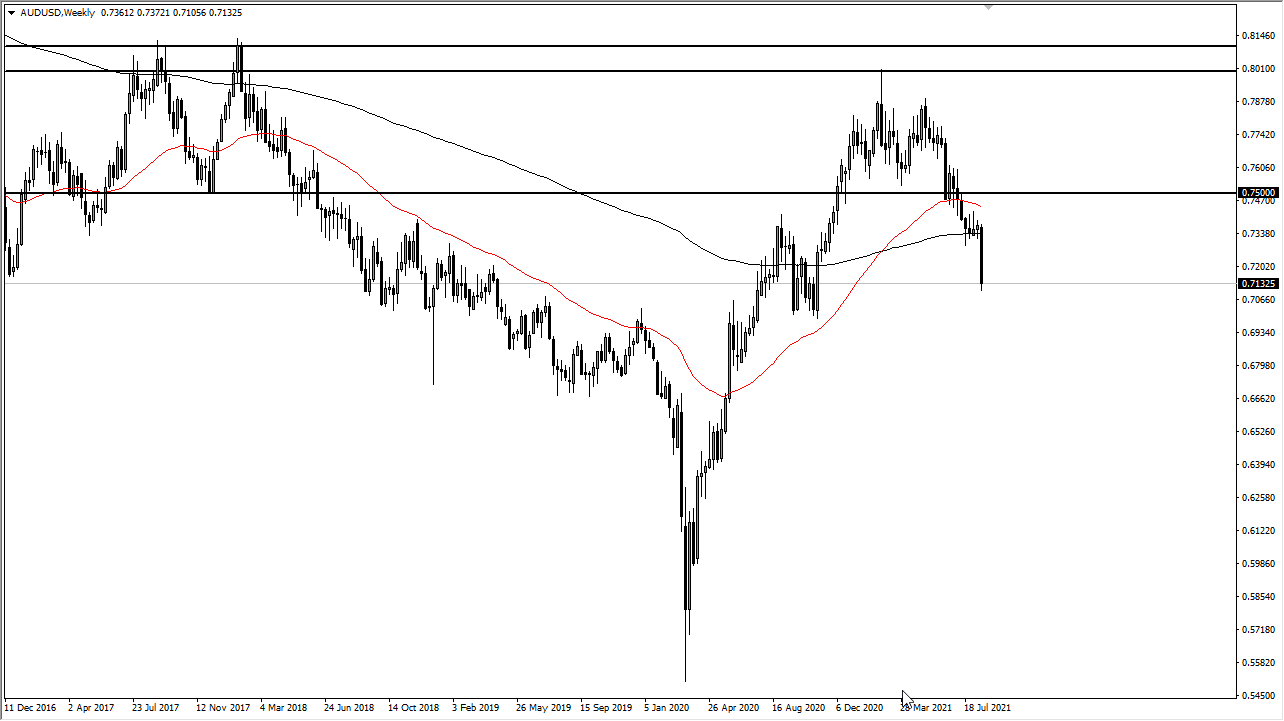

AUD/USD

The Australian dollar broke down rather significantly during the week, dropping over 3%. With this type of candlestick, it can mean either capitulation or the beginning of something bigger. I think it is the lattter because we are seeing a lot of negativity across risk assets in general. If we do rally from here, then I think it is only a matter of time before we see signs of exhaustion that we can sell into. I have no interest in buying the Aussie until we break out above the top of the candlestick for the week.

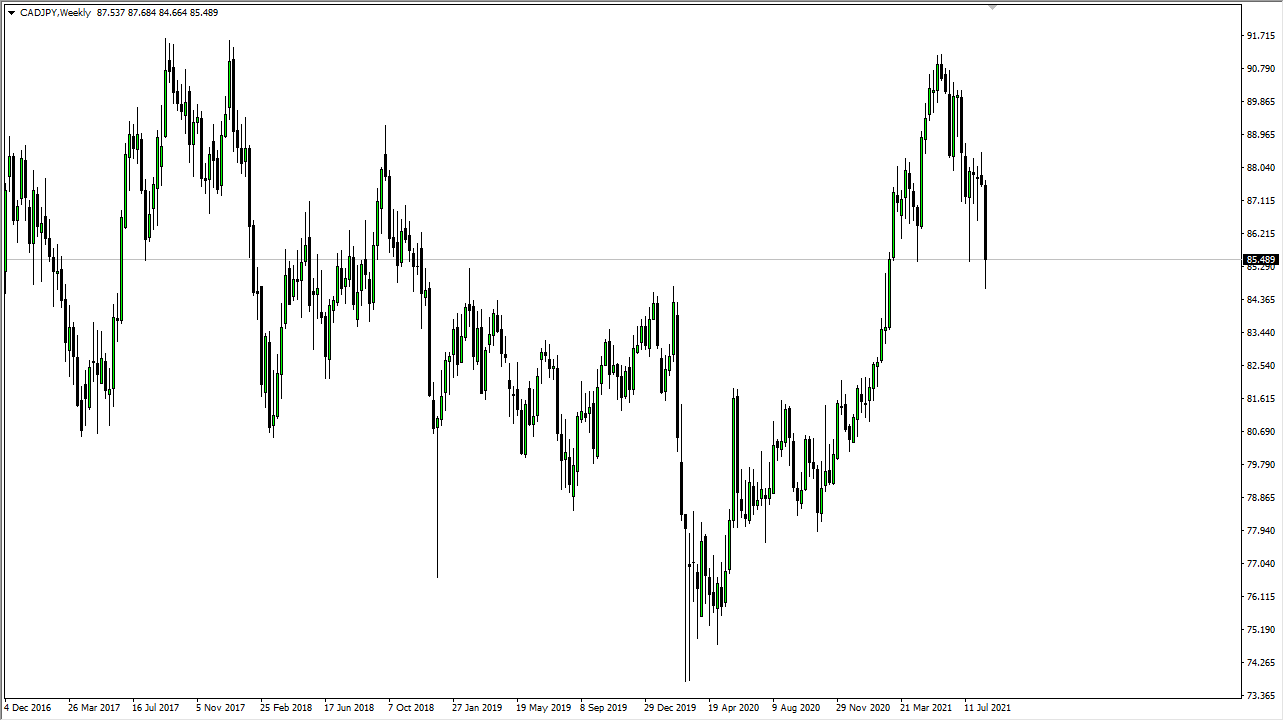

CAD/JPY

The Canadian dollar broke down significantly during the week as oil lost over 8%. Because of this, the CAD/JPY pair sold off quite drastically, breaking below the ¥85 level at one point. With the type of candlestick that we have formed, I think that rallies will be sold into, and then perhaps we could be selling a break below the candlestick as well. If we do break down, I think it is very possible that this market goes looking towards the ¥81 level over the longer term.