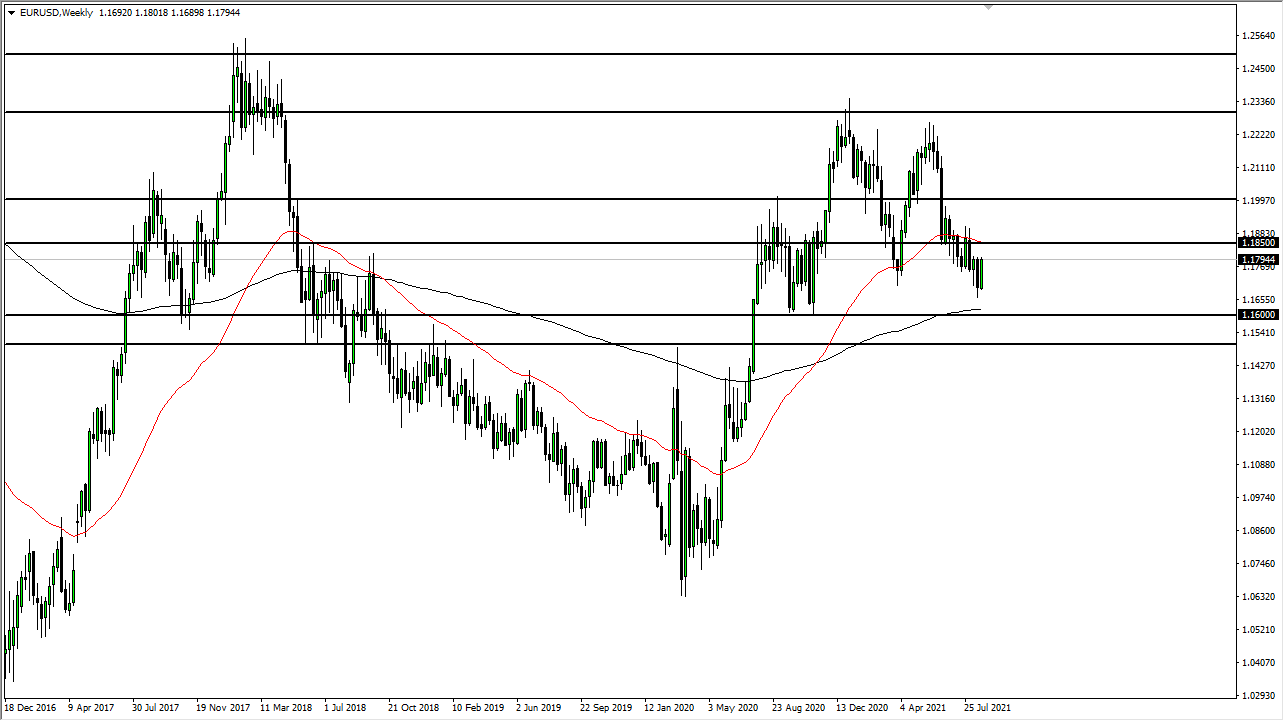

EUR/USD

The euro rallied a bit ast week, especially now that Jerome Powell has come out and suggested that although tapering will probably happen sometime later in this year, the reality is that we will see no interest rate hikes. Because of this, we are seeing the market rally a bit, but I also recognize that the 1.1850 level above is going to be difficult to overcome. In the short term, it certainly looks as if we are going to try to get there. With this, the market seems as if it is building a bit of a base, but I cannot really say that it is overly strong yet.

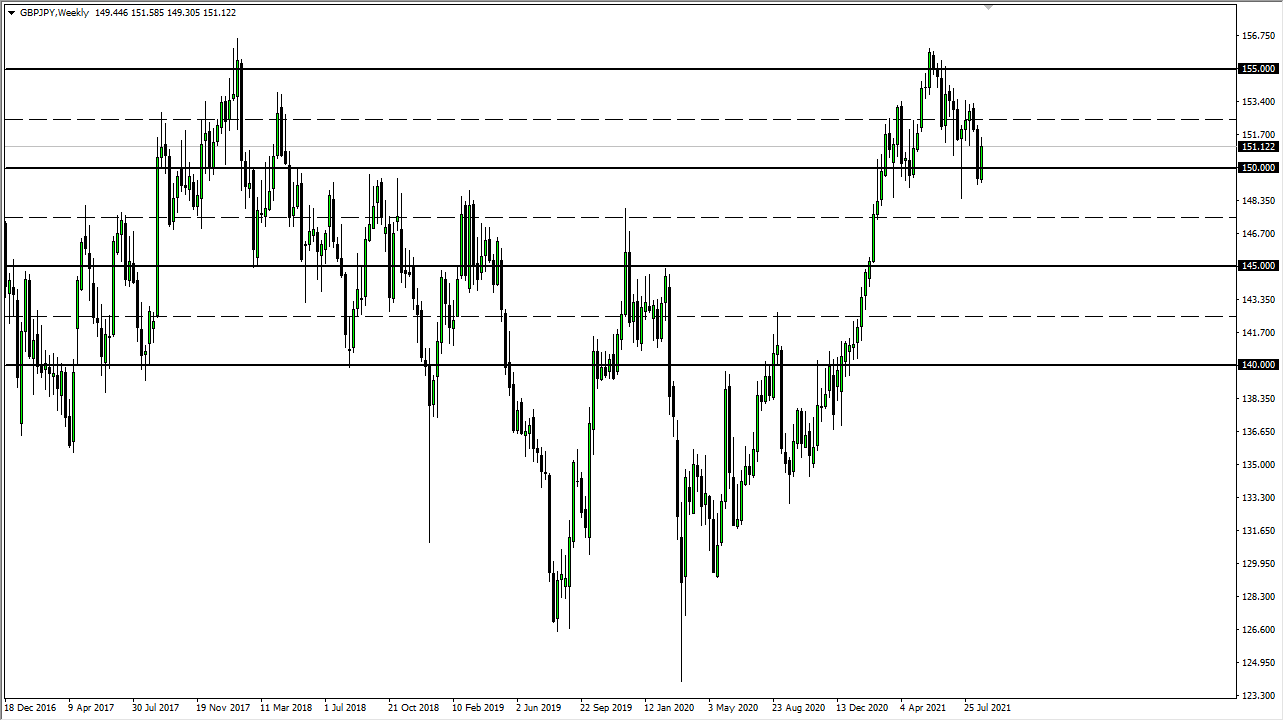

GBP/JPY

The British pound rallied significantly against the Japanese yen during last week, but as you can see, we did give back some of the gains late in the day on Friday. It is worth noting that the market still looks as if it is “slumping” overall, especially on the daily chart. If we turn around and break down below the lows of this week, then it is likely that we go much lower. On the other, the 152.50 level could be the target but we need to take out the highs from the week. I think this pair will continue to be very choppy and very difficult over the next several days.

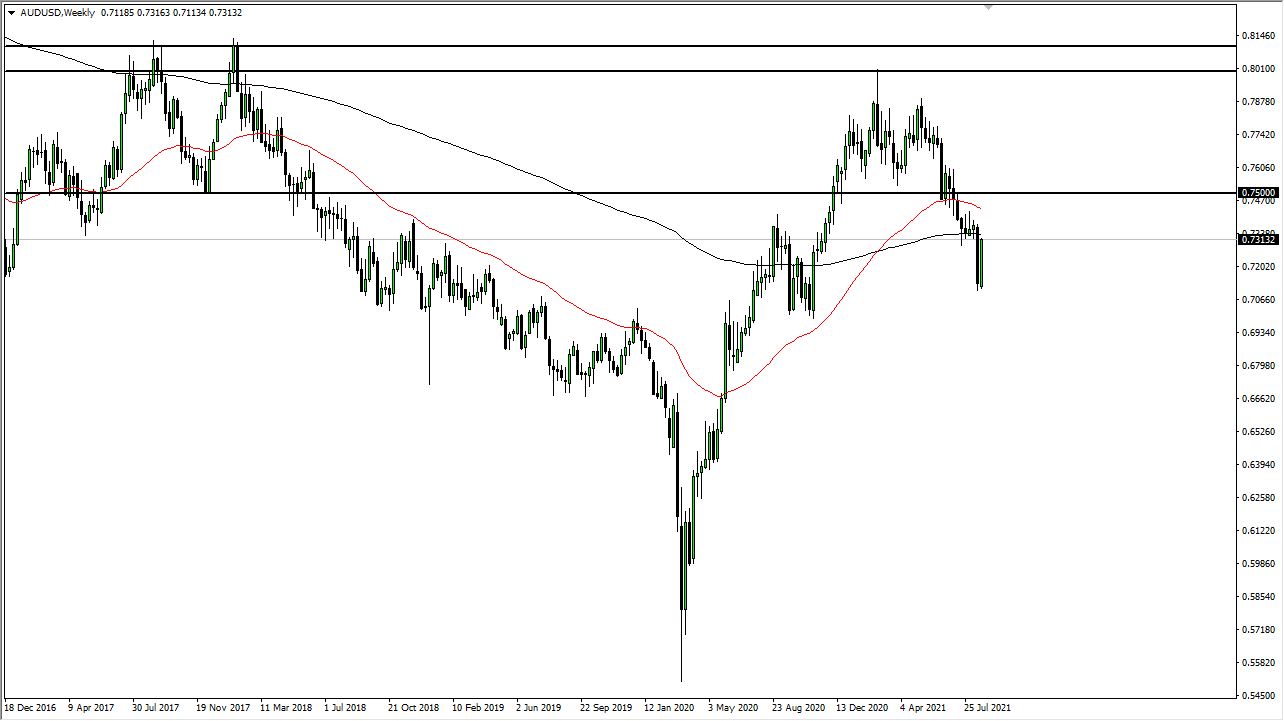

AUD/USD

The Australian dollar shot straight up in the air last week, looking like it is trying to turn things back around and take out the highs of the previous week. At this point, I think we are very vulnerable to some type of exhaustion, and that exhaustion will probably be sold into. If we can break above the 0.74 handle, then the market is likely to go looking towards the 0.75 level. This will be all about the inflation picture, and right now it looks as if the market is trying to turn things back around and rally again.

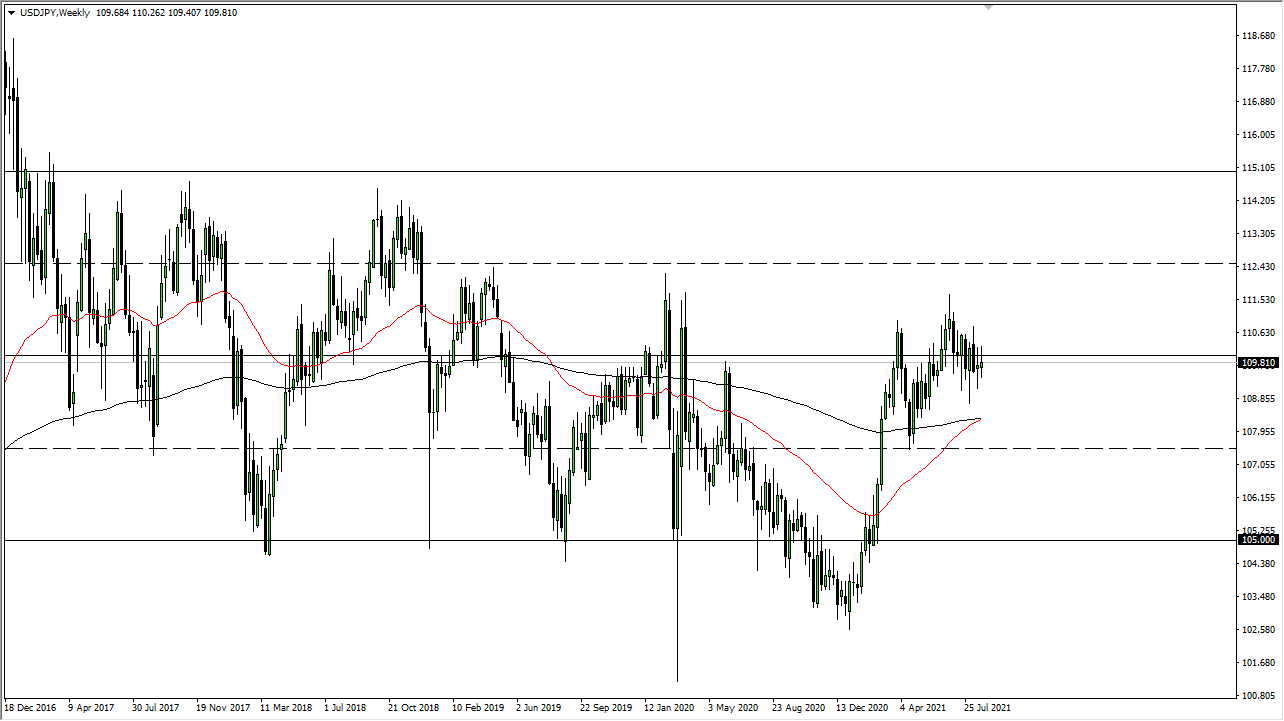

USD/JPY

The US dollar fluctuated last week, and it looks like we are simply stuck to the ¥110 level. The ¥110 level is an area that has been important more than once, and I think at this point we continue to see sideways action more than anything else. The last week of August tends to be rather quiet also, so it is not until we break down below the ¥109 level that I would be a seller, or break above the ¥112 level that I would be a buyer. If you are a short-term trader, you may be able to go back and forth but I would not get too aggressive.