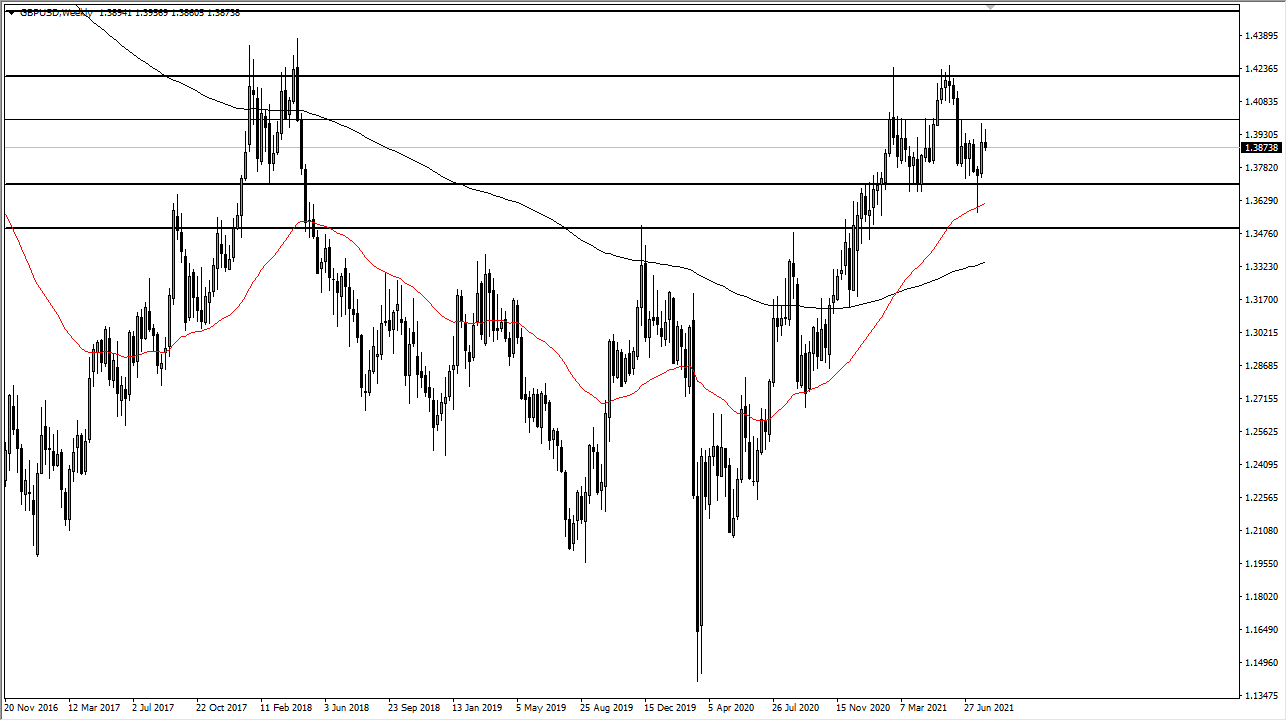

GBP/USD

The British pound initially tried to rally last week, but as you can see, we have given those gains up. This is a market that looks as if it is ready to continue fluctuating, especially considering that the 1.40 level continues to be massive in importance. The 1.37 level underneath is also going to be important, so that is worth paying close attention to. Ultimately, I think this is a market that will continue to fluctuate over the next couple of weeks and stay within the current range.

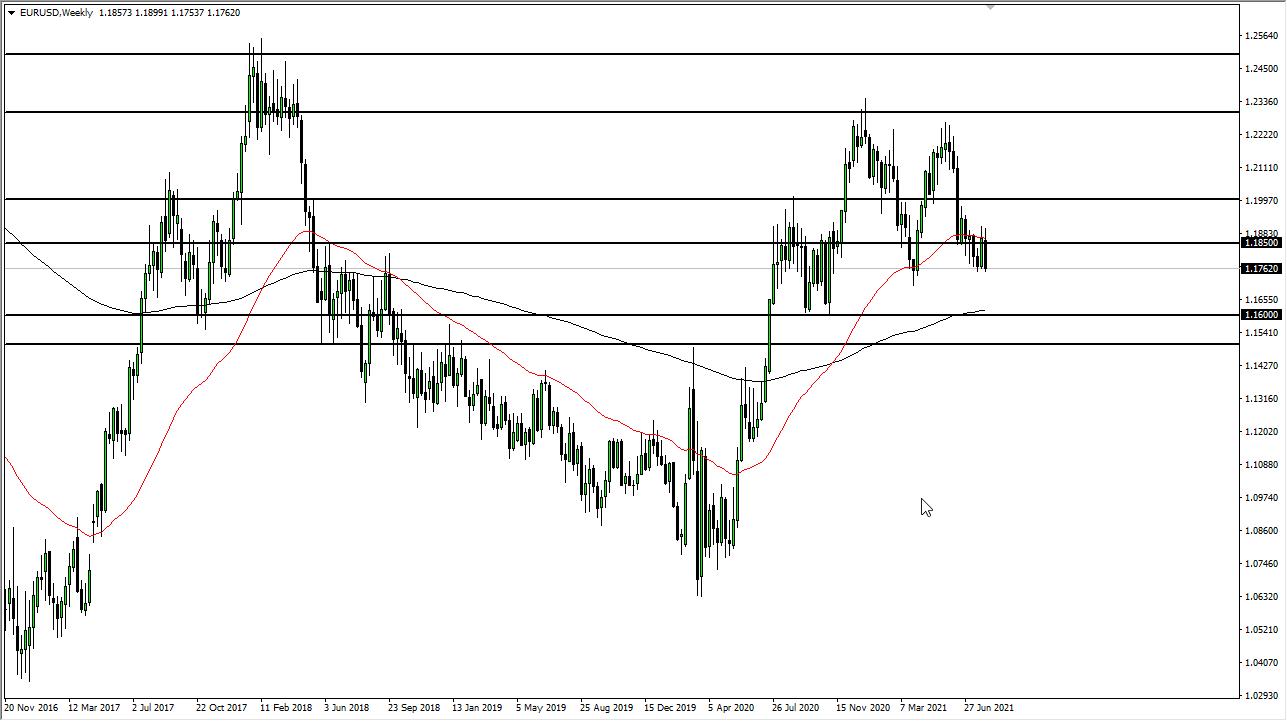

EUR/USD

The euro initially tried to rally last week but then broke down rather significantly. At this point, the market is starting to test the 1.1750 level, an area that has been supportive multiple weeks in a row. If we break down below that level, then it is likely that we will go looking towards the 1.16 level underneath, which is an area that has been massive. On the other hand, as long as we stay above the 1.1750 level, the market is likely to bounce around between there and the 1.1850 level.

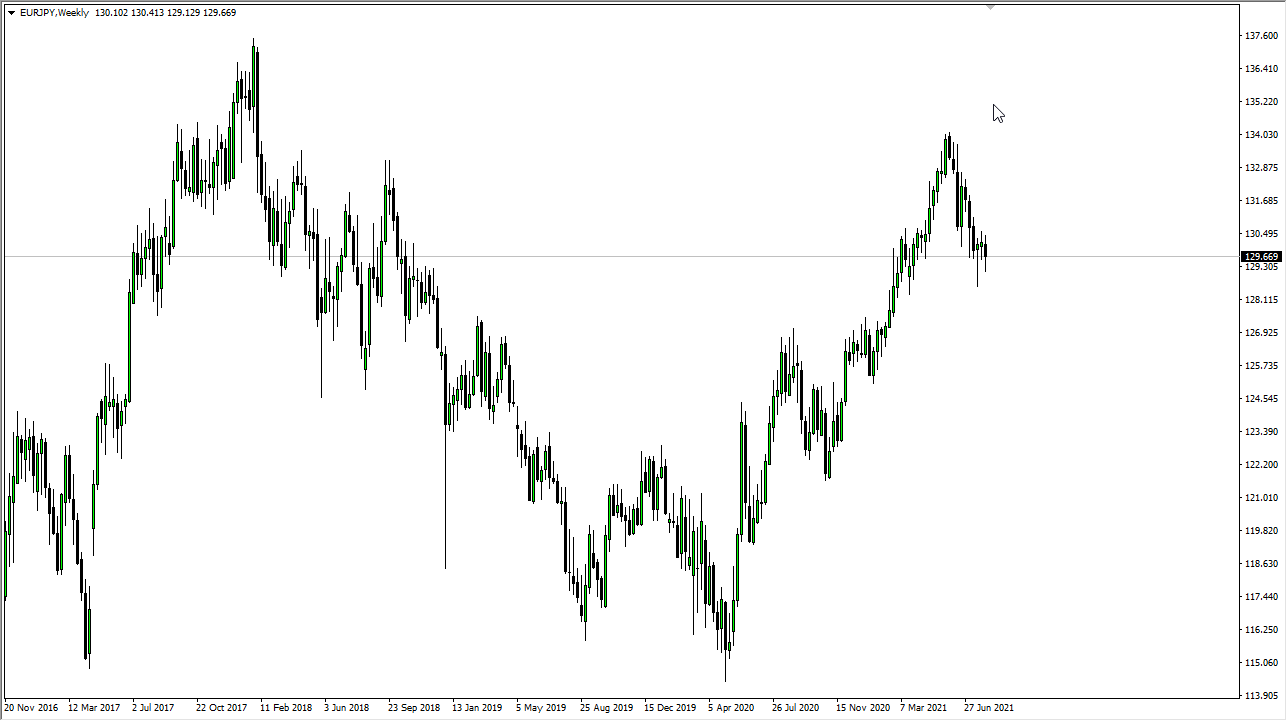

EUR/JPY

The euro drifted again last week, reaching down towards the ¥129 level but managing to stay above it. If we were to break down below that level, then it is likely that we would drop down to the ¥127 area. On the other hand, if we were to turn around and break above the ¥130.50 level, then the market could go higher. I think most of your time this week in this pair will be watching these couple of levels and whether or not we can make a move outside of them. With that being the case, be patient and simply follow what the market wants to do next.

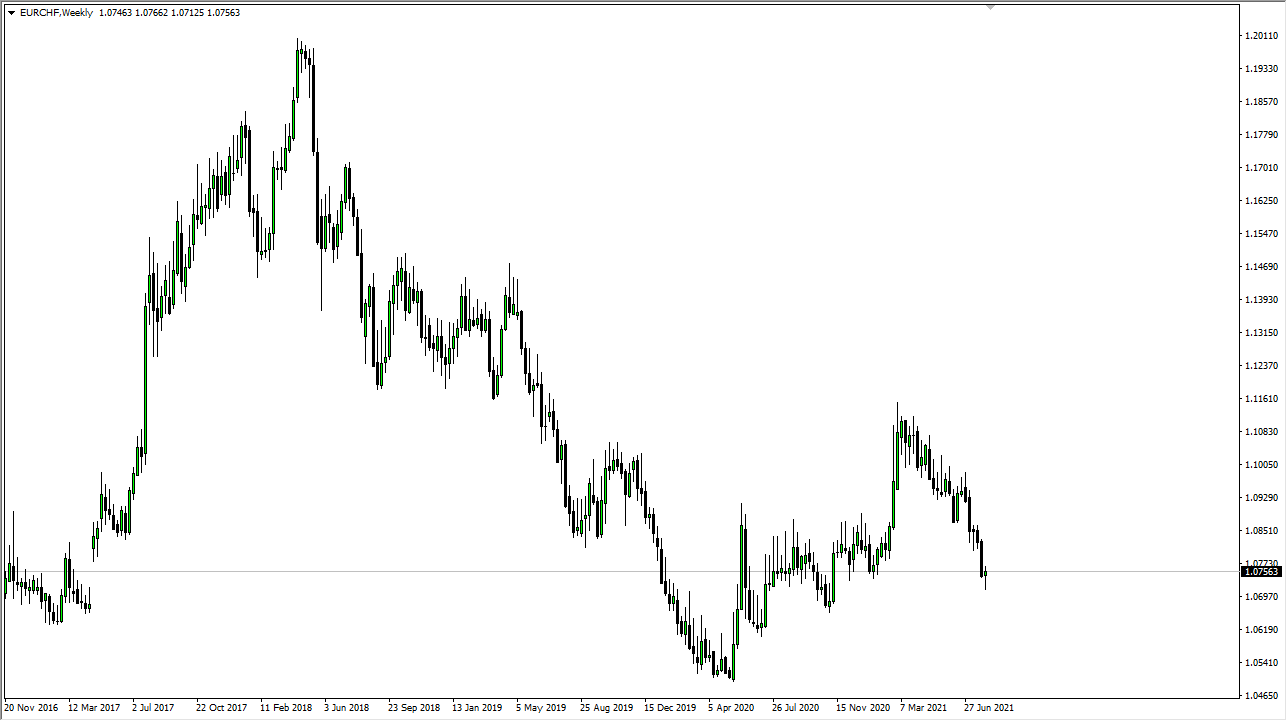

EUR/CHF

The euro spent most of the week trying to fall, but turned around on Friday to form a bit of a hammer. We do look as if we are trying to find a bit of support at the 1.0750 level, perhaps causing a bit of a short-term bounce. However, if we break down below the bottom of the weekly candlestick, that could open up a move down to 1.07, and then possibly even a break down to the 1.06 level.