The West Texas Intermediate Crude Oil market fell rather hard during the trading session on Monday as we have gotten less-than-enthusiastic PMI figures from China. This has people worried about future demand, but whether or not that sticks is a completely different scenario. After all, we have seen this game before and it is worth noting that the PMI figures out of China were 50.4, which means that we are still seeing expansion in that part of the world. If that is going to be the case, then the world’s second-largest consumer of crude oil is still in play. In other words, I think we will probably see some type of reaction to the upside in this market, as the reaction may have been a bit overdone.

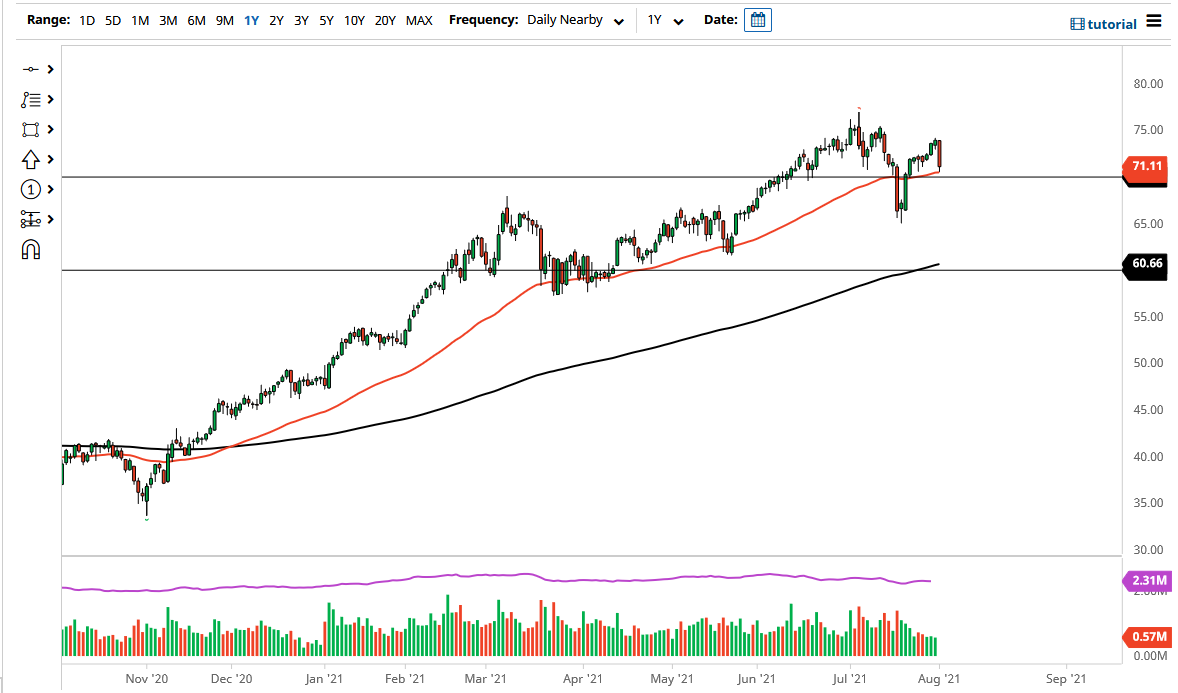

Underneath at the $70 level, I would anticipate seeing a certain amount of support, as it is a large, round, psychologically significant figure and will be worth paying attention to. This is especially true considering that the 50-day EMA is sitting right there as well, so I think there is going to be a lot of noise in the same general vicinity that people will be paying close attention to. If we were to break down below there, then the market is likely to go looking towards the $65 level underneath which has been crucial in the past as it caused a major bounce. I like the idea of buying some type of support when it shows itself, as we have been in a major uptrend for quite a while. It is only a matter of time before we turn around.

To the upside, the $75 level is a target, followed by the recent highs. At this point, is very likely that the market would then go looking towards the $80 level above. The $80 level above is a longer-term target and would cause a certain amount of a reaction due to the fact that it is such a psychologically important level. I think we will continue to see a lot of volatility, but more of an uptrend than anything else.