The West Texas Intermediate Crude Oil market initially fell during the trading session, especially as Joe Biden decided to suggest that OPEC increase output. However, in a strange twist of irony, traders came to the conclusion that Joseph Biden is not the leader of OPEC, and that the cartel will make its own decisions. Because of this, the algorithmic trading chilled out and human traders came back to the fold.

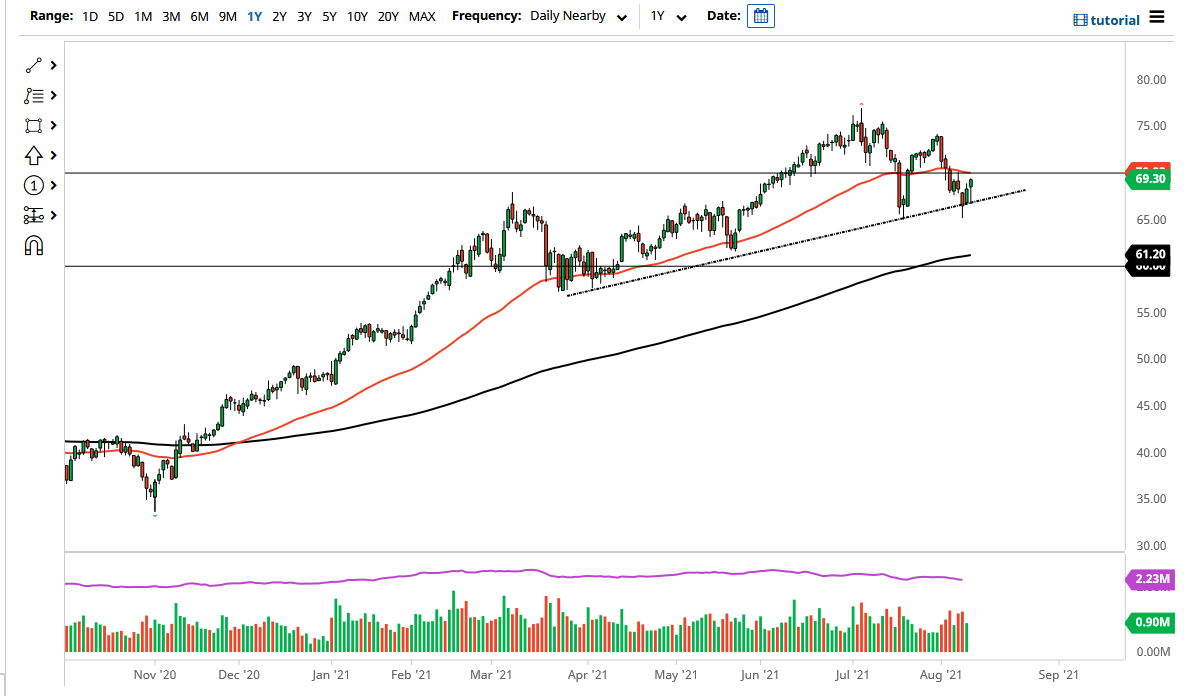

It is worth noting that there was a nice reaction at the uptrend line during the session, which suggests that the uptrend is still very much intact. To the upside, the 50-day EMA is offering resistance, right at the $70 level. The $70 level is a large, round, psychologically significant figure, and it makes sense that the market will respect that area. If we were to break above there, then the oil market is more likely than not to go looking towards the $74 level where we peaked previously.

On the other hand, if we break down below the bottom of the candlestick for the session on Wednesday, then we are more likely than not going to go looking towards the $65 level. The $65 level has offered a bit of a “double bottom”, which is a very supportive look. If we were to break down below that level, then I think we have much further to go to the downside. At that point, the market is likely to go looking towards the 200-day EMA, which currently sits at the $61.20 level.

This is a market that is going to continue to be very choppy as the world tries to decipher whether or not there is going to be further global demand. Oil is one of the best-performing markets out there, at least until the last couple of weeks. We are at a bit of a crossroads, so it certainly means that you need to be cautious about your overall exposure, at least until the trade starts to work in your favor. Most pundits believe that oil is going higher, but it certainly has not behaved that way as of late, and we clearly have an area underneath which, if it gets violated, could be a very ugly scene.