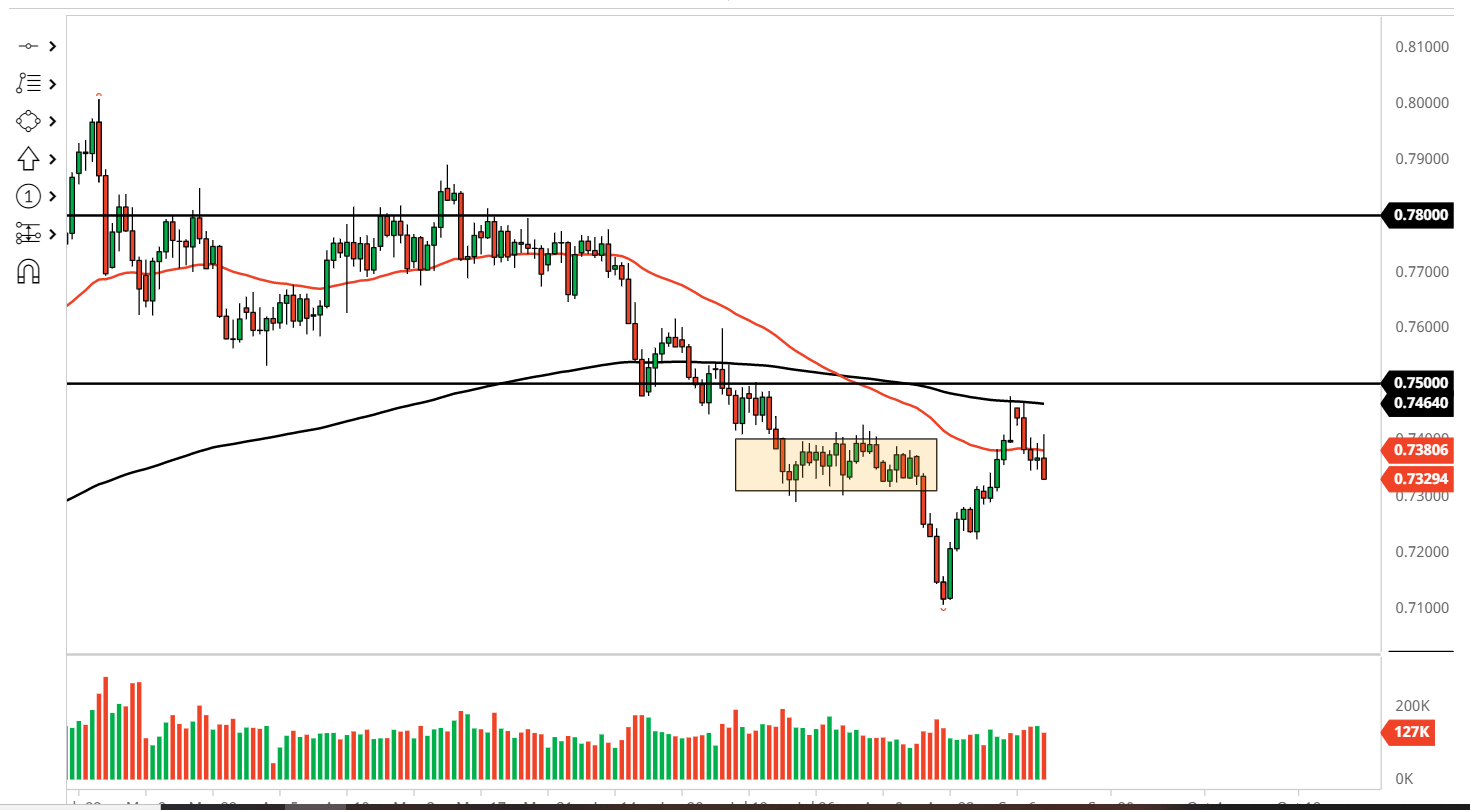

Bearish View

Set a sell-stop at 0.7330 and a take profit at 0.7245 (61.8% retracement).

Add a stop-loss at 0.7400.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 0.7350 and a take-profit at 0.7450.

Add a stop-loss at 0.7300.

The AUD/USD price remained under pressure in early trading as Australia continued making progress in handling the new COVID wave. The pair is trading at 0.7355, which is slightly above last week’s low of 0.7345.

China Data and US Inflation Ahead

Australia has made progress in handling the new coronavirus wave. While cases in Central Sydney more than doubled last week, the total number of cases recorded on Sunday in New South Wales was 1,262. That was down from the previous day’s 1,600. The country’s seven-day moving average was about 1,300.

Therefore, with no economic data scheduled from Australia today, investors will focus on the upcoming economic data from the US, China, and Australia.

The most important number will be from the United States, where the Bureau of Labor Statistics (BLS) will publish the latest Consumer Price Index (CPI) data on Tuesday. Economists believe that the CPI remained at elevated levels as the supply logjam remained. Precisely, analysts expect that the headline CPI declined from 5.4% in July to 5.3% in August.

Inflation numbers are important because they give more indications of the state of the economy and point to what the Federal Reserve will do. Stronger inflation data will incentivise the Fed to start tapering its asset purchases in the fourth quarter.

The AUD/USD pair will also react to the latest data dump from China that is scheduled for Wednesday. The country’s statistics office will publish the latest retail sales, industrial production, and fixed asset investment numbers. There is a likelihood that these numbers slowed down as the country handled its wave of COVID. Chinese numbers tend to move the AUD/USD because of the volume of goods that China buys from Australia. Finally, Australia will publish its jobs numbers on Thursday.

AUD/USD Forecast

The two-hour chart shows that the AUD/USD has been under pressure since Thursday last week. The current price is slightly above last week’s low of 0.7345. The price is slightly above the 38.2% Fibonacci retracement level. It has also moved below the 25-day and 50-day moving averages (MA). The Relative Strength Index (RSI) has also dropped o 40.

Therefore, the pair will likely maintain the bearish trend especially if bears manage to move below the key support at 0.7345. If this happens, the next key level to watch will be at the 50% retracement level at 0.7290.