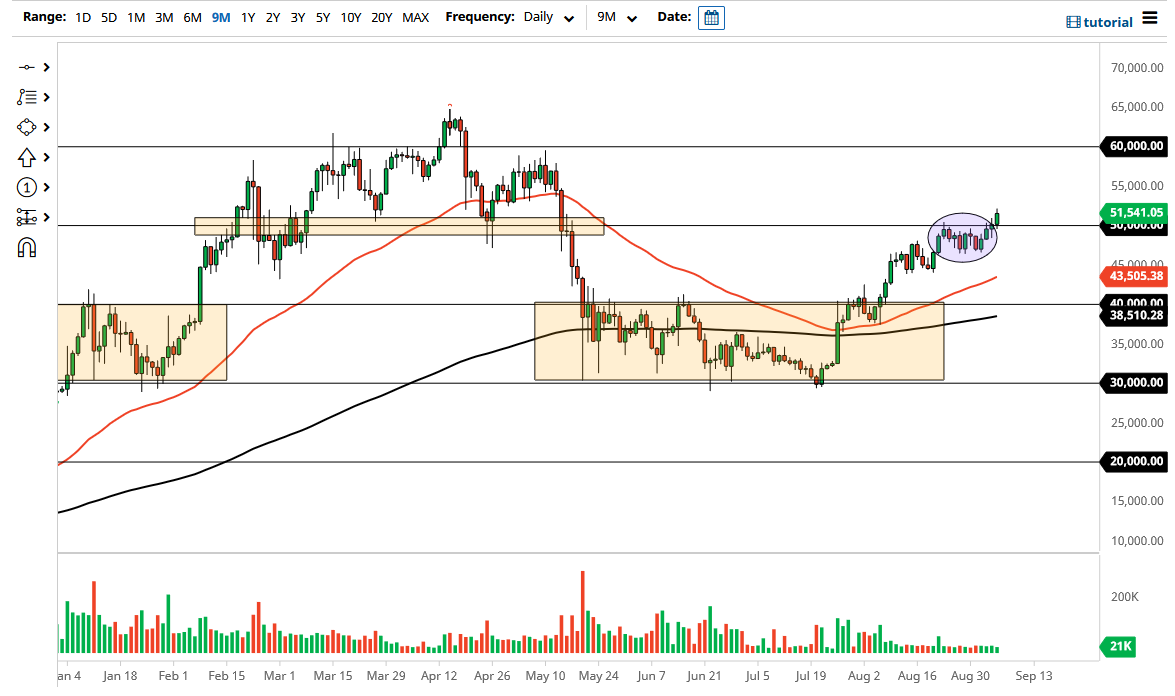

The bitcoin market has finally broken higher during the trading session on Monday, to break well above the $51,000 level. Now that we have done this, it is very likely that the Bitcoin market continues to go higher, perhaps reaching towards the $55,000 level, an area that it has seen a little bit of resistance at, so with that in mind I think you need to keep that as your initial target.

In the short term, it is very likely that the $50,000 level would offer a certain amount of support, if for no other reason than the psychology involved. However, there is support that extends all the way down to roughly 47,000, as it has so many traders getting involved in the market in this general region. The market breaking out of this little consolidation area is a positive sign, and it looks like Bitcoin is ready to make its bigger move.

If we can break above the $55,000 level, then it opens up the possibility of a move towards the $60,000 level, an area that cause quite a bit of resistance last time we got there. Breaking above that then opens up a huge “buy-and-hold” type of situation. This is quite remarkable considering that Bitcoin still is not being used to any great amount. Nonetheless, markets continue to go higher so there is no point in fighting it at this point in time.

If we did turn around a break down below the 50 day EMA, which is currently sitting at the $43,510 level, then you can make an argument for a little bit of continuation when it comes to the selling pressure. Underneath there, then the market goes looking towards the $40,000 level, and possibly even the 200 day EMA which is rapidly approaching that level. That being said, this move is very unlikely, so I think you continue to see this market as a “buy on the dips” type of scenario going forward. With this, the uptrend has been very strong for quite some time, and now that we have broken out of the recent consolidation, it looks like more momentum can get into this market and start to drive it higher. If the US dollar continues to break down, that will obviously help the Bitcoin market as well, as it is a way to escape fiat currency.