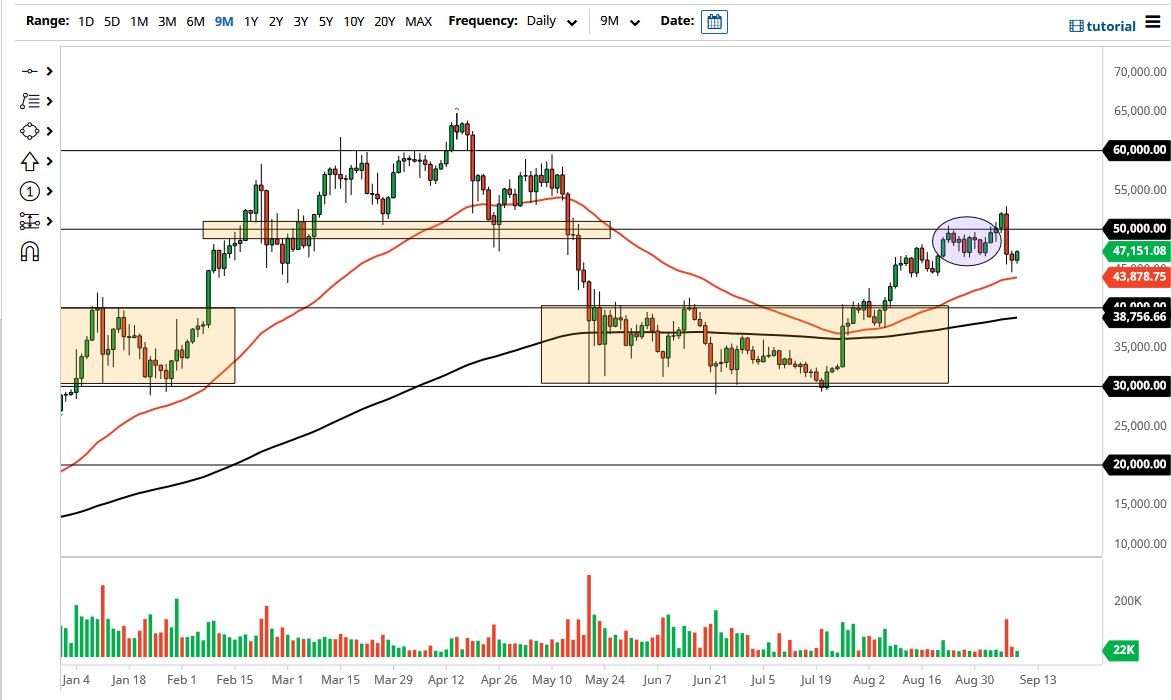

The Bitcoin market had rallied a bit during the trading session on Thursday, but the most important thing you look at is the fact that the market has stabilized over the last 48 hours. At this point in time, the market is likely to see a lot of positivity in this move, due to the fact that Bitcoin has been in an extraordinarily strong uptrend to begin with.The nasty candlestick from Tuesday still has to be paid close attention to, because it is quite common that a nasty candlestick like that does not happen in some type of vacuum. However, that does not necessarily mean that we have to break down, just that it is the most common thing to happen.

The 50 day EMA sits just below the 44,000 level, and that could offer quite a bit of support. Ultimately, you should also pay close attention to the fact that the hammer that formed on Wednesday was also a good sign as well. Now that we have spent 48 hours going sideways, this could start to tempt people into the market as we had been in such a strong uptrend previously.

If we were to break down below the 50 day EMA, then it is likely that we could go looking towards the $40,000 level. The $40,000 level is an area that a lot of people will pay close attention to due to the fact that the 200 day EMA is there, but perhaps more importantly they should pay attention to the fact that the $40,000 level was the top of a larger consolidation area, and therefore “market memory” should come into the picture and have some support in that area. Breaking down below the $40,000 level would change the entire attitude of this market.

From what I see, the most likely thing is that we are going to go sideways, and therefore bounce around just below the $50,000 level until we can build up enough momentum to go higher. If we break above the top of that nasty looking candlestick from the Tuesday session, then it is likely that we go looking towards the 55,000 level, and then eventually the $60,000 level. Pay close attention to the US Dollar, it could have its influence on this pair as well.