Bullish signal

- Buy the BTC/USD and set a take-profit at 52,000.

- Add a stop-loss at 44,000.

- Timeline: 1-2 days.

Bearish signal

- Set a sell-stop at 46,000 and a take-profit at 44,000.

- Add a stop-loss at 48,000.

The BTC/USD pair tilted upwards as the market reflected on the recent testimony by Gary Gensler and the relatively strong economic data from the United States. The Bitcoin price is currently trading at $47,908, which is about 12% above the lowest level last week.

Bitcoin Cautious Rebound

The BTC/USD rose after Gensler, the Securities and Exchange Commission (SEC) chairman, was grilled by the Senate Banking Committee. In the testimony, he expressed concerns about cryptocurrencies and said that the agency was working to come up with some regulations. He also asked cryptocurrency developers to talk to the agency about the industry.

Bitcoin also appeared to ignore a statement by Ray Dalio, the billionaire behind the world’s biggest hedge fund. In an interview with CNBC, he said that regulators will shut down the currency if it becomes so successful.

The comment came a few hours after Cathie Wood, the founder of Ark Invest predicted that the price of Bitcoin will rise to about $500,000 in five years. To back her predictions, Wood said that she would invest in Canada’s Bitcoin ETFs even as she planned to unveil her own. In addition to Wood, other high-profile investors who have jumped into the crypto bandwagon are Paul Tudor Jones and Stanley Druckenmiller.

The BTC/USD also reacted to the relatively weak inflation data from the United States. The numbers showed that the country’s inflation rose by 5.3% last month, down from the previous 5.4%. Core inflation also tilted lower to 4.0%.

These numbers are usually important because they tend to have an impact on the Federal Reserve’s interest rate decision. They also have an impact on the US dollar. Later today, the pair will react to the latest American retail sales data.

BTC/USD Forecast

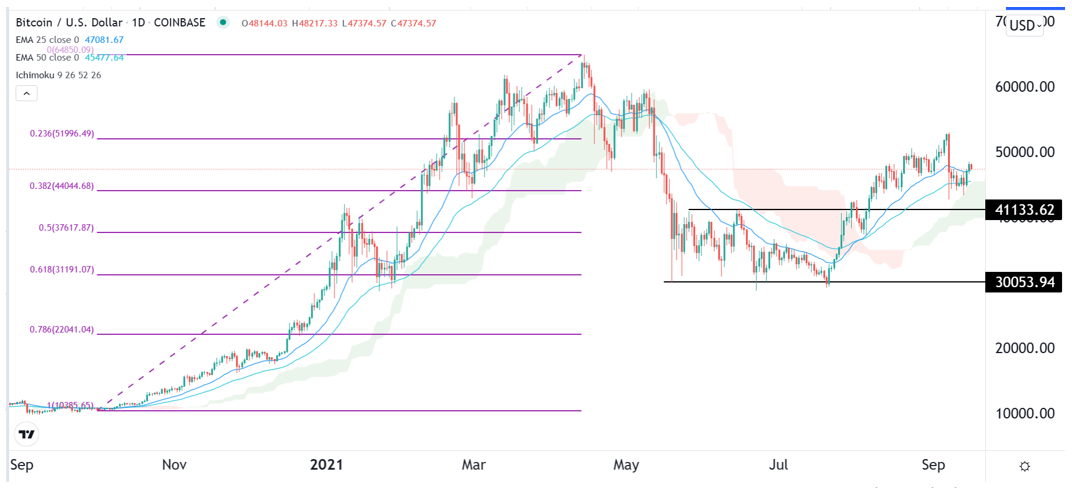

The daily chart shows that the BTC/USD pair has crawled back in the past few days. It is trading at 47,544, which is slightly below this week’s high of $48,300. It is slightly above the 25-day and 50-day moving averages and the Ichimoku cloud.

The pair is also between the 38.2% and 23.6% Fibonacci retracement level while the Relative Strength Index (RSI) has tilted higher. Therefore, the pair will likely maintain the bullish trend as bulls target the key resistance at 50,000 during the weekend.