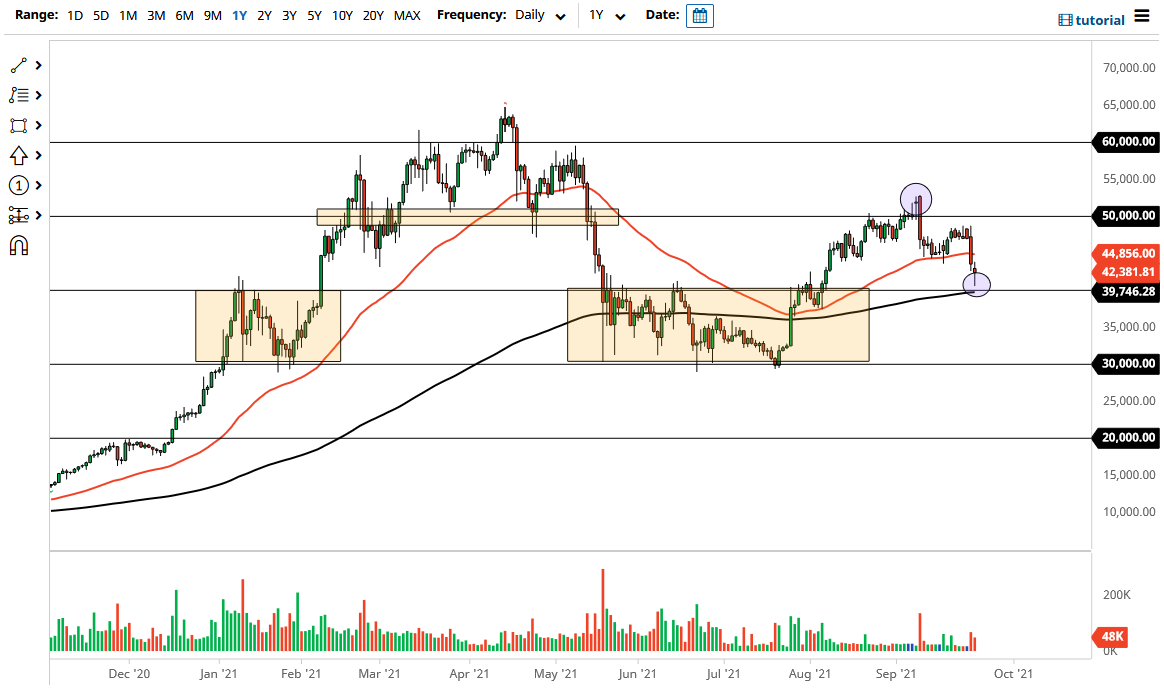

The Bitcoin market fell on Tuesday to reach down towards the crucial $40,000 level. However, we have turned around to show a certain amount of support at the $40,000 level, which is not a huge surprise considering that it was previously resistance. After all, “market memory” comes into the market at that level as it was previous resistance at the top of a long-term consolidation range. Furthermore, we also have the 200-day EMA sitting just below there, so it would be a very important level not only due to that big figure but also the fact that the 200-day EMA is so widely followed.

By the end of the day, we did end up forming a bit of a hammer, which is a bullish sign. As you can see, I have highlighted the $52,000 region and the $40,000 region. This is the range that we are currently shopping around in, and if we break above the top of the candlestick for the session on Tuesday, then I think we will go back above the 50-day EMA. As we are at the bottom of that range, it makes sense that we would see a bit of a bounce from here.

The Bitcoin market has been very choppy over the last couple of days, and we have most certainly sold off quite drastically. However, the fact that we bounced at the end of the day suggests that there are people out there willing to pick up a little bit of value, so on a break above the top of the daily candlestick, I am willing to go long, and I would anticipate that the market would go looking towards the $49,000 level. However, if we turn around and break down below the 200-day EMA, then it is possible that we could go looking towards the $37,500 level, and then after that the $30,000 level. Anything below that area could be a very negative turn of events, which would suddenly break down the overall uptrend, and I suspect that Bitcoin would fall apart at that point. I anticipate that we have a lot of noisy behavior ahead of us, but we have been to the upside for a while, so I still think that buying is the easiest thing to do.