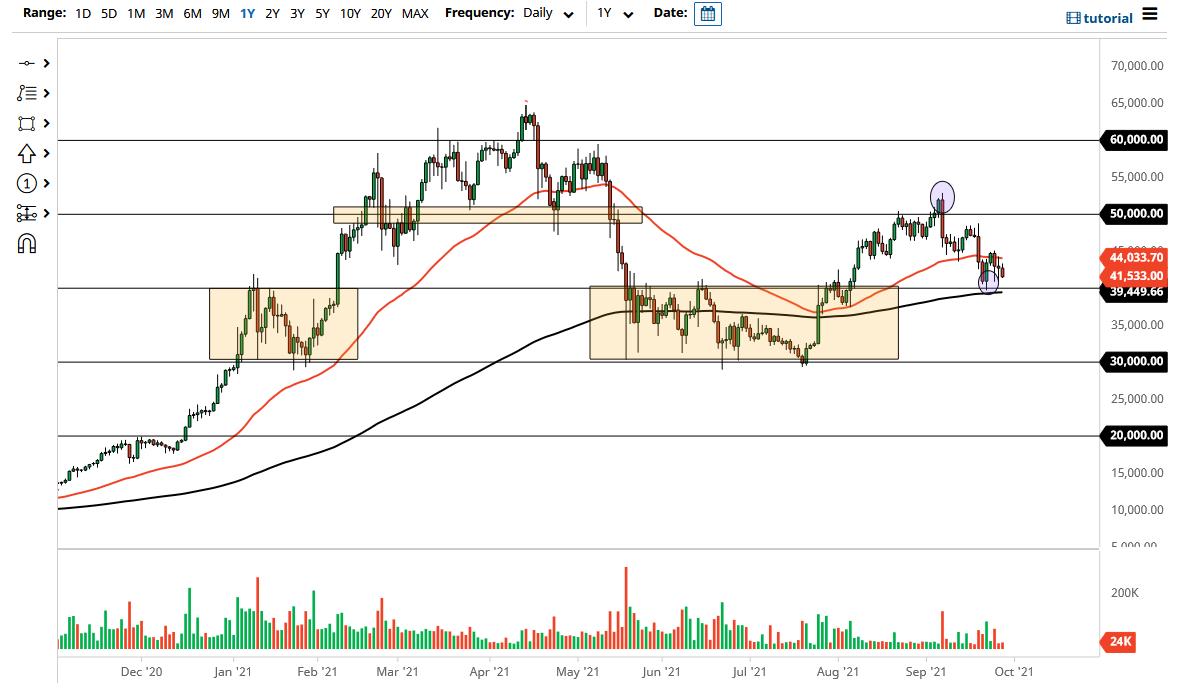

Bitcoin markets initially tried to rally on Tuesday but then gave back gains yet again to show signs of exhaustion. Ultimately, this is a market that I think is probably going to try to break down through the 200-day EMA, but obviously there is a significant amount of buying pressure in this general vicinity. The $40,000 level being a large, round, psychologically significant figure also helps, so I think all put together this is going to be a very difficult breakdown if it does in fact happen.

Crypto has been all over the place as the Chinese started working against it, and now there are a lot of questions asked. At the end of the day, we are hanging onto the 200-day EMA which is obviously a rather important technical figure, so it is worth noting that we probably have a lot to determine over the next couple of days. On a move below the support area, I do believe that Bitcoin could be a bit of trouble. This would be further cemented if we break down below the $37,500 level, as it opens up a potential move down to the $30,000 level underneath. That is a major support level, and I think at that point we would see a lot of value hunters coming back into the market.

That being said, if we were to turn around and break out above the recent highs over the last several days, right around the $45,000 level, then we could very well go looking towards the $48,000 level above where we had recently sold off from. After that, then you start to look at the $52,000 level which I have circled on the chart. Anything above that opens up more of a “buy-and-hold” type of scenario in this market but I think we have a lot of work to do before we see that type of turnaround. At this point, even if you are bullish, the best you can hope for the short term is probably going to be some type of consolidation above the $40,000 level. The more stabilization that we see in this market over the next couple of days, the more bullish it will be for Bitcoin overall. Keep in mind that crypto tends to be very volatile, so your position sizing will be crucial.