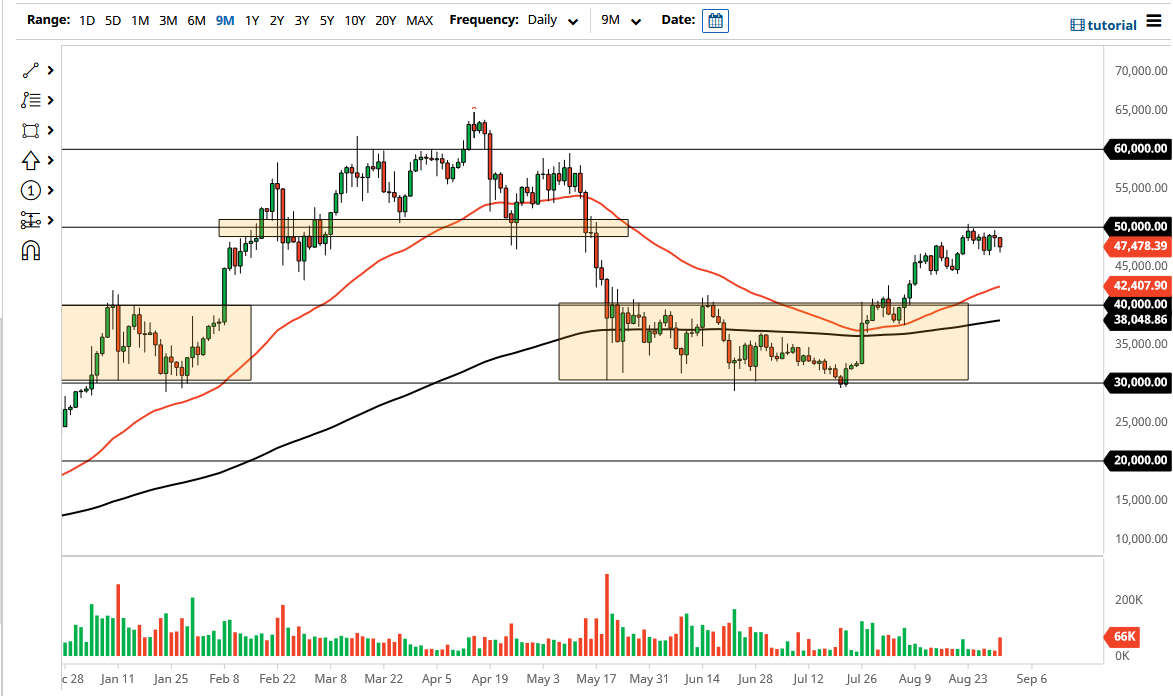

The Bitcoin market pulled back just a bit on Tuesday as the $50,000 level continues to be a headache for the market. At this point, the most obvious barrier to overcome is the $50,000 level, so if we can get above there then it is obvious that Bitcoin would continue to go much higher. That being said, this is a market that tends to be impulsive after little bits and pieces of sideways action like we are seeing right now.

To the downside, the $45,000 level should be supportive, right along with the 50-day EMA reaching towards it. If we were to break down below there, then it is likely that the $40,000 level then comes into the picture as support, especially now that the 200-day EMA is starting to tilt higher and approach that region. Furthermore, that was also an area that was the beginning of the most recent break out, as we have been consolidating between the $30,000 level underneath and the aforementioned $40,000 level. In fact, that area measured for a $10,000 move, meaning that we should have reached the $50,000 level. We have already done that, so now the market needs to digest those gains.

Bitcoin will perhaps be influenced slightly by the US dollar peripherally, so if the US dollar suddenly starts to selloff, then it is possible that Bitcoin could take advantage of that. Alternately, if the US dollar starts to strengthen, it is possible that Bitcoin would get sold off, at least temporarily. Long term though, it seems as if Bitcoin will simply move on its own momentum, and it certainly looks as if we are going to try to get to the upside. I suspect that this point, any significant selloff of a few thousand dollars will continue to see value hunters coming back into the market.

Structurally speaking, it looks like we are getting a little bit tired, but I do not have any concern whatsoever about some type of major breakdown. That being said, if we did break down below the $40,000 level, that could be rather ugly, albeit unlikely at this point in time. Ultimately, we may simply go much higher, but I think that given enough time we will see $60,000 cause a little bit of a headache on the way higher.