Last Monday’s BTC/USD signal was not triggered as there was no bullish price action at either of the support levels which were reached that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Thursday.

Long Trade Ideas

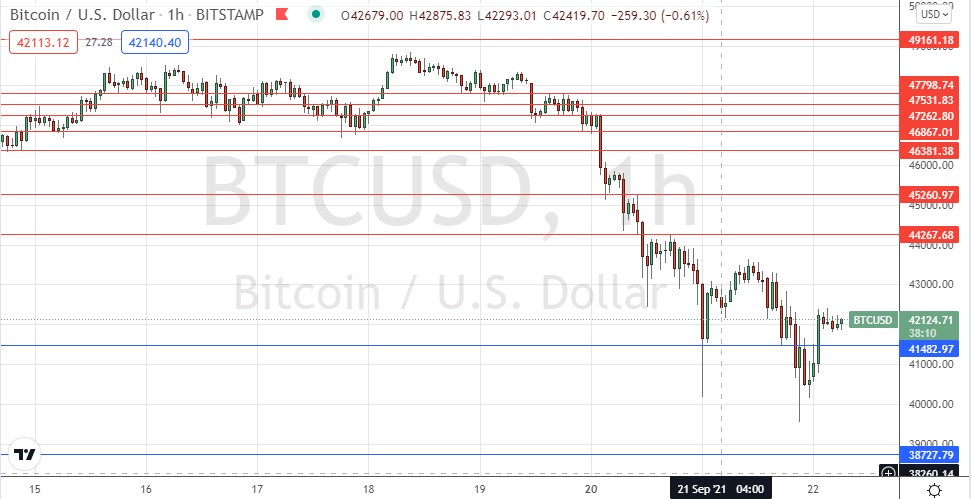

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $41,483 or $38,728.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Idea

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $44,268 or $45,261.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Monday that the defining feature within the price chart was the support level at $43,836 which was very pivotal, although I was looking for a short trade following a retracement and not on a breakdown below that price level. I was correct about $43,836 as once that price broke down, the price continued in a downwards direction over the rest of Monday and closed well below the daily open and $43,836 so I was correct to be looking to the short side.

We have seen an increase in volatility here over the past couple of days, with the price still making lower swing lows and lower swing highs. However, we may have a solid support level at $41,483 which could make a lot of difference.

I think that the way to trade Bitcoin today will be to sit tight until the level at $41,483 is reached and see if we get a bullish bounce there – which will indicate that the price will most likely make a weak and possibly choppy rise towards $44,268 – or whether the price breaks below the level and holds there, which would be a bearish sign suggesting the price will fall further and trade below the $40k area.

I doubt we will see a bearish break down and I do not want to trade it if we do. I see a slow-moving long trade from a bounce at $41,483 as the best potential setup here today.

Concerning the USD, there will be releases of the FOMC Statement, Federal Funds Rate, and Economic Projections at 7pm London time, followed by the usual press conference half an hour later.