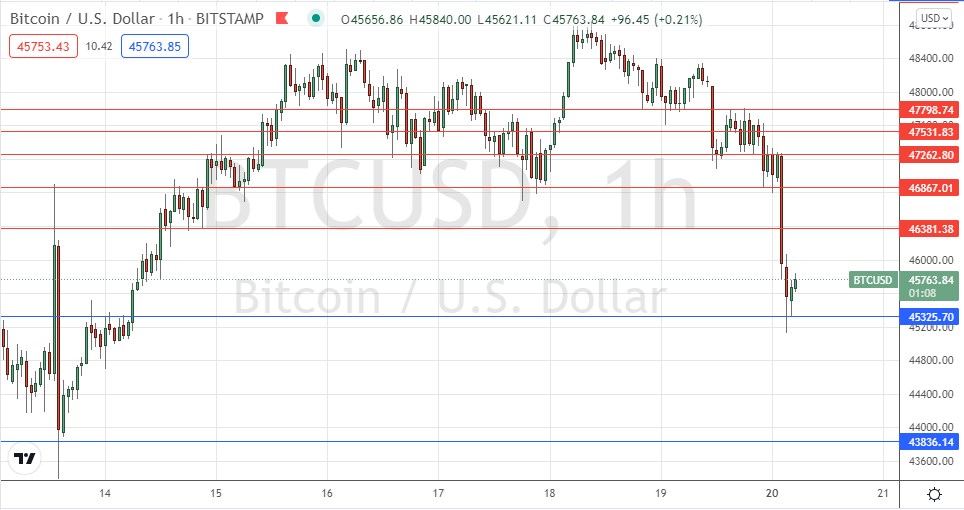

Last Wednesday’s BTC/USD signal produced a profitable long trade from the bullish bounce at the key support level identified at $46,837.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

Go long after a bullish price action reversal on the H1 time frame following the next touch of $45,326 or $43,836.

Place the stop loss $100 below the local swing low.

Move the stop loss to break even once the trade is $100 in profit by price.

Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Idea

Go short after a bearish price action reversal on the H1 time frame following the next touch of $46,381, $46,867, or $47,263.

Place the stop loss $100 above the local swing high.

Move the stop loss to break even once the trade is $100 in profit by price.

Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that the price had risen to the key resistance level at $47,532 and the big question was whether this resistance level would hold and produce a bearish double top formation or be overcome by the price which would then advance to new multi-week highs.

If the price broke down below $46,171 then I expected that would be a bearish sign.

This was a good call, as the break above $47,532 did then produce a stronger upwards price movement which reached as high as $48,400 before falling back.

A few days can be a long time in Bitcoin, and we have seen the price tumble significantly over the past few days due to a general souring of risk sentiment in the markets. The defining feature within the price chart below is the support level at $43,836 which is very pivotal, but we have a new higher support level which has just formed as a flip from resistance to support, and this is going to be the first key level that will either hold or break down – so bulls have two main lines to defend if the action takes a bearish turn.

I am ready to take a long trade following a healthy bullish bounce at either of the two closest support levels. Alternatively, a short trade would look attractive from a bearish reversal at the resistance level of $46,867, although there could be strong resistance beginning at any point from as low as $46,381.

There is nothing of high importance scheduled today concerning the USD.