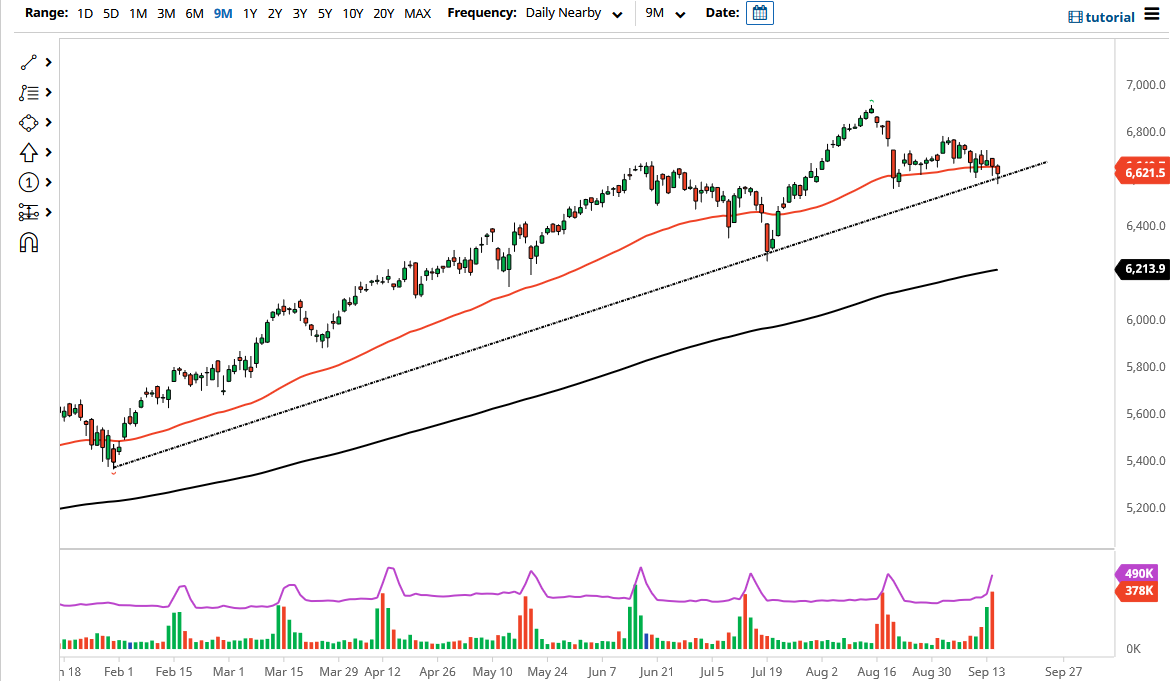

The Parisian index fell significantly during the course of the trading session on Wednesday to peak below the uptrend line that has been so important for a while. However, we have turned around to form a bit of a hammer, which is a bullish sign. If we break above the top of the hammer, then it is possible that we could go towards the €6800 level, but quite frankly you have to keep in mind that the Parisian index is highly sensitive to risk appetite anyway.

All things been equal, this is a market that has been in an uptrend for a while but pulled back to reach towards the 50 day EMA and consolidate. I think that most indices around the world are in the same predicament right now, trying to decide whether or not they are going to go higher or if they are going to pull back in order to show signs of weakness. I think Paris will be one of the first places you see negativity in the European Union, as it has been underperforming its biggest rival, the DAX.

Remember that the CAC is highly driven by luxury brands, so it comes down to consumer spending more than anything else. I like the DAX, it is not so much about industrials, so it is a nice comparison to what is going on in Germany at the moment. The Euro is starting to soften a bit, so that might help with the idea of exports, but we need to see a little bit more downward momentum to make that happen. The market breaking down below the 6600 level could open up a move down to the €6500 level, but after that the market is likely to look towards the 200 day EMA underneath.

To the upside, the market then could go looking towards the 7000 level over the longer term, but obviously we would need to see some type of momentum pick up to make that happen. The market is on the precipice of doing something, so now it is just a matter of following it to make sure that we go with the overall momentum. If we get a continuation of the move to the upside, you could even make an argument for a little bit of a “double bottom” near the 6600 level.