The CAC Index got hammered on Friday as the jobs numbers from America came in extraordinarily weak. That being the case, it has people worried about luxury goods and spending in general. The CAC is highly levered to luxury, so it makes sense that even though it was an American announcement, it was felt across the pond.

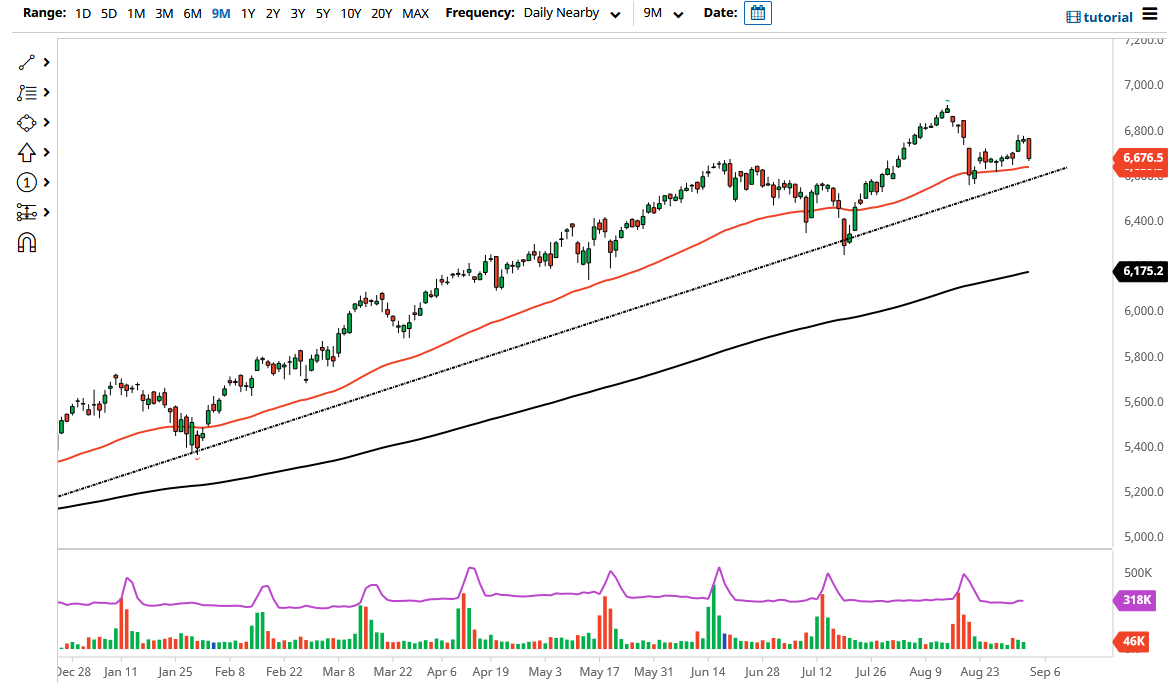

The Parisian index is currently sitting just above the 50-day EMA and the uptrend line, so all of that needs to be kept in the back of your mind. I think that we are more likely than not to offer a bit of a buying area. This is a market that I think will show quite a bit of volatility, but we still have buyers underneath just waiting to get involved. That being said, this 50-day EMA and the uptrend line both will cause a lot of noise. Because of this, I am looking for some type of supportive candle to get involved in this market, but right now it does not look as likely.

If we were to break down below both of those, then it is likely that we could see an opportunity to start shorting, perhaps reaching towards the €6400 level. After that, then we could go looking towards the 200-day EMA. The 200-day EMA is a significant technical indicator that a lot of people are going to be paying close attention to, as longer-term traders tend to use that as a trend-defining situation. If we were to break down below there, the bottom would follow.

To the upside, if we can break above the 6800 level then it is likely we will go looking towards the highs again and then eventually the €7000 level. However, with the kind of candlestick we formed on Friday, it is very likely that we will see a little bit of continuation, as the markets will look at the fact that we have closed towards the bottom of the candlestick as an ominous sign, perhaps showing that we are going to see a little bit more selling. But whether or not it has a significant amount of follow-through remains to be seen.