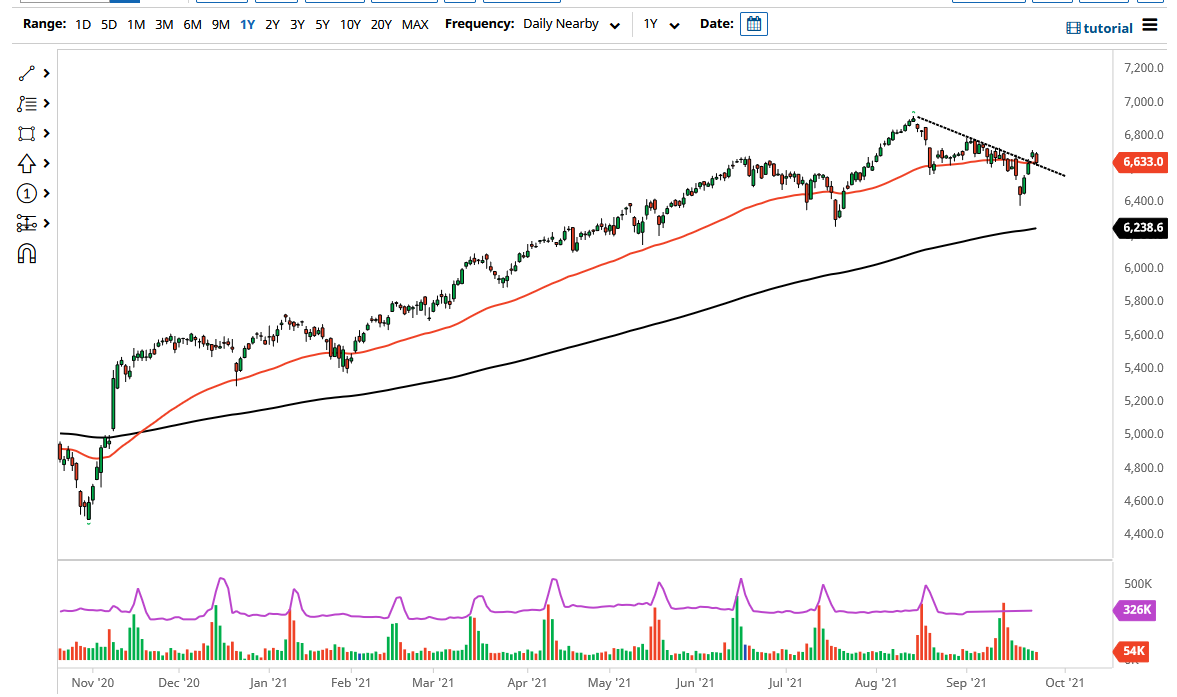

The CAC Index pulled back on Friday to reach towards the 50-day EMA. The CAC has a major sensitivity to risk appetite overall, as Paris tends to be driven by luxury exports. Currently, the 50-day EMA sits at the 6630 handle. The size of the candlestick is not overly concerning, so I think this is a nice pullback of a significant breakout, which is quite often the case after a breakout.

On the other hand, if we were to turn around and break out above the last couple of days, the market then could go looking towards the 6850 level, possibly even the 7000 level after that. After all, the market is bullish longer term, and now that we are still showing signs of buyers getting involved, I think it is likely that we will go reaching towards higher levels. Furthermore, the risk appetite around the world continues to be relatively strong, and it makes ense that we would see the CAC rise right along with it.

Stock markets around the world continue to see volatility, and the CAC will not be any different. That being said, the market is likely to see a lot of volatility, but I still believe that there are plenty of value hunters out there willing to get involved in not only this index, but several other ones around the world as well. Furthermore, pay close attention to the DAX, as it tends to be indicative of what happens with European indices overall.

I do believe that this is a market that will eventually break out to fresh, new highs, but I also recognize that the CAC is quite a bit more fragile than the DAX under most circumstances. With that in mind, if we do see the DAX fall apart, then I will use that as an indicator to perhaps take a look at the possibility of getting short of this market. If we break down below the 6400 level, then it is very likely that the downside pressure will accelerate. I do not necessarily think that will happen, but it is worth noting that the possibility still exists either way.