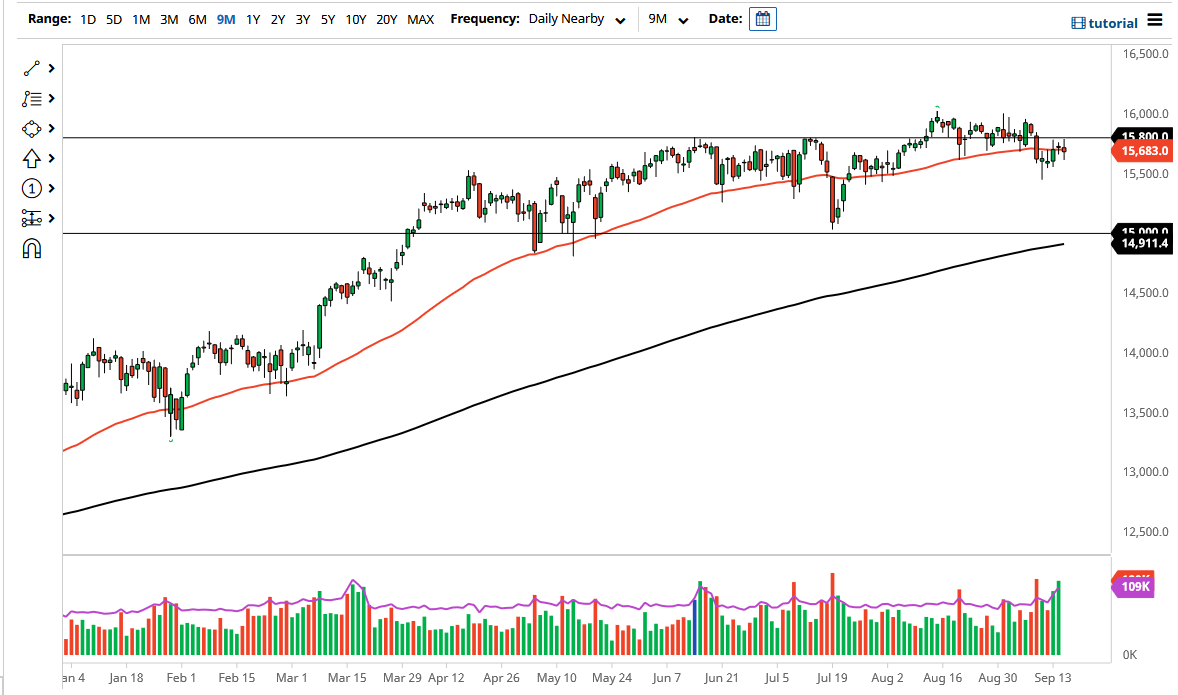

The German index went back and forth during the course of the trading session on Wednesday, as we continue to dance around the 50 day EMA. More importantly, the €15,800 level continues offer resistance as well, so with that being the case it is likely that the market will continue to bounce around in this area, but if we can break above that €15,800 level, then it is likely that we could go looking towards the €16,000 level next.

Keep in mind that the DAX is highly levered to industrial demand around the world, due to the fact that the major German companies that make up the DAX are major exporters. In other words, if there is a huge demand for industrial components, then Germany will do quite well. Furthermore, the market is also range bound at the moment, but had previously been very bullish. In other words, the market is likely to see a bit of continuation after this consolidation. That being said, it is not necessarily mean that we are going straight up in the air. In fact, it is not a guarantee that we go higher at all.

If we were to break above the €16,000 level, then the market is likely to go towards the €16,500 level next. On the other hand, if we turn around a break down below the €15,500 level, then the market is likely to go looking towards the €15,000 level underneath, which is where the 200 day EMA is racing towards, and of course it has a major amount of psychology attached to it as well. Because of this, the market is likely looking at that area as a major “floor the market.”

If we were to break down below the €15,000 level, then it could kill the overall uptrend, but right now I do not think that is very likely. That would obviously be a major turn of events, so if we were to break down below there it is likely that indices around the world would fall apart. Nonetheless, this is a market that will eventually find a reason to go higher, because quite frankly the ECB will keep the liquidity flowing into the markets to make sure something like that does end up happening. It is likely a “buy on the dips” type of scenario we find ourselves in.