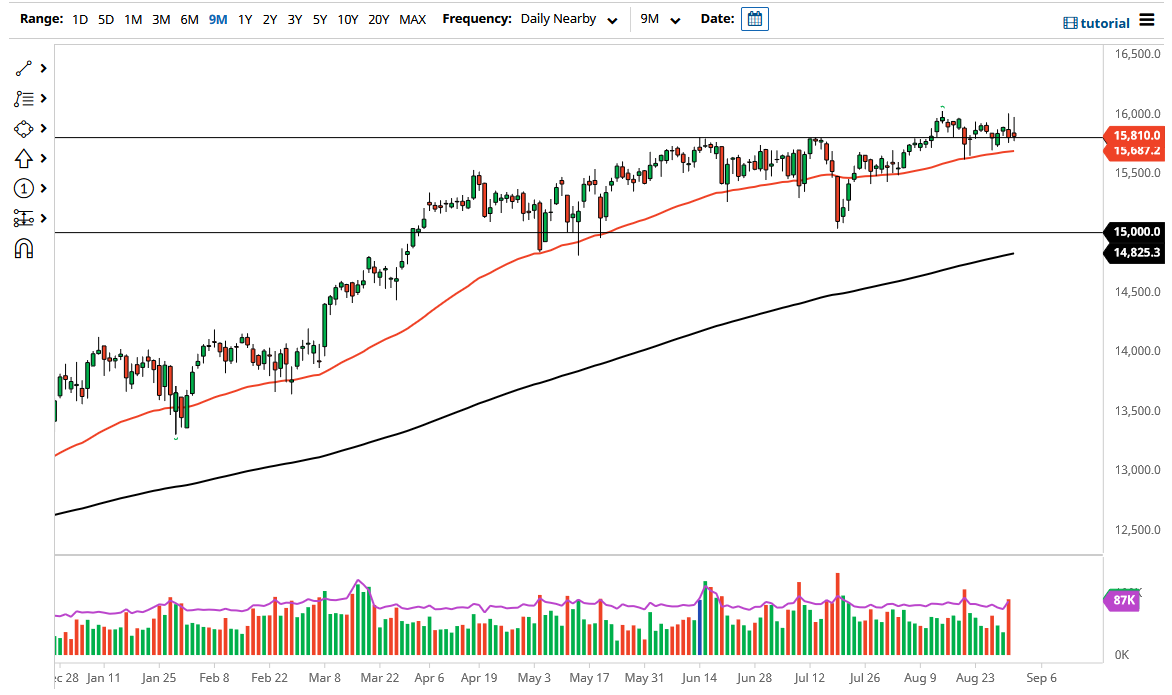

The DAX Index initially tried to rally on Wednesday but continues to struggle at the €16,000 level. The €16,000 level has been a significant level over the last couple of weeks, and it looks as if it is going to continue to be. The 16,000 level has a certain amount of psychology involved in it, and as a result we have formed a couple of shooting stars over the last 48 hours. With that in mind, I think that it shows just how difficult it is going to be to go higher.

The 50-day EMA sits just below and would offer a certain amount of psychological support as well. Breaking down below the 50-day EMA could open up the possibility of a move down to the 15,500 level, and then maybe even the 15,000 level after that. What is interesting about the 15,000 level is that the market will pay close attention to that as a large, round, psychologically significant figure, and an area that is attracting the 200-day EMA, a major support level in and of itself.

On the other hand, if we can break above the 16,000 level, it is likely that we will see the market finally continue to the upside. Part of what we are seeing here could be a reaction to the ECB talking about tapering bond purchases, and that could in fact drive the value of the euro higher, perhaps working against the value of the DAX in and of itself. After all, the DAX is heavily reliant upon exports, which is influential on pricing. As long as the global recovery situation gets a little bit better, then you could see the DAX benefit due to all of the massive industrial exporting companies that make up the bulk of this index.

In general, I think a little bit of a pullback would probably attract a lot of value hunting, and I do think that is actually what could happen. That being said, if we were to turn around and break down below the 15,000 level, that opens up the floodgates of a bear market. I do not think that will happen, so I still look at this through the prism of picking up a bit of value when it is offered.