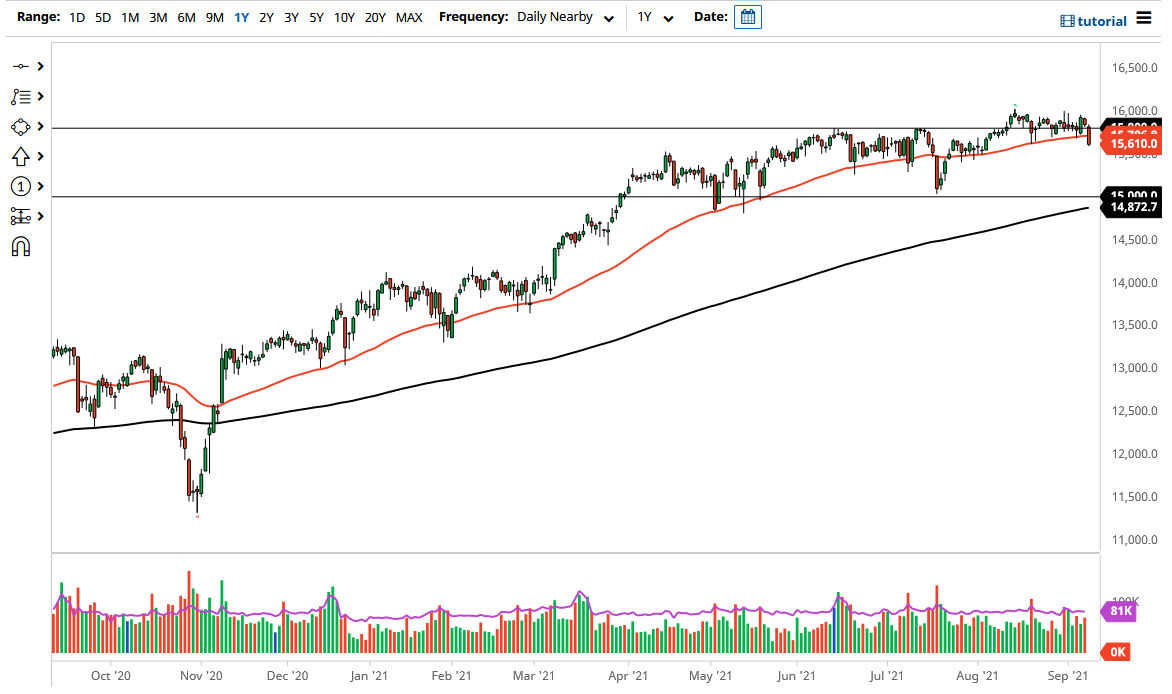

The DAX Index gapped slightly lower at the open on Wednesday, and then broke down below the 50-day EMA. Worse yet, the market closed towards the lowest part of the candlestick, suggesting that there could be a little bit of follow-through coming. If that is going to be the case, then it is very likely that the DAX is going to go looking towards the 15,500 level.

It is worth noting that there was a little bit of a “risk off” type of attitude around the world during the session, and the DAX would have been a victim of that right along with everyone else. The €15,500 level is an area that has offered support previously, but it is not what I would consider to be a major support zone. In other words, we could crack below that level and then go looking towards the €15,000 level, an area that I think is probably much more important for the market overall.

The DAX is highly influenced by global trade, as the German economy is so heavily dependent on exports. Furthermore, there are serious signs that we could see a change in government when it comes to Germany, so that might have something to do with what is going on here as well. It is obvious that the 16,000 level has been significant resistance recently, so reaching towards there and pulling back is not a huge surprise. The question now is whether or not we will see buyers come back into the market relatively soon, or if they will take their sweet time getting here.

Breaking down below the 15,000 level would be extraordinarily negative, as it would not only violate a large, round, psychologically significant figure but it would also violate the 200-day EMA, an indicator that a lot of people pay close attention to on longer-term frames. Because of this, I think that €15,000 is the key to whether or not we remain in an uptrend. Right now, you can make an argument for the market still finding plenty of buyers on dips, but we may have a little bit more in the way of follow-through based upon the candlestick. Either way, I would not be a seller quite yet, and it is difficult to imagine that we will simply slice through all of the support levels underneath without some type of fight.