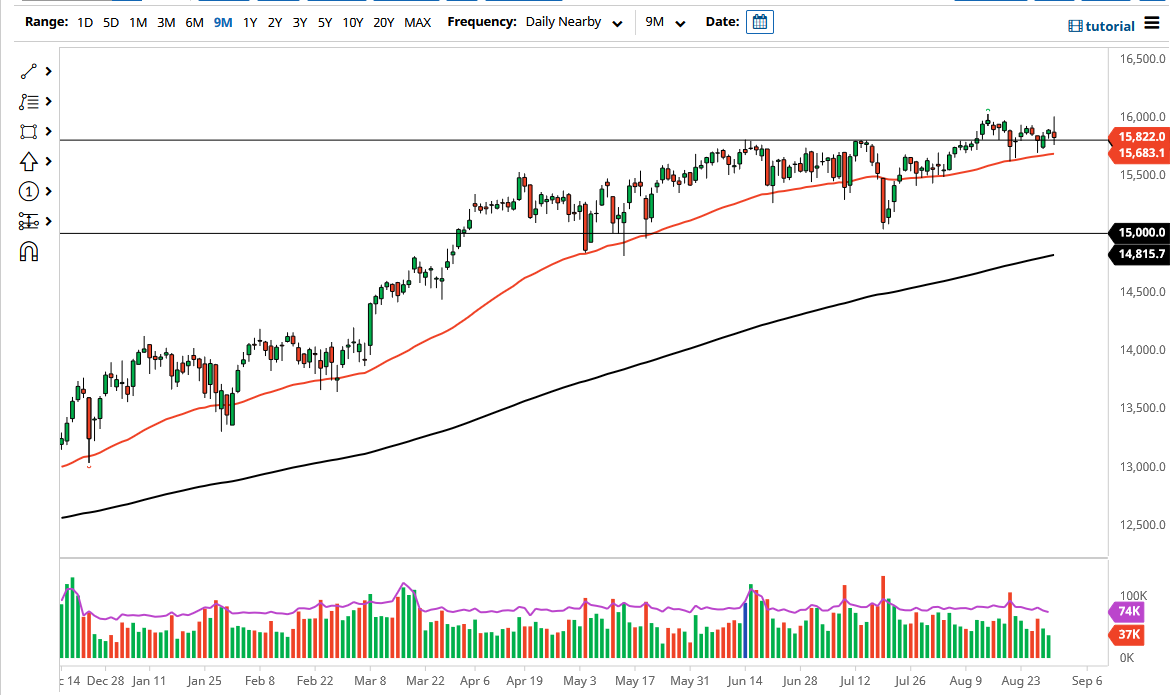

The DAX Index initially rallied to reach towards the 16,000 level before turning right back around to reach towards the 15,800 level. The resulting candlestick is less than desirable because it does show a hesitancy to go higher. This was probably exaggerated by the suggestion that the ECB was going to taper bond purchases, which means that the interest rates in the German bond markets spiked a bit. This has a detrimental effect on the stock market in the short term, but longer-term as long as it is orderly it should be fine.

When you look at the chart, you can see clearly that this is an area where we have seen a lot of interest, and I think that would continue to be the case going forward. The 50-day EMA is at the €15,683 level, and it looks as if we are going higher from that EMA. That is a longer-term indicator that a lot of people will pay close attention to, and it does suggest that we are going to have a very subtle move to the upside. That being said, it is just a moving average, and you can only read so much into the moving average itself.

The longer-term trend has been to the upside, but the DAX has been relatively quiet as we are at the height of vacation season. With that being the case, I think it is only a matter of time before we get some type of impulsive candlestick that we can follow and send this market to the next big destination. If we can break above the recent highs just north of the 16,000 level, then the market is likely to continue reaching towards the 16,250 level, followed by the 16,500 level. On the other hand, if we break down below 15,500, the market very well could go looking towards the 15,000 level where the 200-day EMA is currently racing towards, and an area that would obviously cause a lot of headline noise. Furthermore, we have seen the market test that area multiple times, only to see the buyers come back in. With this, I think if we do get some type of pullback, it is likely that we could get plenty of value hunters out there. If we break down below the 15,000 level, that could lead to something rather drastic.