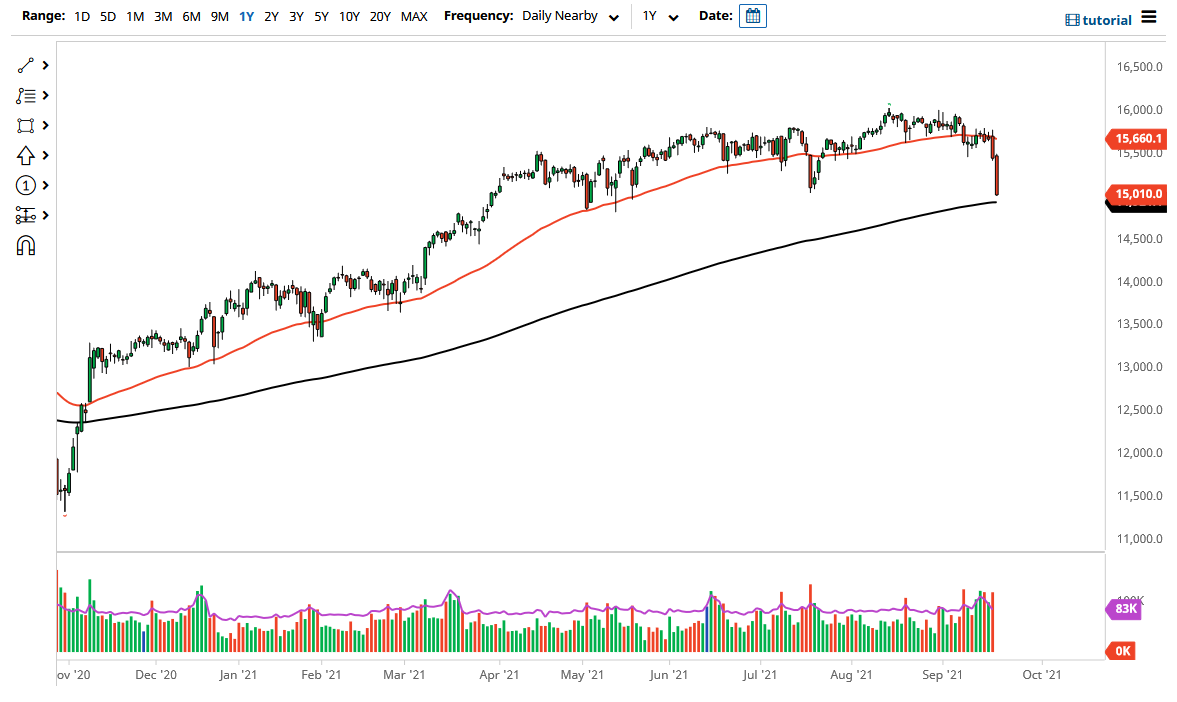

The DAX has been absolutely hammered on Monday to kick off the week on the back foot. The market reached towards the 15,000 level, which is basically where the 200 day EMA sits. Furthermore, the market closed at the very bottom of the candlestick, suggesting that there is more negativity to come. A breakdown below the 200 day EMA opens up the possibility of a bigger move lower, but quite frankly the markets will continue to be volatile more than anything else. With that being the case, no matter what happens next, you need to be very cautious about your position size.

The fact that we have formed two long red candlesticks in a row does not bode well for the overall attitude of this market, but if we do turn around and rally, I think it is only a matter of time before the sellers come back in and punish buyers are trying to be value hunters. That being said, the market looks as if it has made up its mind, so I do think that it is only a matter of time before we see a major sell off.

As far as buying is concerned, I think you need to see the massive candlestick from Monday taken out to the upside at the very least, if not the 50 day EMA to the upside in order to start buying. At that point, you would have to think that the market is going to turn around and continue to rally, but it is obviously going to be a scenario where participants are going to have a lot to say over the last couple of days. The downside could extend all the way down to the 14,000 level, perhaps even the 13,500 level.

The DAX is starting to reflect the problems that European Union has as far as energy is concerned, and therefore the fact that the economy could shut down, or at least be crippled. With that being the case, if you need to pay close attention to this chart, because it could give you a bit of a “heads up” as to what the rest of the European Union may do as far as stocks and other assets are concerned. Quite frankly, this chart needs to turn around rather quickly, or we could fall apart quite drastically.