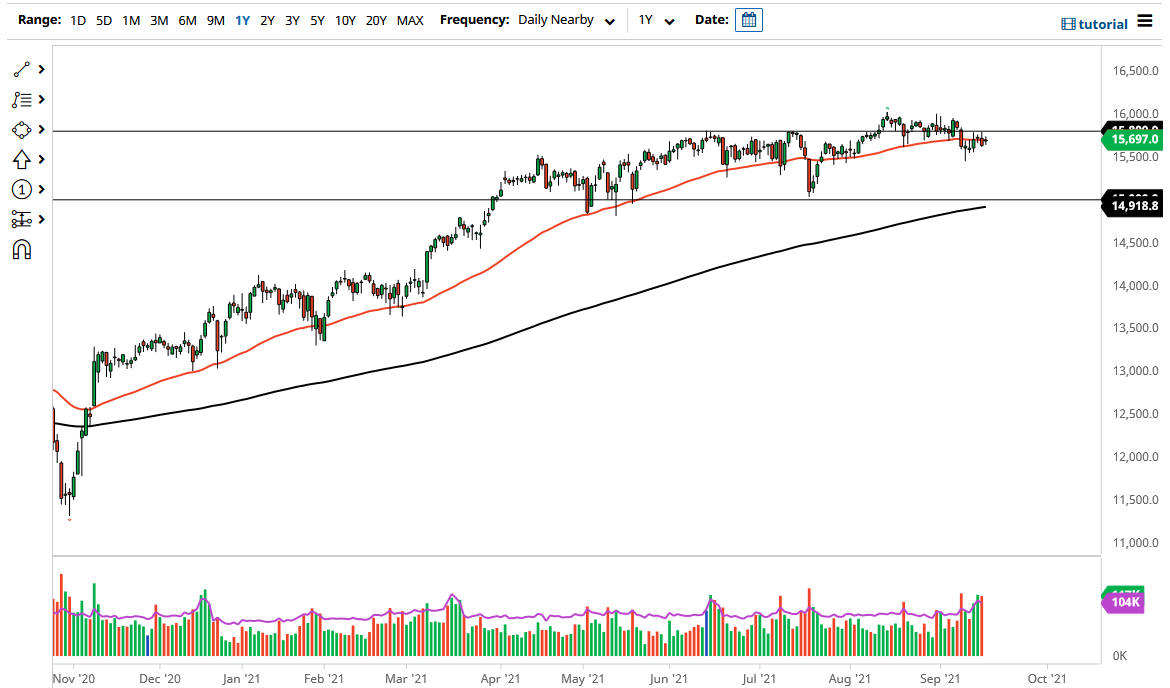

The German index has gone back and forth during the course of the trading session on Thursday as we continue to be attracted to the 50 day EMA. The 15,800 level is an area that a lot of people would be paying close attention to as well, as it has been both support and resistance recently. Even if we break above there, then the 16,000 level comes into the picture as major resistance.

If we break above the 16,000 level, then I feel that the DAX will continue to go much higher, perhaps reaching towards much higher levels as the 16,500 level might be targeted. Short-term pullbacks in the meantime will almost certainly offer support, especially near the 15,500 level where we had bounced from previously. That is an area that has been important more than once, but if we break down below there then I think the next major support level is at the 15,000 level, where the 200 day EMA is starting to reach towards.

Keep in mind that the DAX is highly levered to global growth and of course industrial demand. There are a lot of German industrial corporations that make up the bulk of the DAX, and those a lot of the time will move based upon the Euro and of course the demand coming out of multiple other countries. The global economy of course is an open question, so therefore I think this will continue to be very choppy index. However, if it does take off to the upside it is likely that we can continue to add to a position. Furthermore, if this takes off to the upside, then it is likely that the indices around the world will continue to go much higher. Furthermore, I think you could add to a position as it works out in your favor, because as this market has been grinding sideways forever, the momentum finally coming into the market on a breakout would be something worth paying close attention to. On the other hand, if we break down below the 200 day EMA, then this market will collapse, probably dragging quite a few other indices around the world right along with it. That being said, I still favor the upside but also recognize there is a lot of noise to chew through before we make a bigger move.