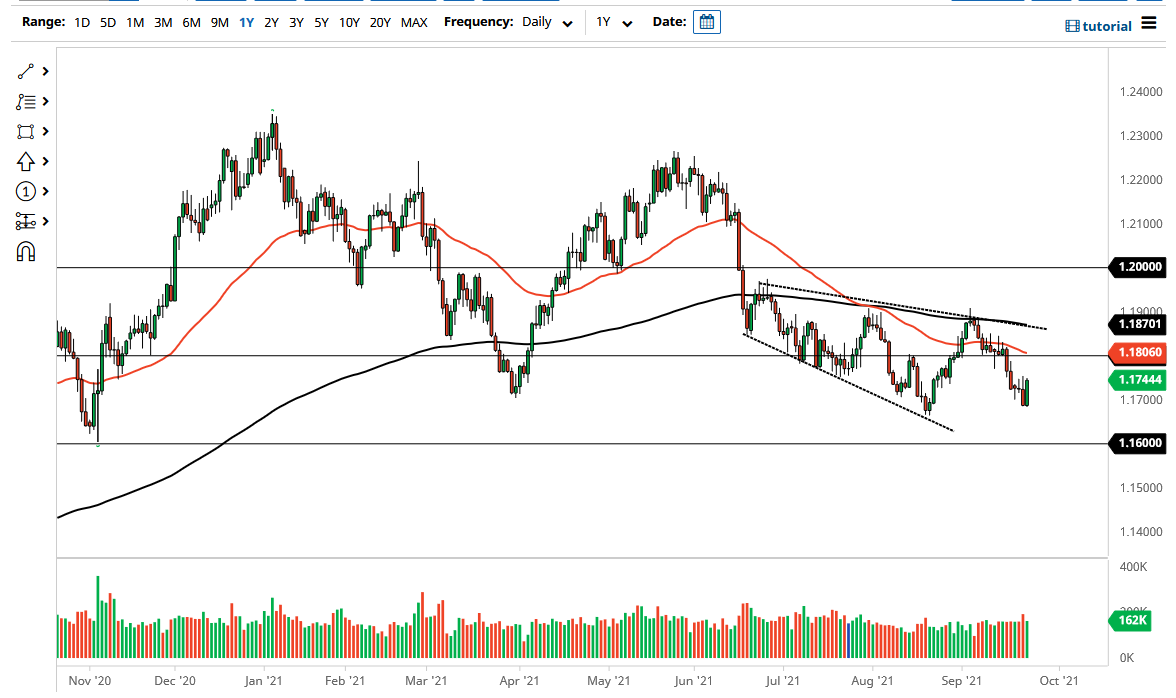

The Euro has bounced significantly during the day on Thursday, as the US dollar got sold off overall. At this point in time, the market is likely to continue to be very noisy, but it should also be noted that there are still plenty of sellers above, and the European Union itself has a lot of issues. The market will continue to be very noisy, but it is clear to me that if we can break above the 1.1750 level, the market is likely to go looking towards the 1.18 level above.

The 1.18 level is where the 50 day EMA currently resides, and that is something that you be kept in the back of your mind. The market is always very noisy anyway, so this should not be a huge surprise. The 1.17 level has offered a bit of a floor in the market, and it is likely that we will continue to see that level be thought of as important. The market is quite often very noisy, so it is worth paying attention to the fact that this is more often than not a decent indicator on US dollar or Euro strength/weakness. In other words, use it as a tertiary indicator more than anything else. As far as a trend is concerned, we have been very choppy as of late, but it is worth asking the question as to whether or not we had just formed a double bottom?

The market will eventually find reasons to go either higher or lower, but right now it seems like it is a bunch of noise. The US dollar strengthening in this market will have a large knock on effect in other markets, and therefore I think this is a very important chart to pay attention to, especially if you do not have the ability to monitor the US Dollar Index in real time. This is a close enough approximation of that chart to use it as that type of tool.

On the other hand, if we were to turn around a break down below the lows, it is likely that we go much lower, perhaps reaching down to the 1.16 handle. That is an area that I think is worth exploring as well, but we would have a lot of effort to get to that area after this move.