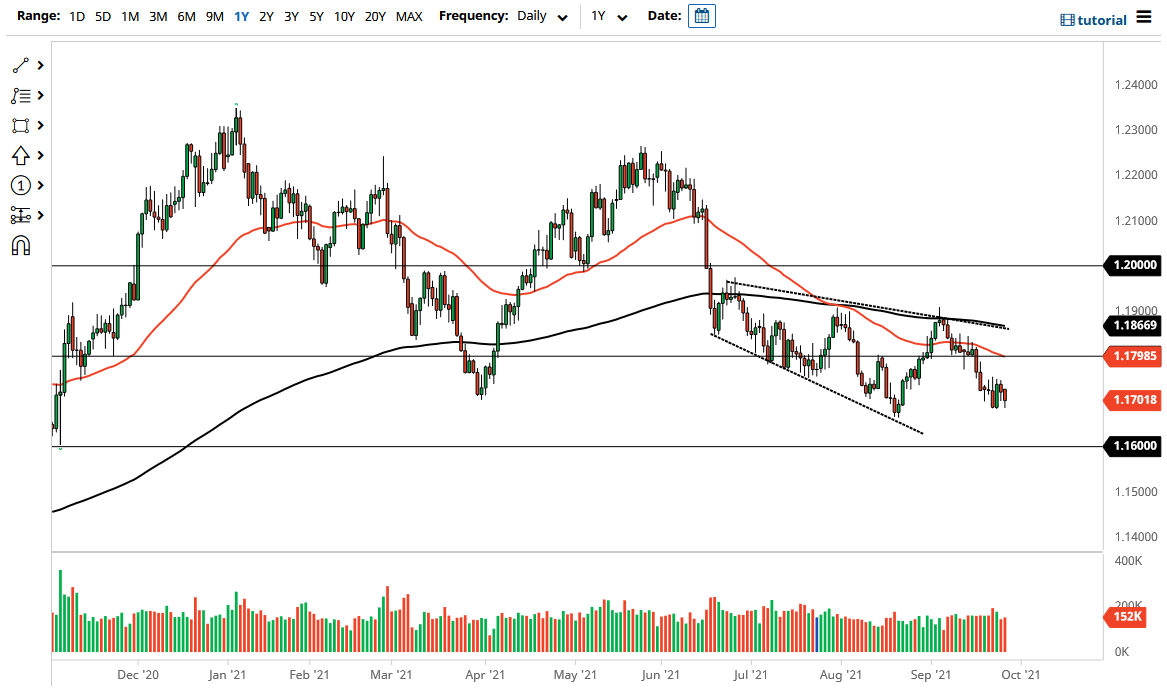

The Euro has fallen significantly during the course of the trading session on Monday to reach just below the 1.17 level. The 1.17 level has been important several times, and at this juncture if we can break down below the lows of the last couple of days, I think the downside will accelerate in this pair, and it is worth noting that we continue to see a lot of choppy behavior, with perhaps the US dollar strengthening due to the fact that the interest rates in America are picking up. That obviously makes the greenback much more attractive than the Euro, and that is playing out on the chart.

On the other hand, if we were to turn around and break above the highs of the last couple of days, it is very likely that we go looking towards the 1.18 level above, where the 50 day EMA currently resides. That obviously would be a very bullish sign and therefore if we can break above there it is likely that we could go looking towards the downtrend line.

The Euro has to deal with a lot of supply chain disruptions in the European Union itself. This supply chain issue is something that a lot of people are starting to pay attention to, due to the fact that it is going to have a major disruption in the overall economy. Looking at this market, it is obvious that we are chopping around in a very tight range, and I think the next impulsive candlestick should give us a bit of a heads up as to where we are going yet.

The pair can be used as a tertiary indicator as well, as it is the closest thing to the US Dollar Index that most Forex traders have available to them. The market rising or falling can give you a bit of a “heads up” as to where the greenback is going against multiple currencies, not just this one. With that in mind, it is very important chart regardless of what you are trying to trade. The strength or weakness of the US dollar can be crucial when it comes to a lot of markets. Looking at this chart, we are simply building up the inertia for the next move.