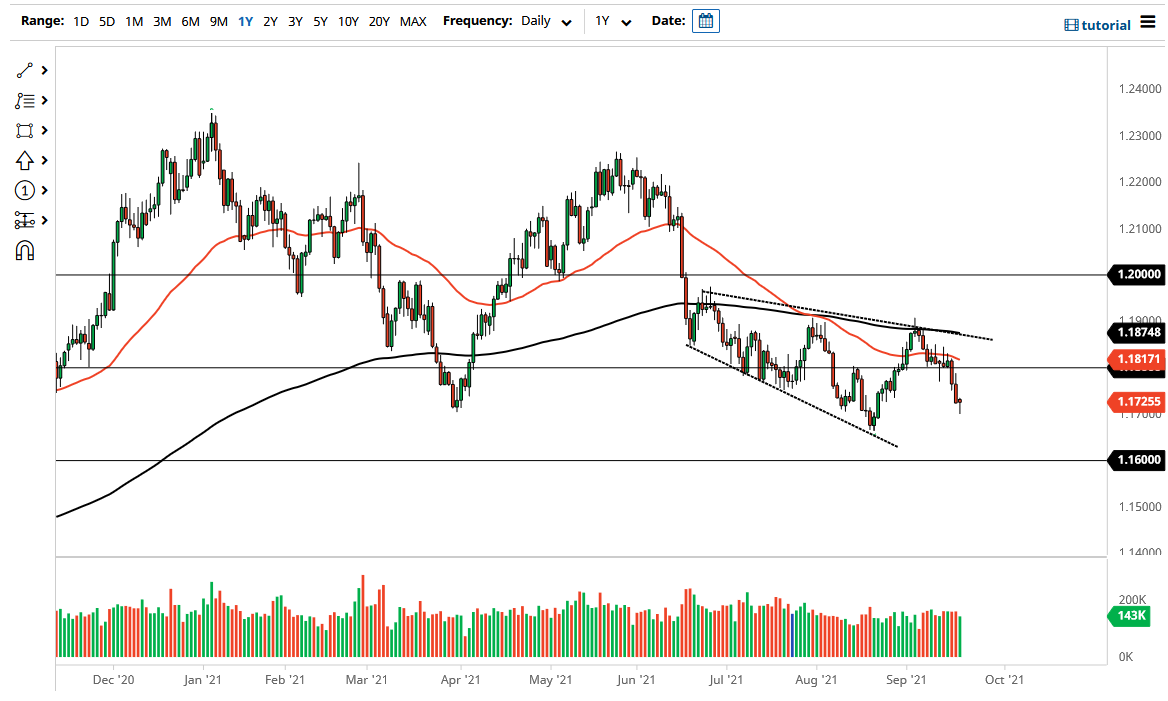

The Euro has fallen significantly during the course of the trading session on Monday, only to turn around and form a bit of a hammer. The 1.17 level has offered significant support, but at the end of the day I do not know that the big figure matters more than anything else. The 1.17 level being broken to the downside opens up the possibility of a move down to the 1.16 level. That is an area where we have seen a significant amount of support previously, so it does make quite a bit of sense that traders will pay close attention to this vicinity. Breaking down below that level would be a catastrophic failure for the Euro.

Having said that, we have turned around quite significantly to form a bit of a hammer, and if we can break above the top of it, the market is likely to go looking towards 1.18 level above, where the 50 day EMA is starting to race towards. The 1.18 level for me is going to be a significant “ceiling in the market”, and with that I think that the market will find quite a bit of exhaustion. Breaking above that could open up the possibility of a move towards the 200 day EMA, which is sitting at the downtrend line at the top of the megaphone pattern that we have formed.

Looking at this chart, it is very noisy, and you should keep in mind that the US dollar is probably going to be the major driver of this market more than anything else, so having said that, I think that the US Dollar Index needs to be followed in order to trade this market. As we have bounced a bit during the trading session on Monday, it suggests that perhaps we are a little bit oversold, but that bounce will more than likely get sold into as well.

I think this pair continues to be very choppy as per usual, as this pair is one of the noisier ones out there. With that in mind, I like the idea of shorting this market, but we might be just a bit overdone, so you probably get a better opportunity at higher levels as we failed to continue moving higher. The market is one that you should be cautious with until we get clarity.