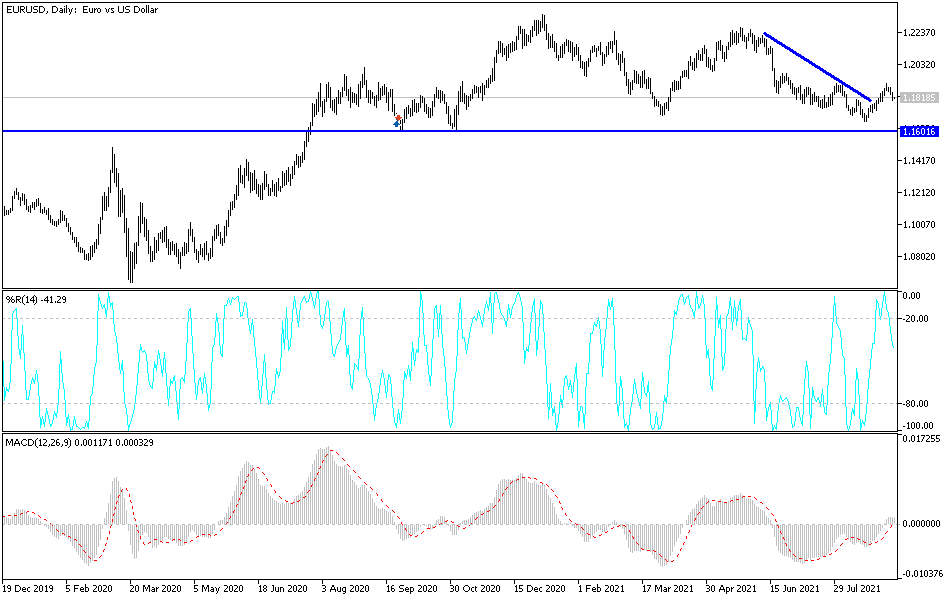

The euro pulled back during the trading session on Wednesday to test the 1.18 level. The 1.18 level is a large, round, psychologically significant figure that a lot of people should be paying attention to. This is an area that has been important more than once, and now that we have bounced from there it does suggest that perhaps the buyers are starting to come back in. However, I would also point out that we pulled back rather rapidly from the 200-day EMA. The question is if we will go back up there to retest it, or if we will break down below the bottom of the candlestick.

If we were to break down below the bottom of the candlestick from Wednesday, I would be a short seller at that point because it would not only slice through a major round figure, but it would also be breaking down below the bottom of a hammer, which in and of itself is a very bearish sign. At that point, I would anticipate that the euro could go looking towards the 1.17 level underneath, possibly even lower. Keep in mind that the European Central Bank has a statement during the day on Thursday, so this is a pair that will probably be very volatile given enough time. That being said, if the ECB does in fact disappoint the market, we may see this market turn right back around and break down. I think a lot of people will be concerned about holding euros, because there is likely to be a lot of ugly volatility at one point during the session.

To the upside, if we were to break above the shooting star that recently pierced the 200-day EMA, then it could give us a little bit more fuel to go higher. Nonetheless, the euro will probably do the same thing it normally does, which means chop back and forth and cause headaches for traders. This is the domain of high-frequency trading, and unfortunately this pair behaves much like some of the futures markets on the indices but in slow motion. In other words, there is a lot of back and forth, so you have to be very quick about catching the turn. Right now, I think the next 24 hours should tell us quite a bit.