The euro rallied significantly on Tuesday as we shot straight up in the air due to word that the ECB will consider tapering bond buyback purchases, like the United States. Ultimately, a rally at this point continues to face a lot of resistance above the 50-day EMA anyway, so the fact that we have initially shot higher only to give back those gains shows just how difficult a rally is going to be at this point.

Furthermore, we are starting to see a little bit of a push towards the greenback due to the fact that interest rates in America are rising already, and that makes the US dollar much more attractive. The shape of the candlestick is also a shooting star, so that gives me yet another reason to think that we will probably pull back heading towards the non-farm payroll figures on Friday. In fact, the market is probably one you will have to approach from a very short timeframe, as we are probably just going to be killing time more than anything else. We also probably should keep an eye on risk appetite during the next couple of days, which can favor the US dollar if we get a couple of sudden shocks.

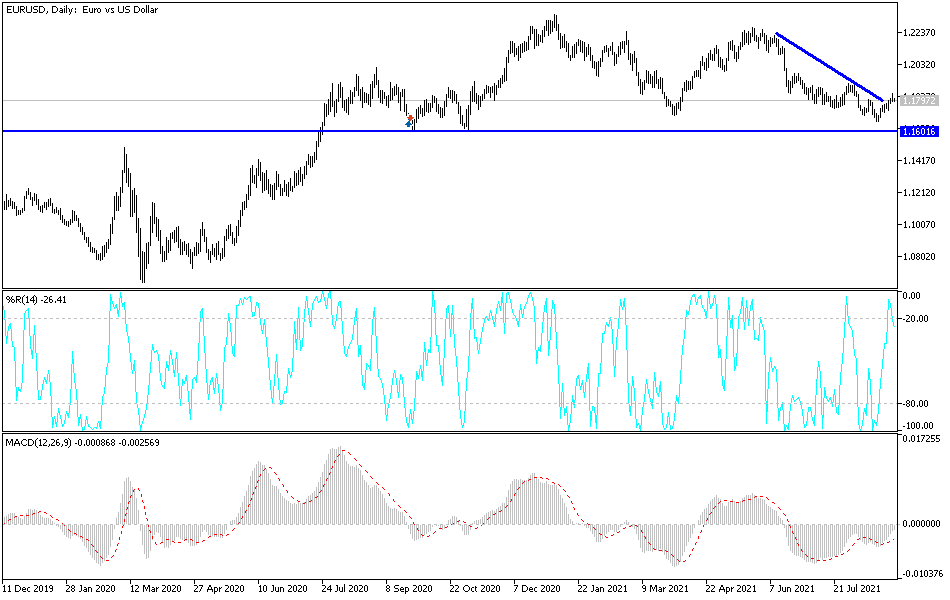

Long term, I had been calling for a move down to the 1.16 level, an area that had been a massive support level. This is a market that did not quite make it all the way down there, but it should be noted that the US dollar strengthened against most currencies, not just the euro. In other words, the market cared a lot less about the ECB tapering than it did the higher interest rates in America. In fact, the NASDAQ 100 also suffered a bit at the hands of higher interest rates, which is a pure sign that the 10-year note is pushing things around again.

Nonetheless, if we can break above the 200-day EMA then I would anticipate a much bigger move, but it does not take much in the way of imagination to see a trendline that we have bumped up against during the trading session and pulled back to show hesitation yet again. I think at this point you probably need to take profits relatively quickly, at least until we get through the jobs figures.