Last Thursday’s EUR/USD signal was not triggered as there was no suitable price action when the nearby support and resistance levels were first reached that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered prior to 5pm London time today.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1818, 1.1850, or 1.1857.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1779 or 1.1783.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

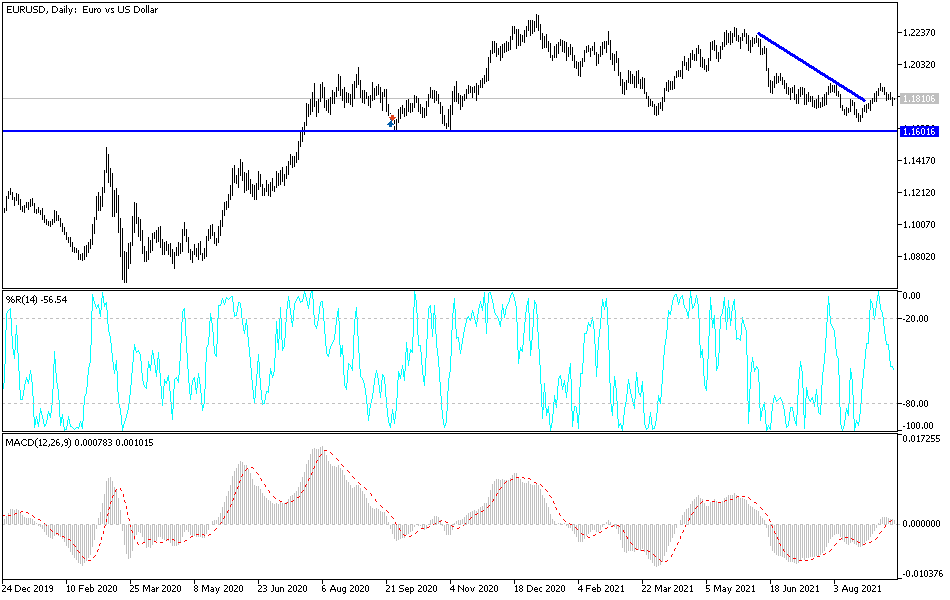

EUR/USD Analysis

I wrote last Thursday that the technical picture was looking more bearish, so I wanted to wait for two consecutive lower hourly closes below 1.1813, with an initial profit target at the next support level which is located at 1.1783 taken within a new short trade.

This was a good call as we did not get a single hourly close below 1.1813, with the level continuing to hold that day as good pivotal support.

The technical picture one week later continues to look moderately bearish, at least over the short to medium-term, with the price continuing to move downwards in waves.

The price yesterday found good support at 1.1779, but the feature which truly stands out within today’s price chart shown below is the resistance level at 1.1818 which is just a small adjustment of our old friend from last week, the horizontal level at 1.1813. This looks likely to be very pivotal today, so it seems to be tradable. I will be happy to take a short trade especially if the price rejects that level again over the first few hours of today’s London session.

On the other hand, if we get two consecutive hourly closes above that level during this time, we will be likely to see an up day today.

Concerning the USD, there will be a release of CPI data at 1:30pm London time. There is nothing of high importance due today concerning the euro.