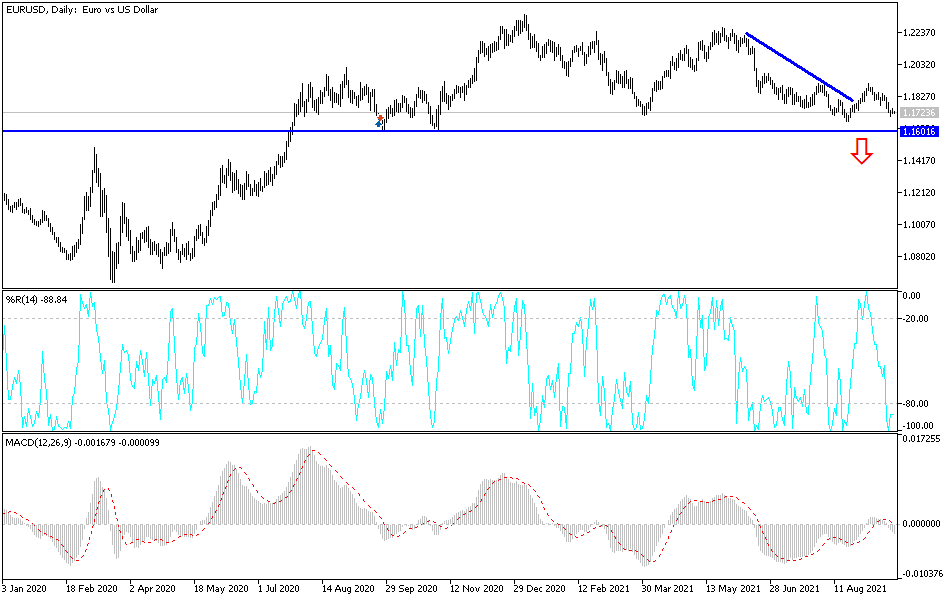

Bearish View

Sell the EUR/USD and set a take-profit at 1.1650.

Add a stop-loss at 1.1780.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1750 and a take-profit at 1.1800.

Add a stop-loss at 1.1700.

The EUR/USD pair erased some of the gains made on Tuesday after the relatively strong American housing numbers and as traders waited for the Federal Reserve decision. The pair is trading at 1.1725, which was slightly below this week’s high of 1.1750.

Federal Reserve Decision

The EUR/USD declined sharply on Monday as investors' concerns about the Evergrande crisis rose. The pair erased some of those losses on Tuesday as it rose to a high of 1.1750. The situation changed after the US published the relatively strong American housing numbers.

The numbers showed that the country’s building permits rose from more than 1.63 million in July to more than 1.72 million in August. This was a bigger increase than the median estimate of 1.6 million.

In the same period, the number of housing starts rose from more than 1.55 million to 1.61 million. This is a sign that the housing market is still stable. It has been boosted by the relatively low-interest rates and higher savings as most Americans stay at home.

Later today, the US will publish the latest existing-home sales numbers. Economists polled by Reuters expect the data to show that the sales declined from 5.99 million in July to 5.89 million in August.

Still, the biggest catalyst for the EUR/USD pair will be the Federal Reserve interest rate decision. The bank is expected to leave its interest rate unchanged between 0% and 0.25%. It will also continue with its large asset purchase program.

Still, the Fed will likely provide more signals about when it will start tapering its asset purchases. Another key mover for the pair will be the schedule of its interest rate hikes. Some analysts expect the Fed to start hiking in 2022.

EUR/USD Technical Analysis

The EUR/USD pair declined sharply on Monday as worries of Evergrande and American debt ceiling issues remained. It is now trading at 1.1730, which is slightly below yesterday’s high of 1.1750. A closer look shows that it has formed a bearish flag pattern. It also remains below the short and longer-term moving averages.

Therefore, there is a likelihood that Monday’s sell-off will accelerate ahead or after the Fed decision. If this happens, the next key support level to watch will be 1.1650.