Bearish View

Set a sell-stop at 1.1665 and a take-profit at 1.1550.

Add a stop-loss at 1.1750.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1700 and a take-profit at 1.1800.

Add a stop-loss at 1.1600.

The EUR/USD retreated in the overnight session as global risks continued rising and as US bond yields rose. The pair also declined to 1.1667 after the relatively weak American consumer confidence data.

US Consumer Confidence Wanes

The rising number of COVID-19 cases and inflation helped drag the US consumer inflation in September. According to the Conference Board, the country’s consumer confidence declined to a seven-year low of 109.5. This drop was lower than the previous 115.2 and the median estimate of 114.5. Consumer confidence is an important figure because of the fact that consumer spending is the biggest part of the American economy.

Later today, the European Commission will publish the latest consumer and business confidence numbers from the region. Analysts expect the data to show that sentiment by both services and industrial sector declined in September. Similarly, the consumer confidence is expected to have declined as well.

The EUR/USD also tilted lower as US bond yields continued their upward trend. The 10-year bond yield rose to a three-month high of 1.512% while the 30-year yield rose to 2.05%. This increase was mostly because of the rising expectations that the Federal Reserve will and other central banks like the Bank of England (BOE) will start tapering their asset purchases sooner.

In a congressional testimony on Tuesday, Jerome Powell reiterated that the economy was doing better than expected. He also said that inflation will likely remain above the bank’s target of 2.0% for a while.

The EUR/USD also fell because of the risks posed by the ongoing energy crisis in countries like China and the UK. Analysts believe that this crisis will likely lead to higher costs around the world. Later today, the key numbers to watch will be the German retail sales data and the German Import Price Index.

EUR/USD Forecast

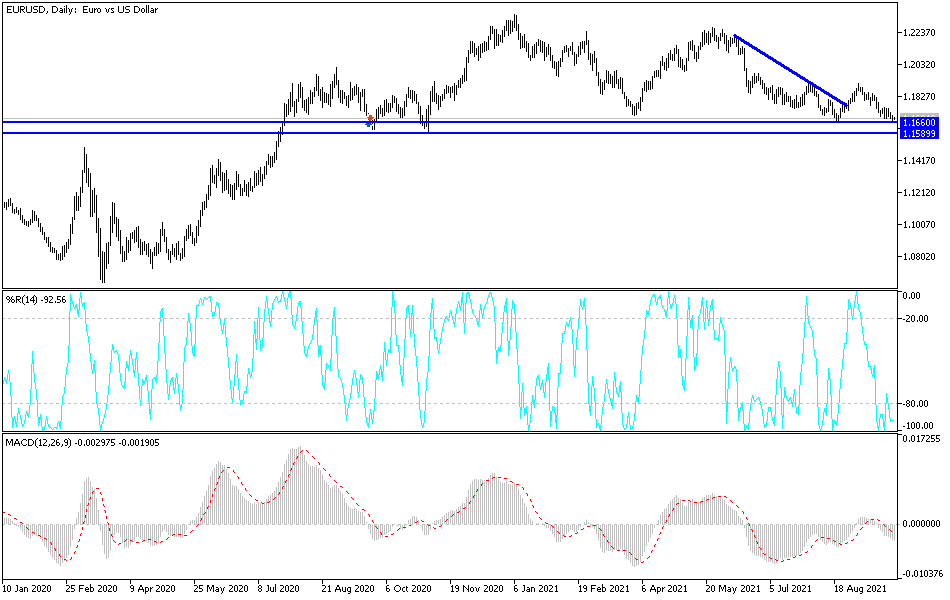

The four-hour chart shows that the EUR/USD pair has been in a major sell-off in the past few weeks. Along the way, the pair has formed what looks like an inverted cup and handle pattern, whose bottom side is at 1.1665. The pair is slightly below the 25-day and 50-day moving averages while the MACD indicator has moved below the neutral level.

Therefore, the path of the least resistance for the pair is to the downside. A more bearish trend will be validated if it declines below the key support at 1.1665.