Bullish View

Set a buy-stop at 1.1840 and a take-profit at 1.1900.

Add a stop-loss at 1.1750.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1785 and a take-profit at 1.1700.

Add a stop-loss at 1.1850.

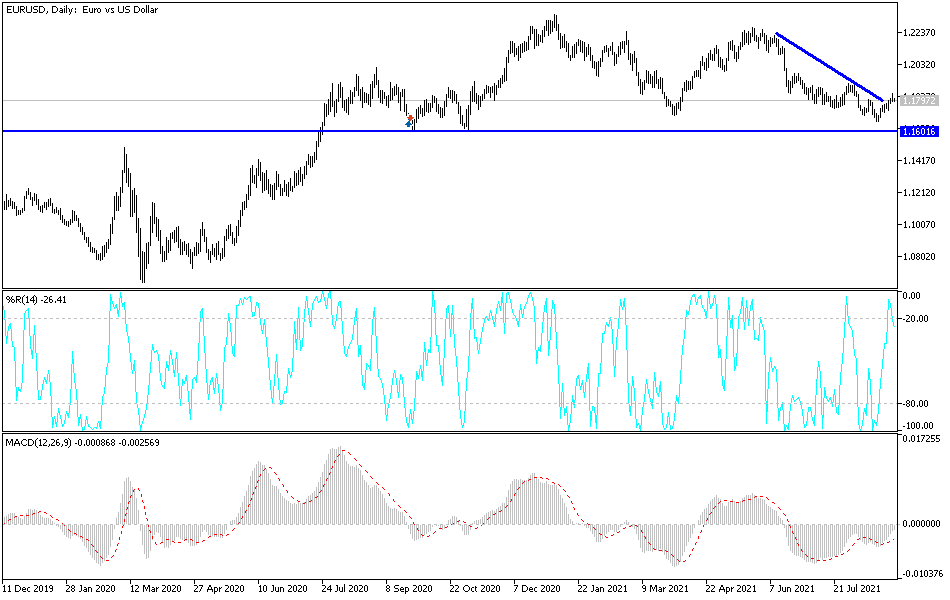

The EUR/USD declined in the overnight session after the relatively weak US consumer confidence data. The pair fell from a high of 1.1844 to a low of 1.1800.

Eurozone Inflation and US Confidence

On Tuesday, the Eurozone published the relatively strong Consumer Price Index data (CPI). The data showed that the headline CPI rose from -0.1% in July to 0.4% in July, helped by higher fuel prices. As a result, the CPI rose from 2.2% to 3.0% on a year-on-year basis. The core CPI rose by 1.6%, which was slightly below the European Central Bank (ECB) target of 2.0%.

These numbers show that the Eurozone economy is doing relatively well as more countries continued to ramp up vaccinations. This was evidenced by data released earlier during the day. In Germany, the unemployment rate declined from 5.6% in July to 5.5% in August. Similarly, in France, the CPI rose to 1.9%. Later today, Markit will publish the latest Eurozone Manufacturing PMI data.

The EUR/USD also declined after the relatively weak US consumer confidence data. According to the Conference Board, consumer confidence declined from 125.1 in July to 113.8 in August. This was the lowest it has been in about 6 months. Recently, similar data from Michigan University showed that the confidence declined to the lowest level during the height of the pandemic.

These numbers signify that the Delta variant and increase in breakthrough cases has dented Americans’ views about the economy and recovery. Looking ahead, the pair will react to the ISM and Markit Manufacturing PMIs that will come in the afternoon session. The pair will also react mildly to the ADP non-farm private payrolls numbers. The data is expected to show that employers added more than 613k jobs in August.

EUR/USD Forecast

The EUR/USD has been in a strong bullish trend as shown in the three-hour chart below. Along the way, the pair has formed an ascending channel shown in blue. The price is approaching the lower side of this channel. It has also moved slightly above the 25-day and 50-day exponential moving averages. Also, the pair is below the important resistance at 1.1900.

Therefore, the pair will likely rebound as investors target the key resistance at 1.1900. On the flip side, a drop below 1.1750 will invalidate the bullish view.